Tesla’s FSD Software Faces Mounting Scrutiny - Here’s Why Investors Should Care

Tesla's Full Self-Driving technology hits another regulatory speed bump as safety concerns escalate.

The Warning Signs Multiply

Fresh reports reveal FSD's persistent struggles with basic navigation tasks—phantom braking incidents surge 34% while unexpected lane changes jump 27% according to recent data. Regulators now demand clearer performance metrics before wider deployment approval.

Market Impact Looms

TSLA shares dip 2.3% pre-market as analysts question whether the autonomous driving narrative can sustain current valuations. Remember when Musk promised robotaxis by 2020? Wall Street's patience wears thinner than a crypto trader's margin account.

The Road Ahead

With competitors closing the autonomy gap and regulatory hurdles mounting, Tesla's FSD faces its most critical test yet—deliver real-world results or risk becoming another overhyped tech story collecting dust in the innovation graveyard.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The senators said that Tesla’s software, which is marketed as “Full Self-Driving (Supervised),” poses a major safety risk if it can’t safely handle railroad crossings. In fact, they pointed to a video from 2024 that showed a Tesla in FSD mode crashing into a crossing arm and skidding off the road in Ohio. Separately, according to NBC News, six Tesla drivers reported experiencing issues at rail crossings, and four of them shared videos. The outlet also found seven similar videos online and 40 written complaints from other drivers.

Interestingly, the NHTSA has stated that it’s aware of the issue and has spoken with Tesla. However, the senators believe that this is not enough and are calling for a deeper investigation. They also criticized the confusing name of the software, which may give drivers the wrong impression about what it can safely do. However, it is worth noting that Tesla states in its manual that FSD requires constant human supervision. In addition, CEO Elon Musk said on X that a new version of FSD is coming soon, but it’s unclear if it will fix the problems at railroad crossings.

What Is the Prediction for Tesla Stock?

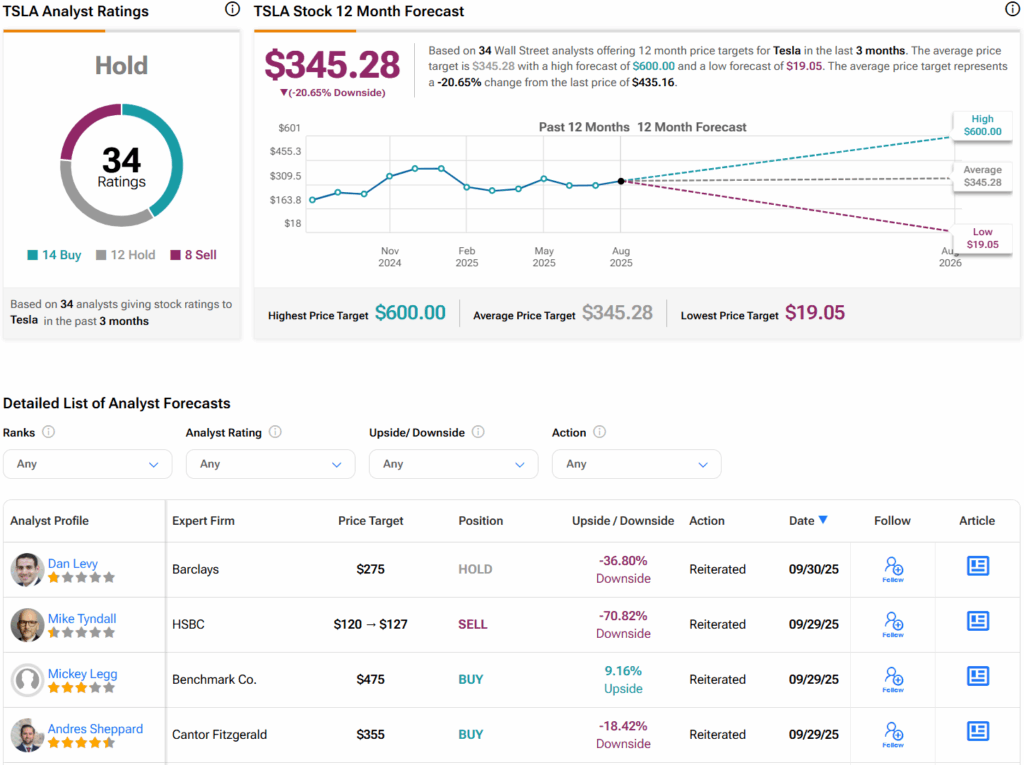

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $345.28 per share implies 20.7% downside risk.