SPY ETF Daily Analysis: October 21, 2025 Market Movements

Wall Street's favorite tracker faces another volatile session as market forces collide.

Market Dynamics

The SPDR S&P 500 ETF Trust continues its dance with economic indicators, trading patterns revealing institutional positioning shifts. Volume spikes during afternoon sessions suggest either accumulation or distribution—depending which side of the trade you're on.

Technical Breakdown

Resistance levels held firm while support zones saw repeated testing. The usual suspects—inflation data, Fed whispers, and corporate earnings—pulled the strings behind today's price action.

Looking Ahead

Traders positioning for tomorrow's economic releases while algorithms chew through every data point. Because nothing says 'efficient markets' like computers reacting to other computers reacting to computers.

The SPY remains the market's heartbeat—sometimes steady, sometimes erratic, but always telling you exactly what Wall Street wants you to know until they want you to know something else.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Within SPY’s holdings, consumer discretionary and industrial stocks showed strength, while utilities and communication services lagged.

Importantly, SPY closely tracks the S&P 500 Index (SPX), which also ended flat. Also, the Nasdaq 100 (NDX) dropped 0.06%.

What Impacted the Market?

Strong earnings from companies such as General Motors (GM) and 3M (MMM) lifted investor sentiment. Also, they bolstered confidence in corporate profitability and the resilience of U.S. businesses despite macro uncertainty.

However, Tuesday marked the 21st day of the U.S. government shutdown, and the lack of progress has fueled fears of long-term damage. Also, concerns are mounting as key services like air travel are starting to feel the strain.

It must be noted that with CPI and Q3 GDP reports due later this week, SPY could see increased volatility.

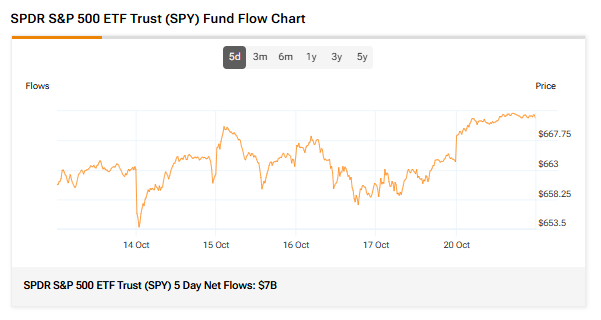

Fund Flows and Sentiment

SPY’s 5-day net flows totaled $7 billion, showing that investors added capital to SPY over the past five trading days. Meanwhile, its three-month average trading volume is 73.74 million shares.

Also, retail sentiment remains neutral, while hedge fund managers increased their holdings in the last quarter.

SPY’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY is a Moderate Buy. The Street’s average price target of $753.46 for the SPY ETF implies an upside potential of 12.24%.

Currently, SPY’s five holdings with the highest upside potential are Moderna (MRNA), MGM Resorts (MGM), Fiserv (FI), Charter Communications (CHTR), and News Corporation (NWSA).

Meanwhile, its five holdings with the greatest downside potential are Paramount Skydance (PSKY), Intel (INTC), Super Micro Computer (SMCI), Tesla (TSLA), and Palantir (PLTR).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market.