Oracle Soars After Securing 50,000 AMD Chips to Fuel AI Expansion Frenzy

Oracle's stock rockets as the tech giant makes its biggest AI hardware bet yet—snapping up 50,000 AMD chips to power its artificial intelligence infrastructure push.

The Chip Gambit

This massive hardware acquisition signals Oracle's determination to compete head-on with cloud rivals in the AI arms race. AMD processors will form the computational backbone of Oracle's expanded AI services—from enterprise machine learning to generative AI applications.

Market Reaction

Investors cheered the move, sending Oracle shares sharply higher as Wall Street bets the chip deal will accelerate the company's AI revenue streams. The timing couldn't be better—every tech executive suddenly needs an AI strategy, even if half can't explain what their AI actually does.

Silicon Showdown

This 50,000-chip procurement represents one of the largest single AI infrastructure commitments this year—a bold strike in the escalating battle for AI dominance. Oracle's betting big that hardware supremacy will translate into cloud market share gains.

Because nothing says 'innovation' like buying 50,000 of someone else's chips and calling it a strategy—but hey, it made the stock go up, so mission accomplished.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The partnership marks one of Oracle’s largest single chip commitments to date and showcases the company’s push to diversify its AI hardware beyond Nvidia (NVDA). By integrating AMD’s latest accelerators, Oracle aims to reduce dependence on a single supplier and create a more flexible, cost-efficient cloud ecosystem for enterprise AI applications.

AMD Stock Climbs as Oracle Boosts Demand Outlook

Shares of AMD ROSE 3.3% in pre-market trading, reflecting renewed confidence in the chipmaker’s AI positioning. Oracle’s announcement signals a growing appetite for AMD’s data-center accelerators as hyperscalers and cloud giants look to secure supply amid surging global demand for AI compute.

The move builds on AMD’s recent momentum in the data-center segment, driven by its Instinct MI300 series. Analysts have noted that AMD’s ability to attract large-scale cloud partners like Oracle and Microsoft could accelerate its market share gains against Nvidia in 2026 and beyond.

Meanwhile, Oracle shares edged higher by 1.1%, as the market interpreted the deal as a vote of confidence in the company’s AI infrastructure strategy and long-term growth plans.

Oracle Deepens AI and Cloud Collaboration with AMD

The expanded partnership comes as Oracle positions itself as a major player in the AI infrastructure race. The company’s ongoing investments in GPU clusters, high-speed networking, and multi-tenant AI training environments have made it a preferred choice for enterprise clients seeking hybrid cloud deployments.

By adding AMD chips to its arsenal, Oracle enhances its ability to serve workloads across both training and inference stages. The deployment is also expected to improve price efficiency for Oracle’s customers, particularly those seeking alternatives to Nvidia-based systems.

Industry observers said the announcement reinforces a broader industry shift toward diversified chip sourcing. “Enterprises want optionality,” said one analyst. “AMD’s rise as a credible AI chip supplier means hyperscalers like Oracle can scale faster without waiting for Nvidia’s limited supply.”

The Rollout Will Begin in Q3 2026

The rollout will begin in Q3 2026, with phased integration across Oracle’s global data centers. Both companies are expected to share further details on performance benchmarks, customer adoption, and regional deployment later this year.

The announcement follows a surge in AI infrastructure spending across the cloud sector, with Oracle, Amazon, and Microsoft all racing to meet enterprise demand for model training and deployment at scale.

While competition among chip vendors remains fierce, Oracle’s collaboration with AMD signals that the next phase of the AI boom will hinge not only on power and performance but also on choice, cost, and availability.

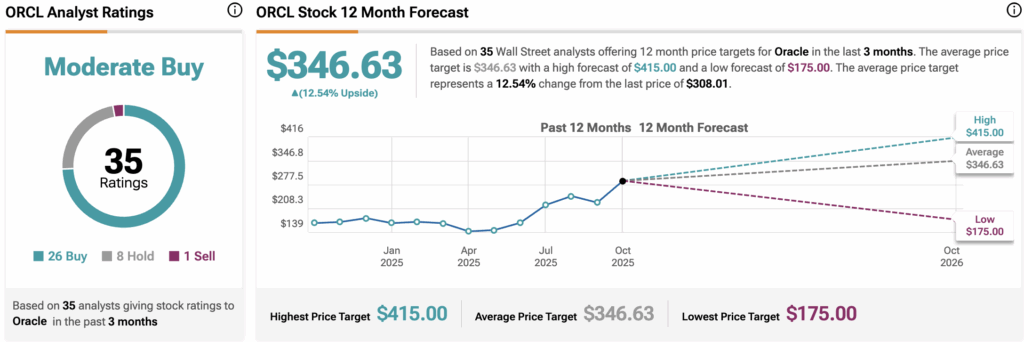

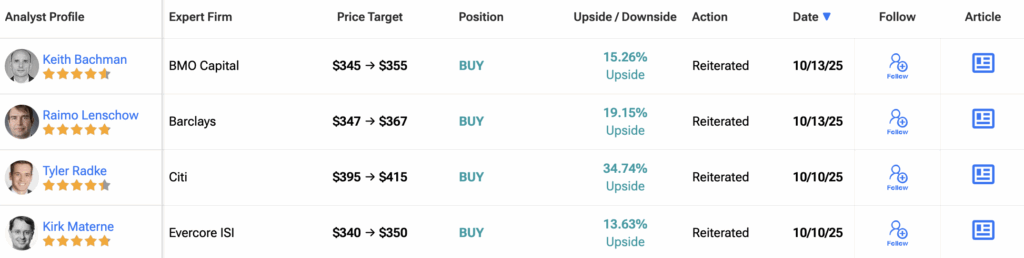

Is Oracle a Good Stock to Buy?

Currently, Wall Street has a Moderate Buy consensus rating on Oracle stock based on 26 Buys, eight Holds, and one Sell recommendation. The average ORCL stock price target of $346.63 indicates 12.5% upside potential from current levels.