Bank of America Bullish on Gold: $5,000 Target Stands Firm Despite Recent Pullback

Gold's recent stumble isn't shaking Bank of America's confidence—the banking giant just doubled down on its $5,000 price prediction.

Steady Hands in Volatile Markets

While gold traders panic-sell during the current pullback, BAC analysts maintain their conviction. The $5,000 target isn't just optimistic—it's calculated. They see temporary dips as buying opportunities rather than trend reversals.

Institutional Faith Versus Retail Fear

Bank of America's positioning reveals a classic divide: institutional patience versus retail impulsiveness. Their research team cites macroeconomic factors that transcend short-term price fluctuations—because apparently, someone still needs to think beyond the next quarterly report.

Gold's pullback? Just noise. The $5,000 target? Still very much in play. Because when traditional banks start sounding like crypto maximalists, you know the financial world has officially lost the plot.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Commodities analysts at the U.S. lender say the surge in gold’s price this year has not been extreme and that they expect the rally to continue after the current price correction is over. After rising more than 60% year-to-date and hitting a record high of just over $4,300 an ounce, gold’s price has pulled back over the past week and fallen back below $4,000 per ounce.

In its latest “Global Metals Weekly” report, Bank of America writes that gold “has rallied sharply in recent months on a confluence of macro factors.” The lender adds that while the market has become “overbought, the magnitude of the current rally is not out of the ordinary when compared to any of the gold bull markets since 1970.”

‘Push Higher’

Bank of America now forecasts that gold’s price will end 2025 right around $3,800 per ounce, followed by a “push higher to $5,000 per ounce next year.” Gold performs best in periods of macroeconomic uncertainty and market volatility, notes Bank of America.

Past drivers of sustained bull markets in gold have included oil crises, stagflation, trade upheaval, wars, and the COVID-19 pandemic, notes the bank’s analysts. Bank of America added that “gold prices stopped pushing higher only once the underlying drivers changed.”

Bank of America encourages investors to adopt a 60:20:20 portfolio, i.e. 60% equities, 20% bonds, and 20% gold.

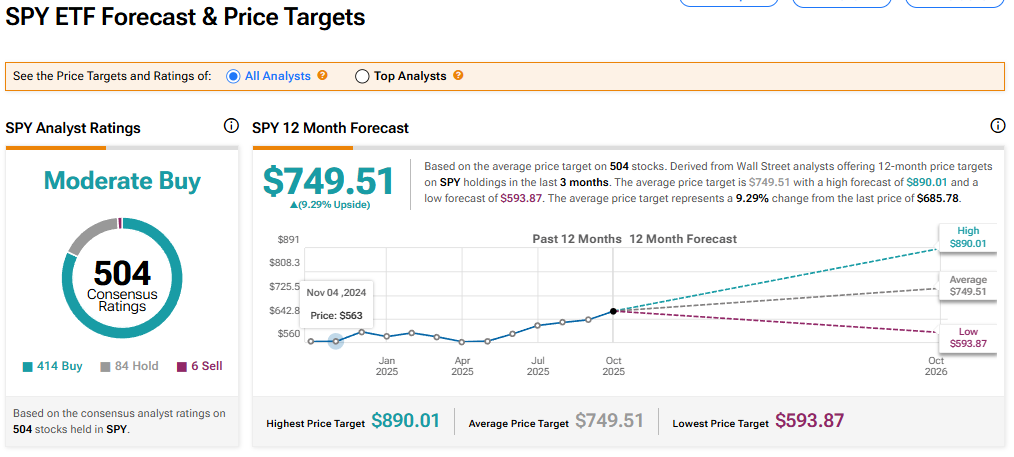

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 414 Buy, 84 Hold, and six Sell recommendations issued in the last three months. The average SPY price target of $749.51 implies 9.29% upside from current levels.