Dow Jones Index Today: DJIA Soars as Inflation Cools and Consumer Spending Surges

Wall Street's benchmark index rockets upward on economic data that's actually making sense for once.

Inflation Finally Cooperates

The Dow Jones Industrial Average isn't just climbing—it's sprinting. Fresh inflation numbers show prices cooling faster than a crypto miner's server room during a bear market. Consumer spending figures confirm what we've suspected: people are actually opening their wallets instead of just staring at them.

Traders Wake Up Smiling

Market participants who've been nursing their portfolios through volatility finally get some good news. The data suggests the Federal Reserve might actually ease up on its relentless rate hikes—something traditional finance has been begging for like Bitcoin maximalists waiting for the next halving.

The Real Story Behind the Numbers

While the Dow gets its moment in the sun, smart money's already looking at how this impacts digital assets. When traditional markets catch a cold, cryptocurrencies used to get pneumonia. Now? They're building immune systems that would make a DeFi protocol jealous.

Another day, another set of economic indicators that'll be revised next month anyway—but for now, enjoy the green candles while they last.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The market was able to breathe a sigh of relief after the Commerce Department announced that August’s Personal Consumption Expenditures (PCE) rose by 0.3% month-over-month and 2.7% year-over-year, with both readings in line with their consensus estimates. PCE is the Fed’s preferred gauge of inflation and tracks prices across a wide variety of goods and services. Core PCE, which excludes volatile food and energy items, matched expectations as well, increasing by 0.2% month-over-month and 2.9% year-over-year.

In another encouraging signal, consumer spending notched a monthly rise of 0.6% in August, beating expectations of 0.5%. Consumer spending accounts for almost 70% of gross domestic product (GDP). That comes as the Commerce Department revised second quarter consumer spending to 2.5% from 1.6%, boosting its second quarter GDP estimate to 3.8% from 3.3%.

While purchase activity continues to grow, consumers aren’t exactly happy about paying higher prices. The University of Michigan’s Index of Consumer Sentiment for September showed that 44% of survey respondents mentioned that higher prices were harming their personal finances, the highest figure in a year. Furthermore, consumer sentiment fell for a third consecutive month.

“Although September’s decline was relatively modest, it was still seen across a broad swath of the population, across groups by age, income, and education, and all five index components,” said Surveys of Consumers Director Joanne Hsu.

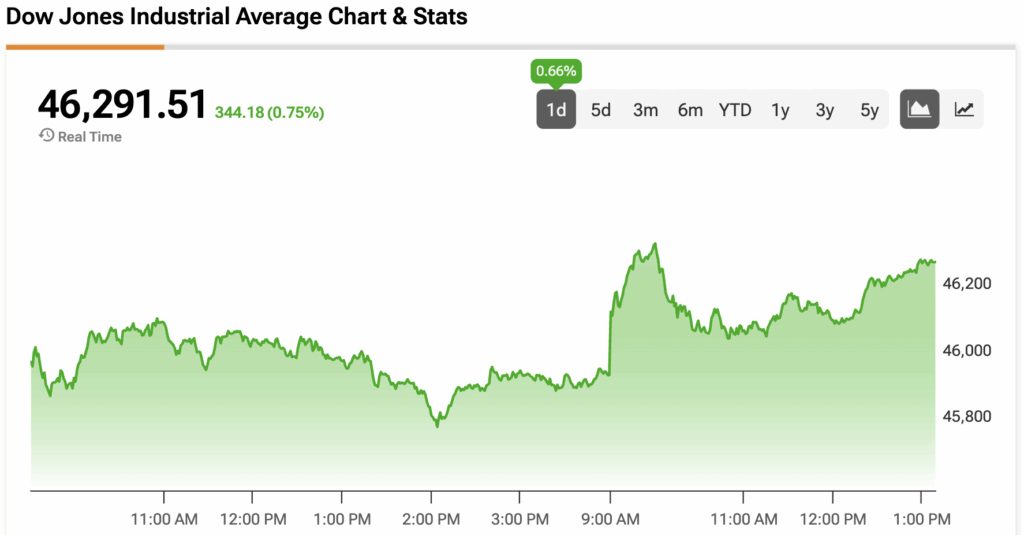

The Dow Jones is up by 0.75% at the time of writing.

Which Stocks are Moving the Dow Jones?

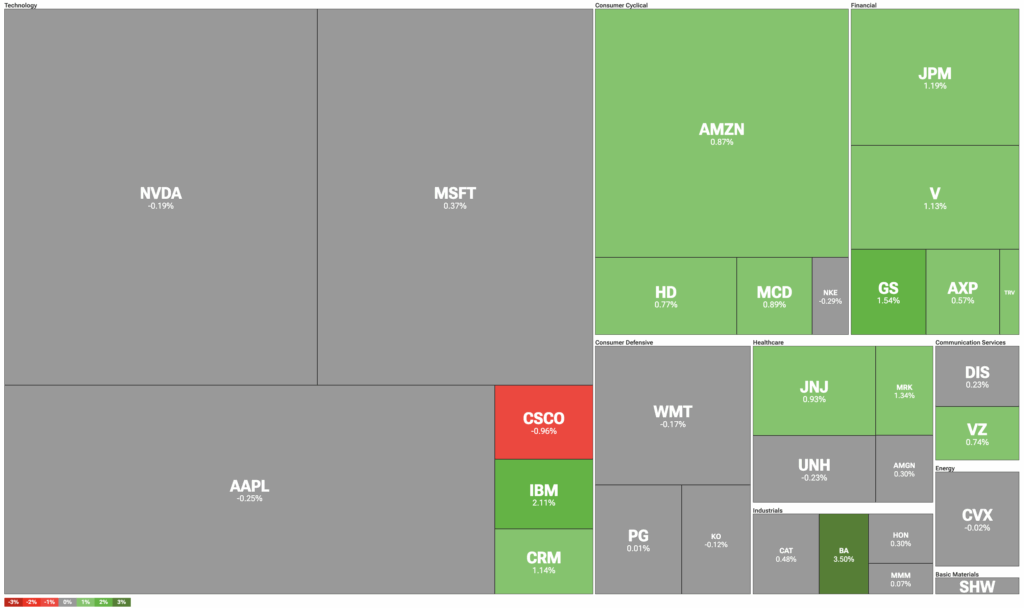

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Consumer cyclical stocks are getting a liftoff from the consumer spending data, while all five financial stocks in the Dow Jones are trading higher.

Meanwhile, Boeing (BA) is up over 3% after the Federal Aviation Administration (FAA) said that the company can sign off on airworthiness certificates for its 737 Max and 787 Dreamliner planes. The FAA blocked Boeing from doing so after the company’s planes experienced crashes and product defects several years ago.

Elsewhere, International Business Machines (IBM) is continuing its winning streak after HSBC (HSBC) reported promising results when testing out IBM’s quantum computer technology on bond trading performance. Other technology stocks, like Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL), are muted on the day.

DIA Stock Moves Higher with the Dow Jones

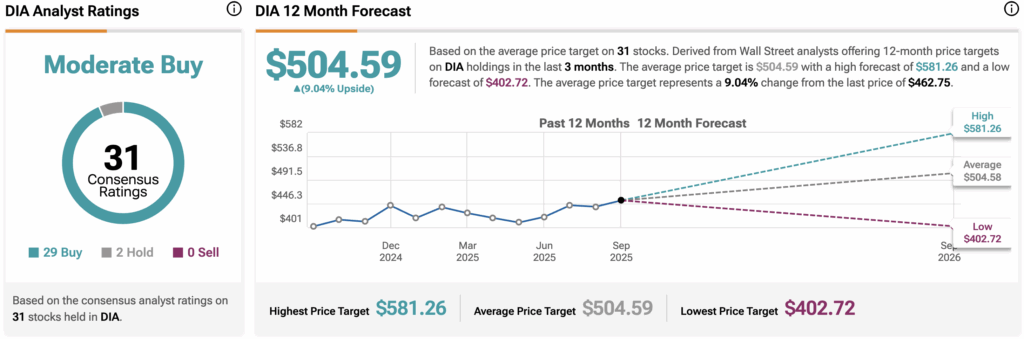

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $504.59, implying upside of 9.04% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.