Solana Price Forecast: SOL Plunges Below $200 as US-China Trade Tensions Escalate

Solana's rally hits a brick wall as geopolitical tensions trigger massive crypto sell-off.

The Trade War Fallout

SOL crashes through the $200 support level that traders watched like hawks. The breakdown comes as US-China trade relations deteriorate faster than a meme coin in bear market. Institutional investors are dumping crypto exposure like hot potatoes.

Technical Breakdown

Solana's chart shows classic capitulation patterns—volume spikes, support shatters, and fear dominates every trading desk. The same investors who called SOL 'the Ethereum killer' now treat it like damaged goods.

Market Psychology Shift

Traders who rode Solana to its ATH now face the brutal mathematics of crypto corrections. The 'buy the dip' crowd suddenly remembers that in traditional finance, sometimes the dip keeps dipping.

Solana's test isn't technological—it's surviving the old-fashioned fear that still governs markets. The blockchain doesn't care about trade wars, but your portfolio certainly does.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

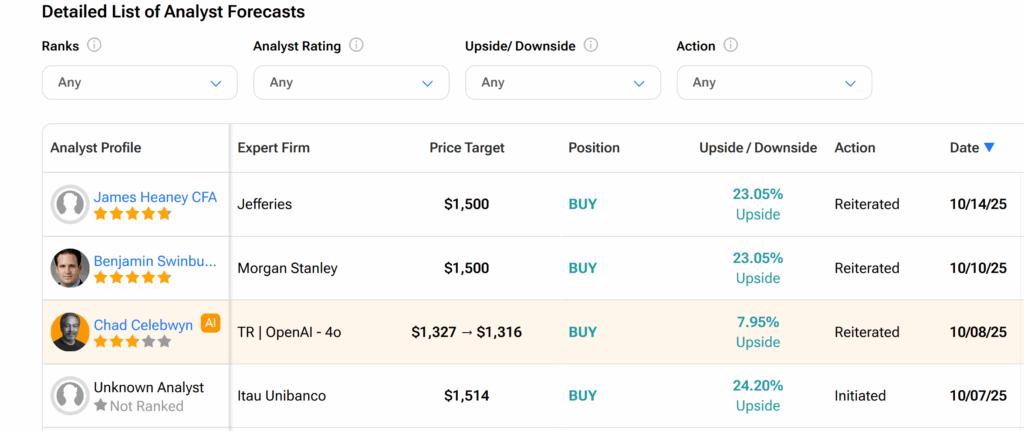

Heaney has set a price target of $1500 for Netflix’s shares, with an upside potential of 23.05%. NFLX stock ended Monday trading marginally lower at $1,219.03 per share.

Jefferies Point to Netflix’s Content Portfolio, Nielsen Data

According to the five-star analyst, his bullish outlook stands on strength of Netflix’s content portfolio, including KPop Demon Hunters, an animated musical urban fantasy recently released by Netflix to wide acclaim, shattering box office records. Heaney also points to Netflix’s “impressive” viewership data for July and August — as provided by data analytics firm firm Nielsen.

Based on these factors, the Jefferies analyst expects Netflix’s revenue growth, minus foreign exchange effects, to surpass 17% in the third quarter, up from 17% in the prior three months period. He also sees Netflix’s revenue jumping between 14% and 16% higher in the next quarter.

What’s the Next ‘Key Catalyst’ for Netflix?

However, Heaney also believes that Netflix’s annual guidance in January next year will be “the key catalyst” in determining how the shares is priced next by Wall Street analysts.

For the incoming Q3 earnings results, the analyst believes that investors will be more interested in company’s audience engagement numbers, as they hope for a better performance than the 1% year-on-year growth seen during the first half of this year.

Furthermore, other analysts have also observed that Netflix cannot afford to underdeliver in Q3, even as the streaming heavyweight’s hybrid business model — under which it introduced ad-based plans — have helped the company turn around the tides in recent years.

Is NFLX Stock a Good Buy?

While Jefferies remains upbeat on Netflix’s shares, across the larger Wall Street, NFLX stock currently hold a Moderate Buy consensus rating. This is based on 26 Buys, nine Holds, and one Sell recommendation assigned by 36 analysts over the past three months, as seen on TipRanks.

However, at $1,403.13, the average NFLX price target indicates a possible 15% growth from the current level.