Marvell (MRVL) CEO Makes $1 Million Bet on Company Stock - Insider Confidence Soars

Marvell's chief just dropped a million-dollar vote of confidence—while Wall Street analysts scratch their heads over semiconductor valuations.

Insider Moves Speak Louder

The CEO's purchase signals brass-knuckles belief in Marvell's roadmap—no corporate fluff, just cold hard cash hitting the tape. That $1 million buy screams conviction louder than any earnings call script.

Semiconductor Sector Gambles

Chip stocks keep swinging between supply chain nightmares and AI-driven demand spikes. This move suggests the top exec sees clearer skies ahead—or at least better odds than your average crypto meme coin.

Wall Street's Selective Amnesia

Funny how traditional finance cheers insider buys while still treating crypto founders' skin-in-the-game as 'speculative'—guess it depends whose ox is being gored.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to filings with the U.S. Securities and Exchange Commission (SEC), Murphy bought 13,600 shares of MRVL stock at an average price of $77.09 each, representing a total investment of $1.05 million. The transaction increased Murphy’s direct ownership of MRVL stock to 268,637 shares worth $22.4 million.

However, Murphy is not the only Marvell executive to buy company stock on the open market. Chief Financial Officer (CFO) Willem Meintjes acquired 3,400 shares at $78.03 per share, worth $265,300 and bringing his total holdings of MRVL stock to 132,159 shares valued at $10.9 million.

Buying Spree

Additionally, President and COO Chris Koopmans acquired 6,800 shares at $78.03 each through a family trust, for an investment of $530,600. The Christopher R. Koopmans Family Trust now holds 104,825 MRVL shares worth $8.7 million.

The combined purchases by Marvell Technology executives totaled about $2.1 million, and signal bullish confidence in the company and its prospects. The stock purchases by senior executives come as MRVL stock has fallen 24% this year. However, the shares have rebounded and risen 14% over the past month. The company recently announced a new $5 billion stock buyback plan.

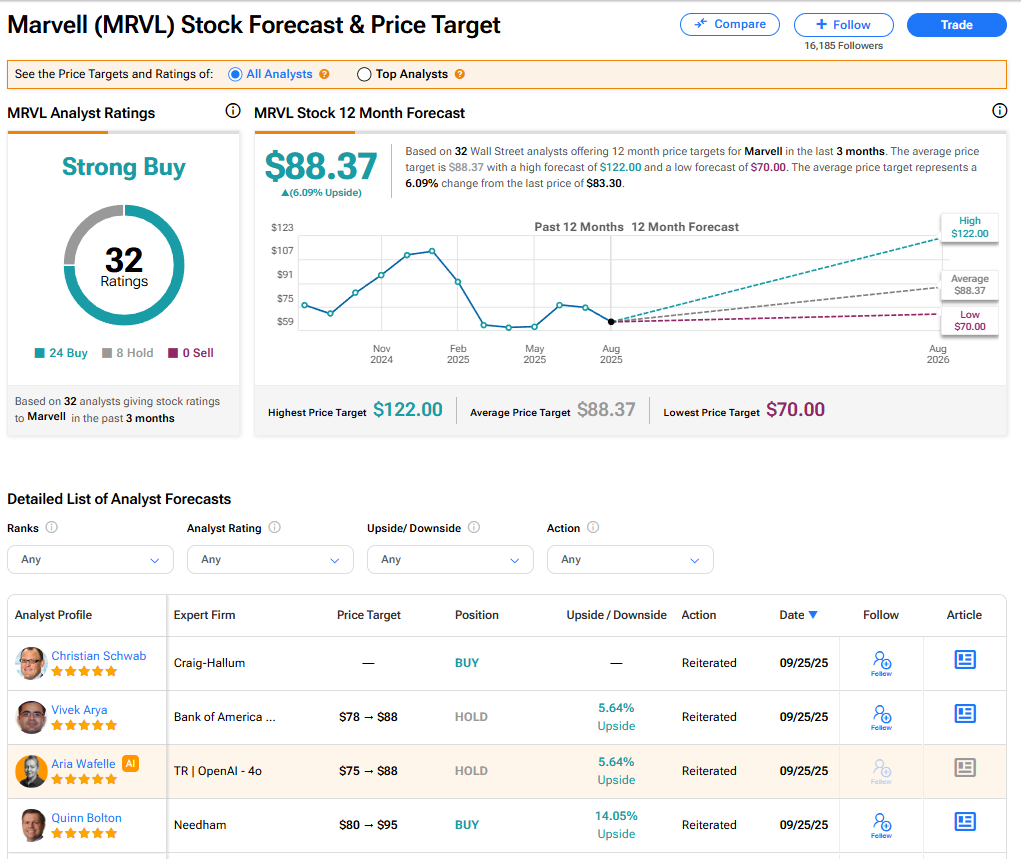

Is MRVL Stock a Buy?

The stock of Marvell Technology has a consensus Strong Buy rating among 32 Wall Street analysts. That rating is based on 24 Buy and eight Hold recommendations issued in the last three months. The average MRVL price target of $88.37 implies 6.09% upside from current levels.