Top Analyst Urges ’Hold’ on CoreWeave Stock Despite Blockbuster OpenAI Partnership

Wall Street's favorite prognosticator just dropped a bombshell recommendation that's sending shockwaves through the tech investment community.

HOLD STEADY AMID THE HYPE

While everyone else chases the OpenAI deal headlines, this analyst sees deeper currents. The firm maintains its position despite the market's knee-jerk reaction to the partnership announcement. Street sentiment suggests holding patterns often outperform frenzy-driven trading—especially when institutional money starts moving.

INFRASTRUCTURE PLAYS DEMAND COLD-EYED ANALYSIS

Cloud computing stocks typically rocket on AI news, but this call emphasizes disciplined valuation metrics over emotional trading. The analyst's track record with infrastructure investments lends weight to the counterintuitive recommendation. Sometimes the smartest move is watching the parade pass by from your balcony.

Remember: Wall Street analysts get paid whether you win or lose—their yacht payments don't care about your portfolio performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lenschow’s Hold rating could stem from concerns about CoreWeave’s already stretched valuation. Year-to-date, CRWV stock has surged over 240%.

Lenschow is a five-star analyst on TipRanks, ranking #419 out of 10,050 analysts ranked. He boasts a 61% success rate and an average return per rating of 12%.

The New Deal Will Boost CoreWeave’s Growth

Following CoreWeave’s deepened partnership with the ChatGPT maker, their total contract value now stands at $22.4 billion. Lenschow pointed out that the new deal is about the same size as the $4 billion agreement OpenAI made with CoreWeave in May 2025, which covered one site through 2029. He suggested that this earlier deal could be a good guide for understanding the structure of the latest agreement, since there is limited information about the new deal.

He added that CoreWeave is set to bring several new data centers online in 2026 through partnerships with Core Scientific (CORZ), Galaxy Digital (GLXY), and Applied Digital (APLD), which are expected to support OpenAI and other incremental workloads.

Demand for Compute Capacity Is Accelerating

Lenschow believes demand for compute capacity is accelerating, which should drive sustained RPO (Remaining Performance Obligation) growth for CoreWeave over the coming years. Furthermore, he highlighted that CoreWeave and other data center companies have been announcing a slew of agreements aimed at boosting their compute and infrastructure offerings.

CoreWeave recently amended its Master Services Agreement (MSA) with semiconductor giant Nvidia (NVDA). Additionally, Nvidia announced a $100 billion deal with OpenAI, and software giant Oracle (ORCL) signed a $300 billion cloud deal with OpenAI.

Analysts project CoreWeave’s 2025 revenue to grow 174% to over $5 billion, though the company is still expected to post a net loss as it continues investing heavily in growth and infrastructure.

Is CRWV Stock a Buy, Hold, or Sell?

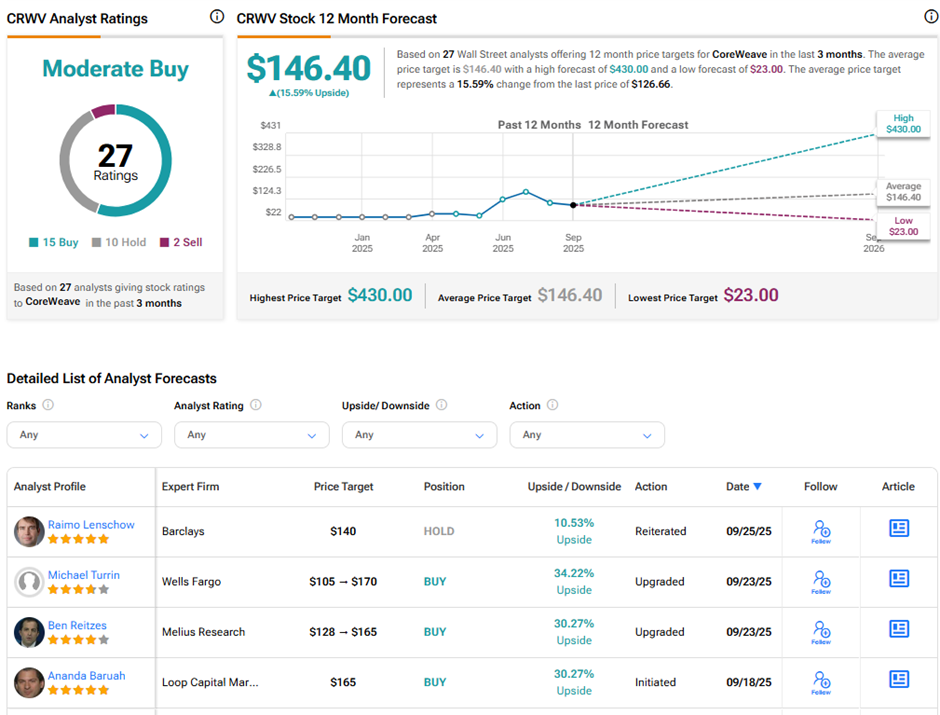

On TipRanks, CRWV stock has a Moderate Buy consensus rating based on 15 Buys, 10 Holds, and two Sell ratings. The average CoreWeave price target of $146.40 implies 15.6% upside potential from current levels.