Broadcom and Oracle Just Catapulted the ’Ten Titans’ to 39% of the S&P 500. Here’s What It Means for Your Investment Portfolio

Traditional finance giants just reshuffled the entire market deck—while crypto quietly builds the new table.

The Concentration Conundrum

Broadcom and Oracle's surge pushes the so-called 'Ten Titans' to unprecedented dominance, controlling nearly two-fifths of America's flagship index. That's concentration risk even Bitcoin maximalists would blush at.

Portfolio Implications

Investors now face a brutal choice: overweight these megacaps and pray they don't stumble, or seek alternatives in an increasingly correlated market. Meanwhile, crypto's decentralized structure keeps looking more attractive by comparison.

Diversification's New Meaning

Smart money isn't just adding small-cap stocks anymore—they're allocating to uncorrelated digital assets that actually offer real diversification instead of Wall Street's version of 'different shades of blue.'

Traditional finance keeps doubling down on concentration while pretending it's diversification—meanwhile, Bitcoin's sitting at all-time highs and actually delivering what portfolio managers promise.

Image source: Getty Images.

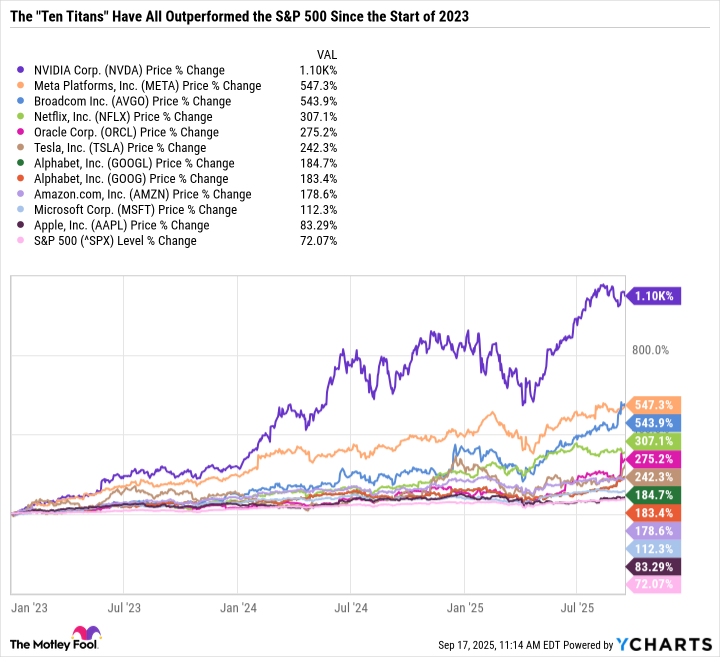

A lot has changed in less than three years

The S&P 500 is up a staggering 70% since the start of 2023, and a big reason for that is artificial intelligence (AI). Specifically, a few major companies are profiting from AI through semiconductors and associated networking hardware, software infrastructure, cloud computing, automation, and efficiency improvements.

The Ten Titans encapsulate this theme. The group is now double the market cap of China's entire stock market and is largely responsible for moving the S&P 500 in recent years.

At the end of 2022, the Ten Titans made up 23.3% of the S&P 500. But since then, many of the Titans have increased in value several-fold, with Nvidia and Broadcom leading the pack.

Data by YCharts.

The Ten Titans' combination of size and rapid gains has redefined the structure of the S&P 500. Here's a look at each company's weight in the S&P 500 as of this writing.

|

Nvidia |

6.98% |

|

Microsoft |

6.35% |

|

Apple |

5.99% |

|

Alphabet |

5.08% |

|

Amazon |

4.13% |

|

Meta Platforms |

3.26% |

|

Broadcom |

2.78% |

|

Tesla |

2.25% |

|

Oracle |

1.43% |

|

Netflix |

0.87% |

|

Total |

39.12% |

Data source: Slickcharts.

Oracle's surge on Sept. 10 briefly pole-vaulted it to become the tenth-largest company by market cap. At that time, the nine largest names in the S&P 500 were all tech companies -- a far cry from the days when the most valuable U.S. companies were from the oil and gas, consumer staples, financials, and industrial sectors.

The Ten Titans' influence is growing

Even if you don't own any of the Ten Titans stocks, their rise may still have Ripple effects for your financial portfolio.

The biggest impact WOULD be if you own index funds or exchange-traded funds (ETFs) with exposure to these holdings. Market-cap weighted passive funds that follow a growth theme or the general market will likely have sizable positions in the Ten Titans. And S&P 500 funds that mirror the index, like the,, the will all have around 39% of their holdings in the Titans.

The sheer size of the Ten Titans means that the S&P 500 is no longer a balanced index, at least for now. Rather, it's more of a growth index, similar to how theis typically viewed.

The S&P 500 may contain hundreds of holdings, but its performance is now based on just a couple dozen companies. Investors looking for mid-cap or even large-cap stocks should venture outside the index because the S&P 500 offers little exposure to non-mega-cap names.

Navigating a Ten Titans-dominated market

The rise of the Ten Titans has benefited their shareholders, S&P 500 index fund investors, and folks with exposure to these stocks through ETFs. However, because they are so big, they will likely make the S&P 500 more volatile going forward.

Investors can offset the Ten Titans concentration by investing in value and dividend stocks that no longer make up a large percentage of the S&P 500. On the other hand, if you're looking for a low-cost and straightforward way to get exposure to top growth stocks, the S&P 500 may be one of the simplest ways to do so.