Microsoft’s $17.4 Billion AI Power Move Unleashes Monster Data Center Stock Buying Frenzy

Microsoft just dropped a nuclear-grade catalyst on the AI infrastructure market—and smart money's already positioning for the fallout.

The $17.4 billion bet isn't just another corporate investment; it's a full-scale declaration of war on legacy data infrastructure. This move effectively greenlights the entire AI data center supply chain.

Why This Isn't Business as Usual

Forget incremental upgrades. Microsoft's capital injection represents the largest single AI infrastructure commitment since the ChatGPT explosion reset industry expectations. That capital doesn't just sit on balance sheets—it flows directly to hardware manufacturers, chip designers, and cooling solution providers racing to meet unprecedented demand.

The Hidden Winners

While Wall Street obsesses over software plays, the real leverage lies in the picks-and-shovels providers building the physical foundations of AI. These companies operate with razor-thin margins until a tidal wave of demand lets them reprice everything—including their stock multiples.

Timing the Wave

The smart move isn't chasing yesterday's news—it's identifying which infrastructure players have the capacity to actually deliver on these contracts without defaulting. The coming months will separate the real operators from the slide-deck heroes.

Of course, traditional analysts will still be modeling linear growth while the entire sector goes parabolic. Some things never change—like finance departments being the last to understand technological inflection points.

17.4 billion reasons to pay close attention to Nebius

Last week, Nebius announced a five-year, $17.4 billion infrastructure agreement with. For reference, up until this point, Nebius' management had been guiding for $1.1 billion in run rate annual recurring revenue (ARR) by December. I point this out to underscore just how transformative this contract is in terms of scale and duration.

The Microsoft deal not only places Nebius firmly alongside peers like Oracle and CoreWeave in the AI infrastructure conversation, but it also serves as validation that its technology is robust enough to meet the standards of a hyperscaler.

For Microsoft, the partnership is equally strategic. With GPUs in chronically short supply and long lead times to expand data center capacity, this agreement allows Microsoft to secure adequate compute resources without stretching internal infrastructure or assuming the upfront capital expenditure (capex) budget and execution risks that come with it.

Image source: Getty Images.

Why this deal matters for investors

AI investment is not a cyclical trend -- it's a structural shift. Enterprises are deploying applications into production at unprecedented speed, workloads are scaling rapidly, and new use cases in areas like robotics and autonomous systems are emerging.

For companies that supply the compute underpinning this increasingly complex ecosystem, these dynamics create durable secular tailwinds. By securing Microsoft as a flagship customer, Nebius has established itself within this foundational layer of the AI infrastructure economy.

Is Nebius stock a buy right now?

Since announcing its partnership with Microsoft, Nebius shares have surged roughly 39% as of this writing (Sept. 16). With that kind of momentum, it's natural to wonder whether the stock has become expensive. To answer that, it helps to put its valuation in context.

Prior to the Microsoft deal, Nebius was guiding for $1.1 billion in ARR by year-end. If I assume Microsoft's $17.4 billion commitment is evenly spread across five years (2026 to 2031), that adds about $3.5 billion annually -- bringing Nebius' pro forma ARR closer to $4.6 billion.

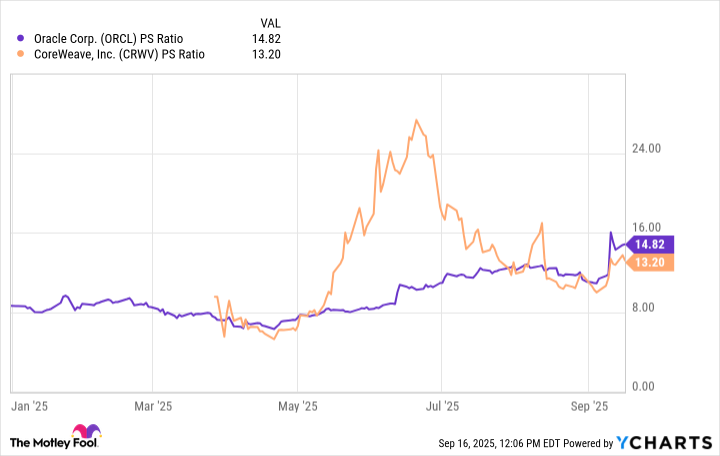

Against its current market cap of $21.3 billion, Nebius stock trades at an implied forward price-to-sales (P/S) ratio of 4.6. On the surface, that looks meaningfully discounted to peers like Oracle and CoreWeave.

ORCL PS Ratio data by YCharts

That said, there are important caveats to consider. My analysis assumes no customer attrition over the next several years -- this is unrealistic due to competitive pressures. While Nebius may continue winning large-scale contracts, it's also reasonable to expect some customer churn.

Moreover, comparing Nebius' future ARR to Oracle's and CoreWeave's current revenue base is not an apples-to-apples match. Oracle, for example, has reportedly inked a $300 billion cloud deal with OpenAI. Meanwhile, CoreWeave also has multiyear, multibillion-dollar commitments tied to OpenAI. The catch is that OpenAI itself doesn't have the cash on its balance sheet to fully fund these agreements -- leaving questions about their viability.

In short, Nebius appears attractively valued relative to its peers -- but the landscape is evolving quickly and riddled with moving parts. The more important takeaway is that Nebius is now winning significant business alongside its brand-name peers.

In my eyes, this validation in combination with ongoing structural demand tailwinds makes Nebius a compelling buy and hold opportunity as the AI infrastructure narrative continues to unfold.