U.S. Pharma Stocks Soar as Trump Threatens 100% Tariffs on Foreign Drugs

Wall Street's prescription for profits just got a major boost from the White House.

Tariff Shockwaves Hit Healthcare

Pharmaceutical stocks surged after former President Trump floated sweeping 100% tariffs on imported medications. The proposal sent domestic drugmakers skyrocketing while foreign competitors faced immediate pressure.

Domestic Pharma's Windfall

American pharmaceutical companies positioned themselves as primary beneficiaries of the protectionist move. Market analysts predict reshored production and premium pricing power for本土 drug manufacturers—because nothing says 'free market' like government-mandated advantages.

Investors Rush for Safe Harbor

The healthcare sector suddenly became Wall Street's favorite defensive play. Traditional market wisdom suggests tariffs distort markets and raise consumer costs—but who cares about economics when there's money to be made?

Another day, another policy-driven market distortion creating artificial winners in the pharma casino.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Trump, in a post on Truth Social, pointed out that only pharmaceutical companies that have broken ground or kicked off the construction of their manufacturing plants in the country will be expected from the impending tariffs.

On Friday morning, shares of Johnson & Johnson (JNJ), Pfizer (PFE), Merck & Company (MRK), Eli Lilly (LLY), and Bristol-Myers Squibb (BMY) exchanged hands at about half a percentage point higher. On the contrary, British drug Maker AstraZeneca’s (AZN) U.S.-listed shares slumped 2.43% to about $74 to close regular trading on Thursday, and further fell by 0.27% in extended trading.

Meanwhile, showing some resistance, the stock of rival Swiss pharma giant Novartis (NVS) ROSE by more than half a percentage point in early trading on Friday. This is even as the shares of its Swiss competitor Roche (RHHBY) dropped nearly 3% at the closing bell for regular-hours trading — that is, before the announcement.

Novartis and Roche Vulnerable to Trump’s Tariffs

Trump’s new tariff threat signals the latest effort by his administration to bolster domestic drug production. In July, had threatened to impose up to 200% tariffs on pharmaceuticals imported into the U.S. However, at the time, he noted that he WOULD “give people about a year, year and a half” to make adjustments.

In August, the administration also slapped a 39% tariff on Switzerland, exempting pharmaceuticals. Furthermore, a bilateral trade deal entered into with the European Union earlier in July also came with a 15% tariff on pharmaceuticals, minus generic drugs.

TD Cowen (TD) analyst Steve Scala recently noted that foreign-based pharma companies such as Novartis and Roche are more vulnerable to Trump’s tariffs compared to American drug makers.

However, pharma companies, especially foreign-based ones, have been doubling down on their investments in the U.S. to cushion against the possible impact of tariffs on their business. In April, Switzerland-based Norvatis and Roche pledged $23 billion and $50 billion, respectively, to strengthen their manufacturing bases in the U.S.

Norvatis last week also said it had boosted its drug stockpile in the U.S that could last until the middle of next year. However, CEO Vas Narasimhan pointed out that it would take some years to firmly establish a stronger manufacturing base in the country.

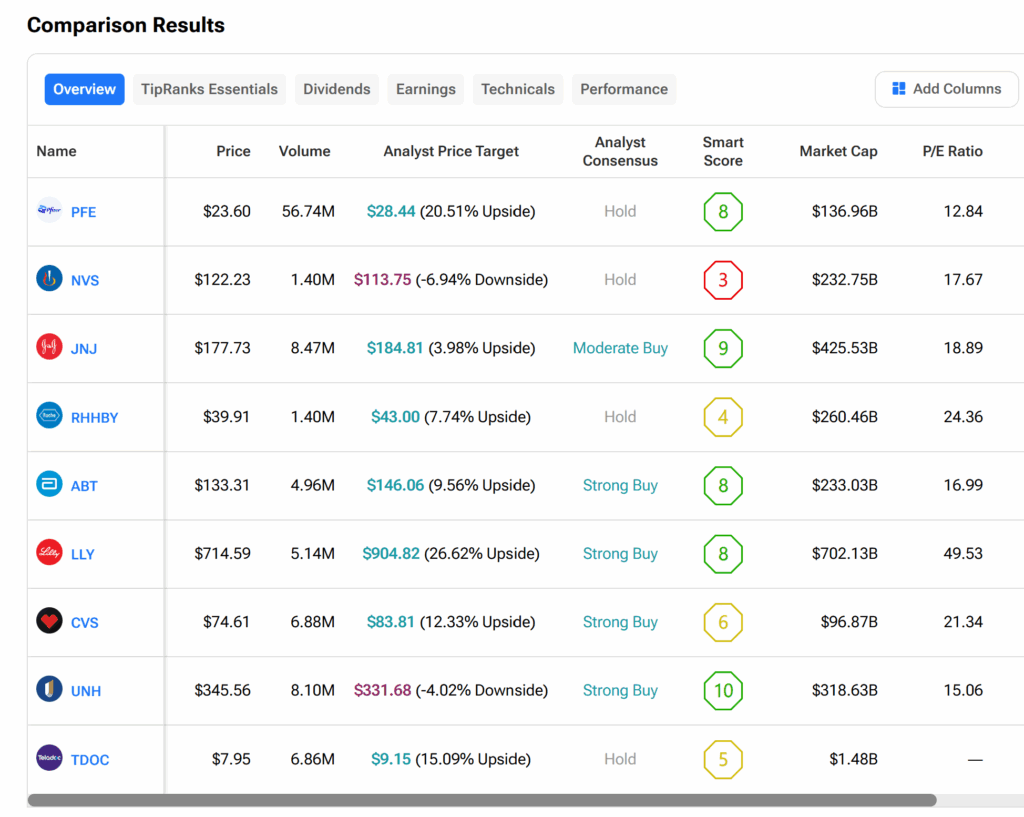

What are the Best Pharma Stocks to Buy?

The volatile tariff enviornment today represents both a threat and an investment opportunity for investors. TipRanks’ Stock Comparison tool provides insight into which pharma and healthcare stocks are worth buying at this time. Kindly refer to the graphics below.