Five-Star Analyst Predicts 21% Surge for Palo Alto Networks (PANW) - Here’s Why

Security giant Palo Alto Networks just got a bullish stamp of approval from Wall Street's top ranks.

Analyst Upgrade Triggers Rally

A five-star analyst's upgrade sends PANW stock climbing with a definitive 21% upside target. The cybersecurity firm's latest platform expansion cuts through legacy security complexity while bypassing traditional market expectations.

Platform Strategy Pays Off

Consolidation play attracts enterprise clients dumping point solutions. The numbers don't lie - unlike some fintech startups burning cash on blockchain buzzwords.

Wall Street finally recognizes what tech insiders knew: real security solutions beat speculative crypto projects every time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Feinseth pointed to the company’s latest quarterly results, which showed strong revenue growth and rising demand for its next-generation security offerings. Furthermore, he said that the mix of Palo Alto’s AI-driven platform, its push into cloud security, and recent acquisitions is helping the company improve margins and gain market share. All of this, he explained, is leading to faster business growth and stronger overall performance.

The analyst also noted that Palo Alto is in a great position to benefit from the increasing global need for cybersecurity. In fact, this demand is being driven by more frequent and advanced cyberattacks, along with the rise of AI, new government regulations, and the need for secure systems in industries like finance and defense. Lastly, Feinseth added that the company’s smart spending, which has been achieved through focused R&D, strategic deals, and strong cash flow, will continue to support its long-term growth potential.

Is PANW Stock a Good Buy?

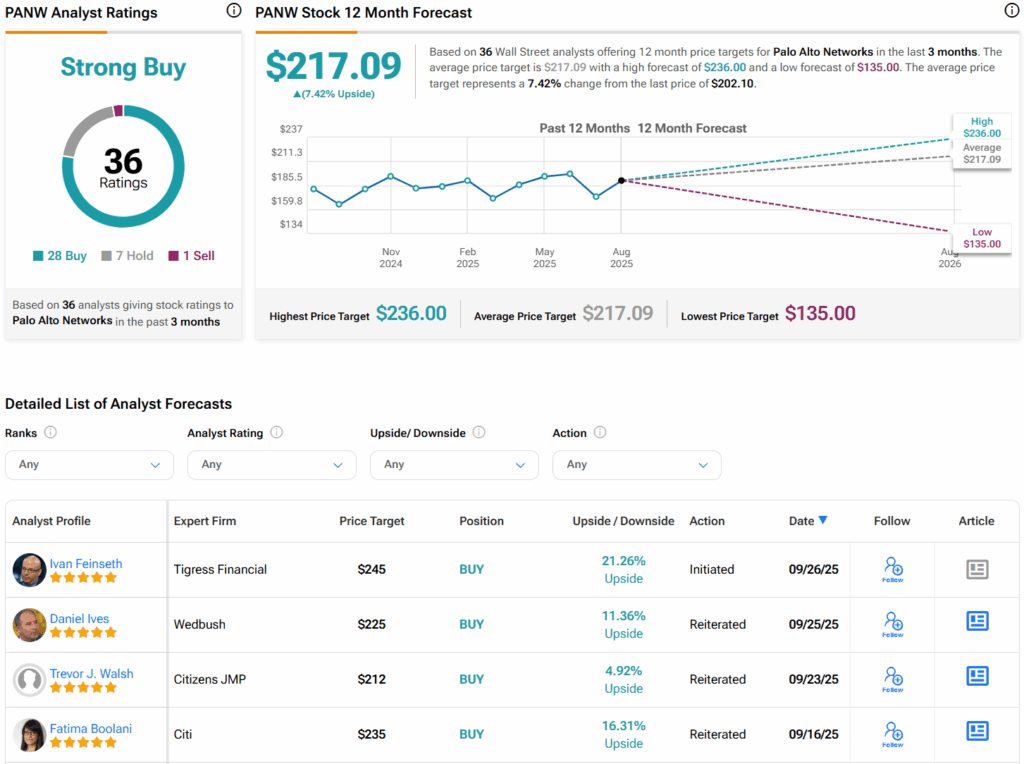

Turning to Wall Street, analysts have a Strong Buy consensus rating on PANW stock based on 28 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average PANW price target of $217.09 per share implies 7.4% upside potential.