ETH Price Consolidates at $3,900-$4,100 - When Will the Next Major Breakout Strike?

Ethereum's price action has traders on edge as ETH continues trading within a tight $3,900 to $4,100 range - the calm before the storm or just another false dawn?

The Consolidation Zone

ETH finds itself trapped between crucial support and resistance levels, creating a pressure cooker scenario that could explode in either direction. The $4,100 ceiling has proven stubborn, while the $3,900 floor keeps holding strong against bearish pressure.

Technical Indicators Signal Impending Move

Bollinger Bands continue tightening like a coiled spring, while volume patterns suggest institutional accumulation beneath the surface. Historical data shows ETH rarely stays range-bound for more than 2-3 weeks before making significant directional moves.

Market Sentiment Mixed

Traders remain divided between those betting on a breakout above $4,200 and others preparing for a dip toward $3,800 support. The perpetual funding rate sits neutral - neither excessively long nor short - indicating genuine market uncertainty.

When traditional finance analysts start talking about 'healthy consolidation,' you know they're just covering their inability to predict crypto's next move. ETH's breakout, when it comes, will likely catch everyone but the true believers flat-footed.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Datadog is a cloud-based monitoring and analytics platform that enables businesses to track the performance of applications, infrastructure, and logs in real time. Meanwhile, GitLab is an online platform that helps teams build, manage, and update software.

Datadog Considers Buying GitLab

Market reports, first highlighted by StreetInsider, suggest a potential Datadog offer for GitLab at over $60 per share, representing a significant premium. Investors reacted enthusiastically, driving trading volume to roughly 19 million shares, about seven times the typical daily average.

The rumors indicate that Datadog sees strategic value in GitLab’s all-in-one DevSecOps platform, potentially combining cloud monitoring with software development tools. So far, neither company has commented, and no agreement has been confirmed.

This isn’t the first time GitLab has attracted acquisition attention. In July 2024, Reuters reported that the company was exploring a sale, with multiple tech firms, including Datadog, expressing interest. Notably, analysts have long viewed GitLab as an appealing target in the DevOps space. Needham’s five-star-rated analyst Mike Cikos noted that buyers like Amazon’s (AMZN) AWS or Alphabet’s (GOOGL) Google Cloud were expected, though a tie-up with Datadog could also make strategic sense.

Overall, the renewed 2025 takeover rumors show that the software development tools market is still seeing consolidation, as companies look to grow their AI-powered DevOps services.

Is Datadog a Buy or Hold?

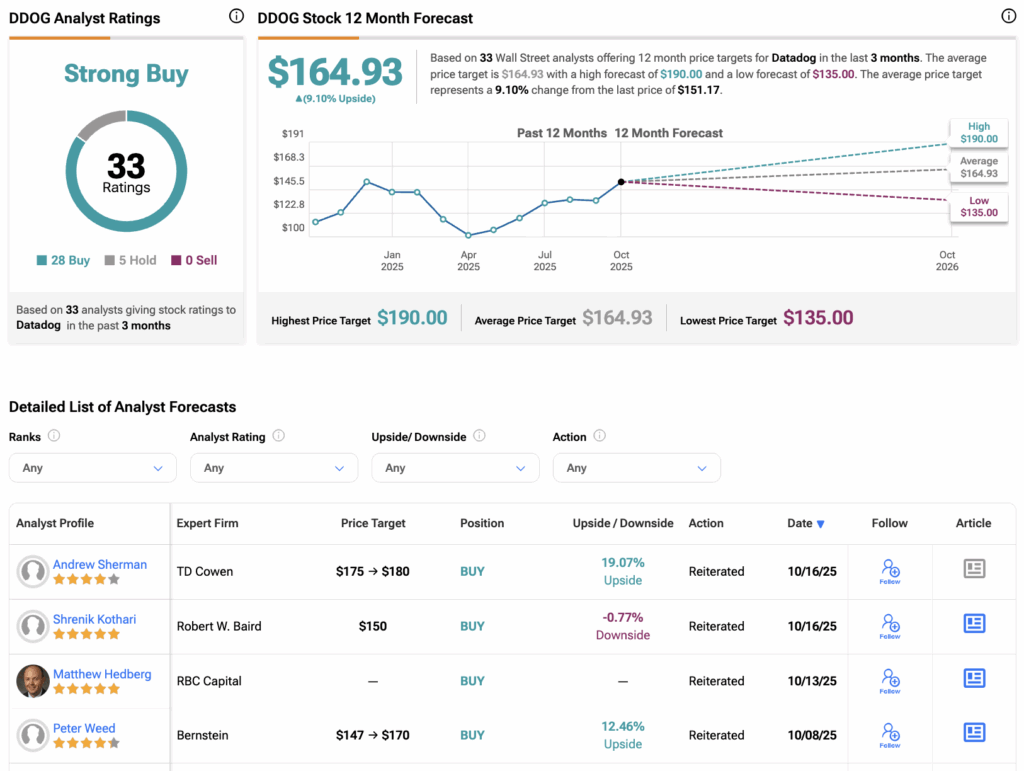

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DDOG stock based on 28 Buys and five Holds assigned in the past three months. The average Datadog stock price target of $164.93 per share implies a 9.10% upside potential.

Year-to-date, DDOG stock has gained 5.8%.