DJIA Plummets as White House Layoff Plan Overshadows Strong Jobs Report - September 26, 2025

Wall Street's flagship index takes a nosedive despite robust employment figures.

Government Shakeup Spooks Investors

The Dow Jones Industrial Average cratered today as the administration's workforce reduction blueprint triggered massive sell-offs across traditional finance sectors. Market participants completely ignored the solid jobs data that would typically send stocks soaring.

Employment Numbers Can't Save the Day

Even with employment metrics hitting expected targets, traders focused squarely on the impending government downsizing. The disconnect between economic fundamentals and market reaction reveals just how jittery institutional money has become.

Traditional Finance Shows Its Fragility

Watching legacy markets buckle under political pressure makes you wonder why anyone still trusts centralized systems. Meanwhile, decentralized assets continue operating without waiting for presidential approvals or congressional hearings.

Another reminder that when governments sneeze, traditional markets catch pneumonia—while crypto just keeps mining.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The White House’s Office of Management and Budget (OMB), which is overseen by President Trump, has instructed federal agencies to permanently fire some employees if the government shuts down. The layoffs WOULD affect agencies whose goals are “not consistent with the President’s priorities” and that face a lapse in funding, read a brief obtained by Politico. The move comes as Congress remains in a deadlock on the terms of a funding extension bill. It also puts more pressure on Democrats, as previous government shutdowns have resulted in temporary furloughs instead of permanent removals.

Meanwhile, the job market continues to show a slow-to-fire-and-hire trend. August’s initial jobless claims fell by 14,000 to 218,000 and came in below the consensus estimate of 235,000. Initial jobless claims have now completely erased a surge to 264,000 at the beginning of the month, allowing investors to breathe a sigh of relief. Furthermore, continuing jobless claims fell to 1.926 million from 1.928 million, although they remain elevated compared to recent years.

In another positive sign, the Commerce Department raised its final second quarter gross domestic product (GDP) estimate to an annualized rate of 3.8% from 3.3%. Consumer spending was a big factor in the revision, increasing by 2.5% compared to the previous estimate of 1.6%. In addition, rising imports, which led to GDP falling by 0.6% during the first quarter, reversed course during the second quarter.

The Dow Jones is down by 0.53% at the time of writing.

Which Stocks are Moving the Dow Jones?

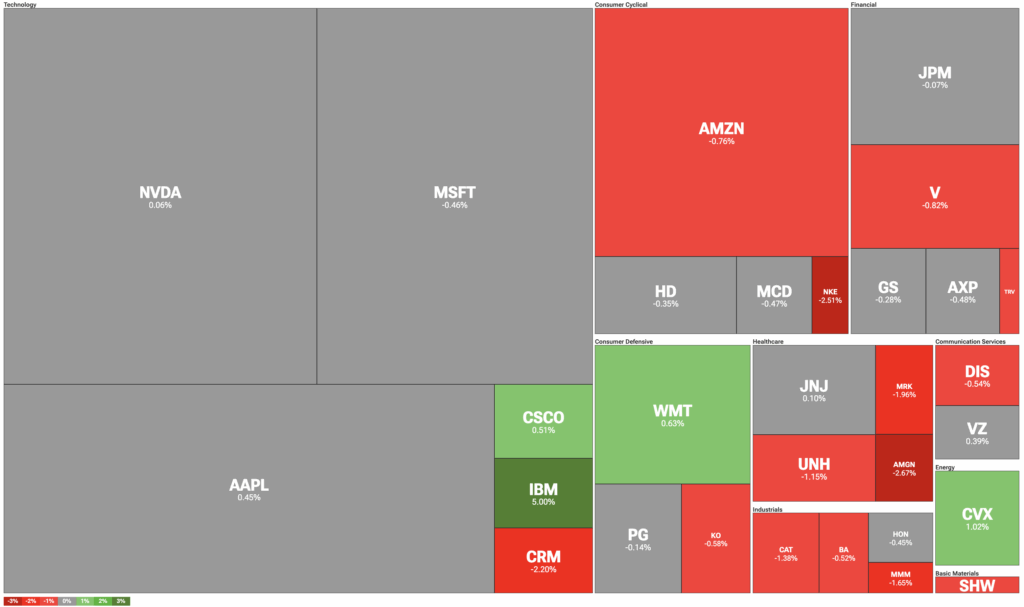

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Amazon (AMZN) is trading lower after the e-commerce leader agreed to pay a $2.5 billion settlement with the Federal Trade Commission (FTC) for allegedly misleading its customers into signing up for Amazon Prime and making it difficult to cancel the subscription. “The evidence showed that Amazon used sophisticated subscription traps designed to manipulate consumers into enrolling in Prime, and then made it exceedingly hard for consumers to end their subscription,” said FTC Chairman Andrew Ferguson.

Meanwhile, International Business Machines (IBM) is the top performer in the index after HSBC (HSBC) said that the technology company’s quantum computing technology delivered significant improvements in bond trading performance as part of trial tests. Other tech stocks, like Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL), are muted on the day. Contributing to the downside in the Dow Jones are the healthcare and industrials sectors.

DIA Stock Moves Lower with the Dow Jones

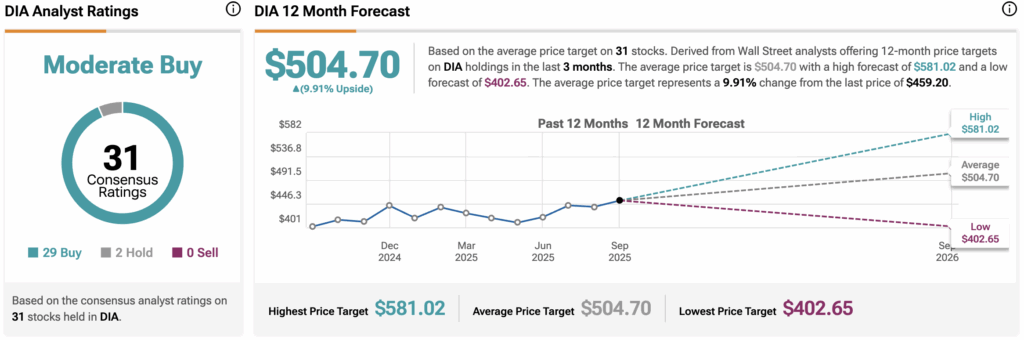

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $504.70, implying upside of 9.91% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.