Bitcoin Q4 Rallies Strong: CryptoQuant Reveals Bold Year-End Target

Bitcoin kicks off fourth quarter with explosive momentum as analysts project significant upside potential.

Market Analysis Breakdown

CryptoQuant's latest research indicates Bitcoin has entered Q4 with unprecedented strength, setting the stage for what could be a record-breaking finish to the year. The analytics firm has officially disclosed its year-end price target, fueling speculation across crypto markets.

Technical indicators suggest sustained bullish pressure as institutional inflows continue to accelerate. Trading volumes have surged approximately 40% quarter-over-quarter while exchange reserves hit multi-year lows—classic signs of accumulation phase.

Industry observers note the timing aligns perfectly with traditional financial calendar cycles, proving once again that crypto markets have more in common with Wall Street than they'd like to admit. The 'decentralized revolution' still dances to the same quarterly performance tunes as every other asset class.

With Q4 typically being crypto's strongest performing period historically, this year's setup appears particularly potent. Whether the target proves accurate remains to be seen, but one thing's certain: the crypto casino is open for business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wood Buys DKNG and Chinese Stocks

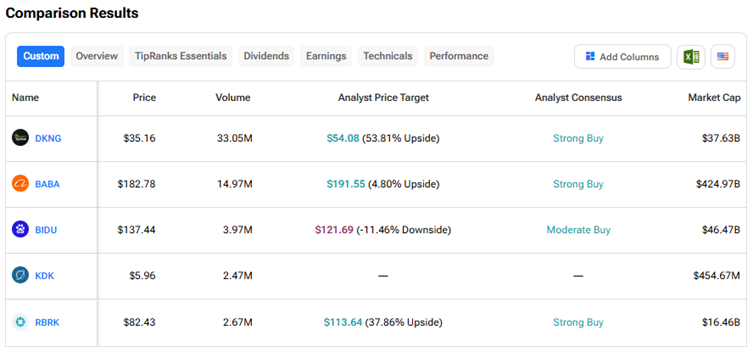

The most significant trade, in terms of value, made on Wednesday was the purchase of 511,049 shares of online betting and gaming platform DraftKings, with a total value of $19.1 million. Specifically, the ARK Innovation ETF (ARKK), the ARK Next Generation Internet ETF (ARKW), and the ARK Fintech Innovation ETF (ARKF) bought 350,315, 103872, and 56862 shares, respectively, of DKNG.

Meanwhile, the ARKK ETF bought 30,137 shares of Chinese e-commerce and cloud computing giant Alibaba, valued at $5.4 million. Additionally, ARKK purchased 21,648 shares of internet giant Baidu, valued at $2.85 million.

Other purchases included 88,236 shares of autonomous driving technology provider Kodiak AI (KDK) by the ARK Autonomous Technology & Robotics ETF (ARKQ) and 46,353 shares of cloud-native data security company Rubrik (RBRK) by the ARKW ETF.

Using TipRanks’ Stock Comparison Tool, we see that among the purchases made on Wednesday, DraftKings, Alibaba, and Rubrik score Wall Street’s Strong Buy consensus rating.

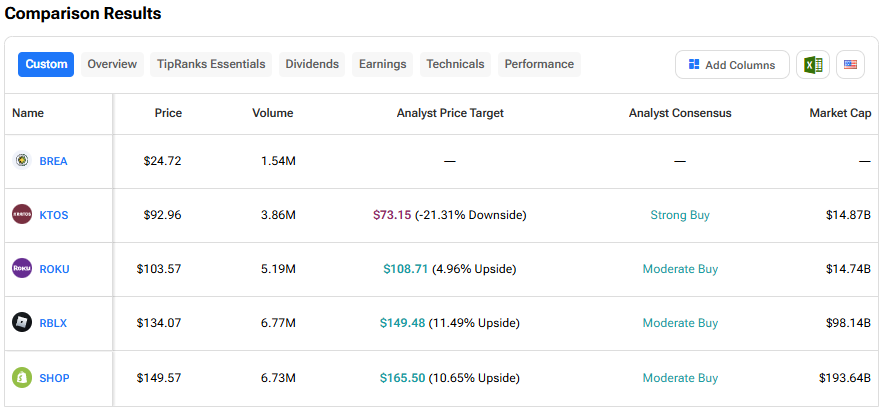

Wood Offloads BREA Stock and More

The ARKK ETF sold 100,983 Brera Holdings shares, worth $3.0 million. Other stocks sold on Wednesday included 25,536 shares of Kratos Defense and Security Solutions (KTOS) for $2.3 million by the ARKQ ETF and 18,440 shares of Shopify (SHOP), valued at $2.7 million, by the ARKF ETF.

Meanwhile, ARKW ETF sold 37,148 shares of Roblox (RBLX), valued at $5.1 million, and 36,697 shares of Roku (ROKU), worth $3.7 million.

Among the stocks sold on Wednesday, Kratos stock scores Wall Street’s Strong Buy consensus rating.