This Spin-Off Could Make Investors Huge Winners in 2025

The corporate spin-off that's quietly positioning itself as the next crypto powerhouse.

Unlocking Hidden Value

While traditional finance scrambles to catch up with blockchain innovation, this spin-off operation cuts through the bureaucratic red tape that typically slows down legacy institutions. The separation creates a leaner, more agile entity focused exclusively on digital asset integration.

Market Disruption in Motion

Unlike traditional IPOs that involve months of regulatory hurdles and banker fees, this spin-off bypasses the conventional fundraising circus. The move signals a fundamental shift in how value gets created and distributed in the digital age—while Wall Street analysts scramble to update their spreadsheets.

Investor Advantage Playbook

Early positioning in strategic spin-offs often generates asymmetric returns. The parent company's existing infrastructure provides immediate operational leverage, while the new entity's focused mandate allows for rapid adaptation to market conditions. It's almost like they're building a decentralized organization within a centralized framework—how delightfully contradictory.

The timing couldn't be more perfect, with institutional adoption accelerating and regulatory clarity finally emerging. Though let's be real—if history teaches us anything, it's that most financial 'sure things' have the structural integrity of a house of cards during a bull market.

Image source: Aptiv.

What's going on?

Aptiv may not be a household name for investors, but it's a prominent player in the automobile components industry with a focus in electrical systems, advanced driver assistance systems (ADAS), and connected vehicle solutions. We actually have to rewind the clock to understand the company's origin story because this isn't the first time it has had a significant strategic shift and spin-off.

The company started its story as Delphi Automotive, an auto parts business spun out ofin 1999 before it filed for bankruptcy in 2005. The company then restructured and spun off Aptiv in 2017 with Delphi keeping powertrain technologies, sensors, valve actuators, among others, and Aptiv taking the higher-growth businesses such as vehicle electrification and safety.

The move looked brilliant at first because Aptiv was rewarded with a higher price-to-earnings ratio due to the HYPE surrounding electrification of vehicles. However, when that electric vehicle (EV) hype slowed, the company's price-to-earnings ratio spiraled lower to match more traditional auto-parts suppliers.

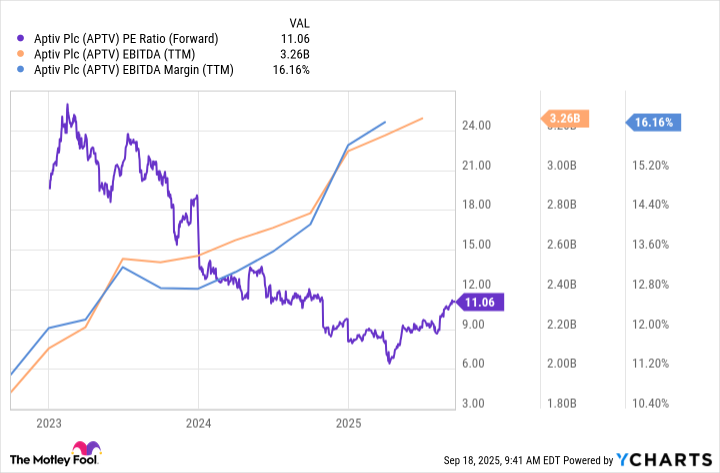

The problem wasn't Aptiv's business, because it was consistently growing earnings and improving margins, as you can see in The Graph below. Aptiv's consistently improving bottom line is also why this investment shouldn't turn into a value trap. In fact, Aptiv is estimated to earn nearly $7.50 per share this year, per FactSet, up from $2.61 in 2021, which is a solid compound annual growth rate of 30%.

APTV PE Ratio (Forward) data by YCharts

Rather, the problem was perception of the stock being too intertwined with the automotive industry -- some of its competitors have diversified far outside the fickle auto industry. That perception drove its price-to-earnings valuation lower.

Round two

If at first you don't succeed, try, try again -- so here we are for round two. In another attempt to shift perception of its business, Aptiv announced it would split into two companies. One company will contain its slower-growth electrical distribution systems (EDS) business, and the second company will focus on the faster-growing safety and software.

In theory, once the spin-off wraps up in the first quarter of 2026, it should enable both new companies to better allocate capital to growth and reward the new higher-growth company to obtain a higher valuation than traditional auto parts suppliers. That's how investors win.

For more context, here's a breakdown of how the two companies and their businesses looked last year. In 2024 the EDS business generated annual sales of $8.3 billion with profit margins checking in at 9.5% EBITDA. On the flip side, safety and software generated 2024 sales of $12.2 billion with EBITDA margins almost double EDS, at 18.8%. But what many investors are overlooking is that safety and software are businesses that can easily reach outside the automotive industry and decouple the company, at least in theory, from its lower auto parts supplier valuation.

What it all means

It's not difficult to see why the businesses should be separated, especially considering the perception and its historic ties to the automotive industry. Delphi's original breakup was an attempt to evolve into a better auto parts supplier, but this spin-off is about focusing on a wider addressable market generating more sales at higher margins.

In fact, Aptiv already acquired communications software provider Wind River in 2022, beginning its expansion outside of the auto industry. The "new" Aptiv could be a diamond in the rough for investors who buy in at a historically depressed price-to-earnings ratio and valuation. If the company executes its spin-off, expands outside the auto industry, and maintains high EBITDA margins, the next few years should reward investors with a consistently rising valuation.