Intel Stock (NASDAQ:INTC) Surges as ’The Big AI Winner’ Investment Thesis Gains Traction

Intel rockets higher as artificial intelligence narrative captures Wall Street's imagination.

The Chipmaker's AI Gambit

Semiconductor giant Intel notches impressive gains amid renewed investor enthusiasm. The company's positioning in the artificial intelligence hardware race sparks fresh capital inflows. Market watchers see potential for Intel to challenge Nvidia's dominance in AI processors.

Wall Street's Latest Darling

Traders pile into INTC shares as the AI investment premise gains credibility. The stock's upward momentum suggests investors believe Intel can capture meaningful market share in the booming AI chip sector. Analysts point to the company's manufacturing capabilities and R&D investments as key differentiators.

The Reality Check

While the AI hype drives short-term gains, seasoned investors remember how quickly Wall Street falls in and out of love with tech stories. Another quarter of disappointing earnings could burst this bubble faster than you can say 'market correction.' Because nothing gets financiers more excited than chasing the next big thing—until they're not.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Demand for AI chips is on the rise. Intel’s AI chips, meanwhile, were never really as popular as those found at Intel’s competitors. But with Microsoft (MSFT) signing on to get its chips produced at Intel Foundry, the idea that Intel could be a bigger force in AI than anyone might have thought possible even just a year ago is now suddenly on the table.

Granted, there is still quite a bit about the Intel / Microsoft deal that is still unknown. But with Microsoft investing in data centers in a big way, Intel serving as a supplier to that expansion effort is likely to mean a big new income stream for Intel. Further, it serves as credibility for Intel, reports note. After all, Microsoft WOULD not turn to a complete loser in the market for supplies, especially not in artificial intelligence development.

Panther Lake Leak

In the shorter term, though, Intel also had another leak about its Panther Lake line of chips, and this leak came with a noteworthy thesis on its own. The new Core Ultra X7 358H chips will, reports note, come with Xe3 Arc GPU performance.

This is an interesting enough development on its own. While the early stats about the X7 358H line do not suggest a game-changing powerhouse in process, the performance should be solid enough to make it worth considering as an addition to future builds. Onboard graphics systems are not yet in a position to replace full GPUs—even entry-level ones—but they are certainly improving, as the X7 358H line notes.

Is Intel a Buy, Hold or Sell?

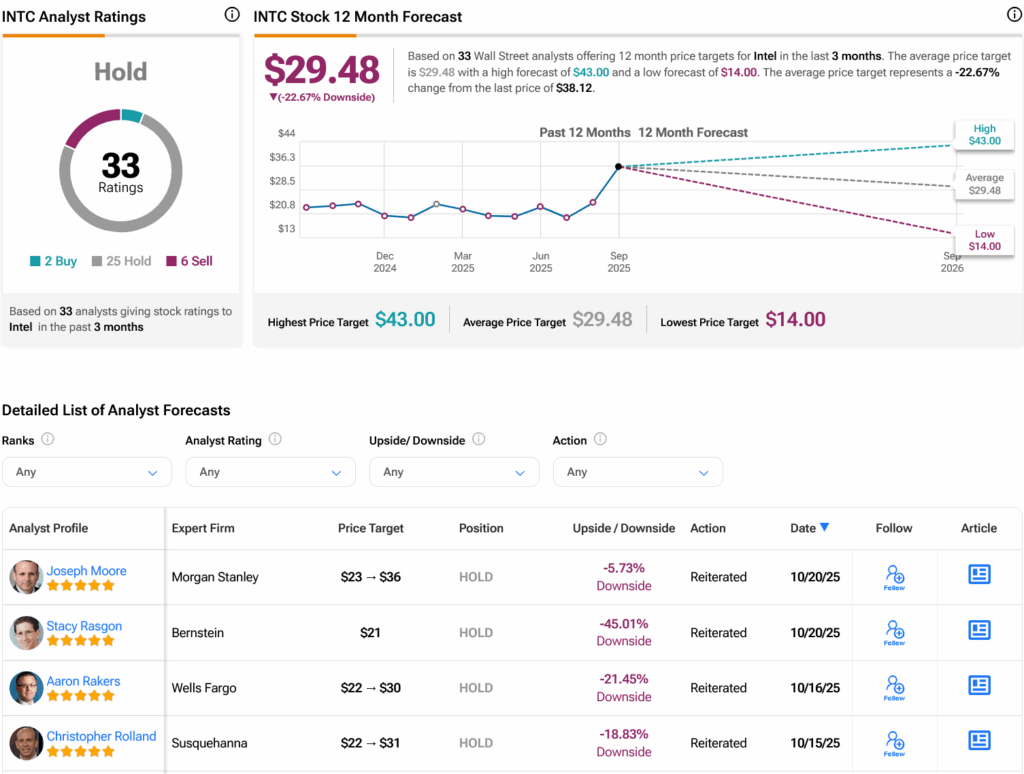

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 25 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 70.09% rally in its share price over the past year, the average INTC price target of $29.48 per share implies 22.67% downside risk.

Disclosure