3 Popular Artificial Intelligence (AI) Stocks to Avoid Like the Plague - Including Palantir

AI Hype Meets Reality Check: These Overvalued Tech Plays Could Torch Your Portfolio

Wall Street's Darling Turns Toxic

Palantir leads the pack of AI stocks flashing serious warning signs. While everyone's chasing the artificial intelligence narrative, these three names carry more baggage than a crypto exchange after a bull run.

Valuations That Defy Gravity - And Common Sense

These aren't just expensive stocks - they're priced for perfection in a world where AI adoption faces regulatory headwinds and implementation challenges. The math simply doesn't work unless you assume monopoly-level margins and zero competition.

When the AI Bubble Pops

Remember when every company adding '.com' to their name sent valuations soaring? Today's AI craze feels eerily similar. Smart money's already rotating out of pure-play AI names into more diversified tech giants - the ones actually generating cash flow instead of just PowerPoint presentations.

Because nothing says 'solid investment' like betting on companies that burn more cash than a Bitcoin miner during a heatwave.

Image source: Getty Images.

Palantir

Palantir's stock has been on an unbelievable run. It's up 2,570% since 2023, 900% since 2024, and 126% this year. With that kind of growth, investors may think I'm advocating for avoiding it because it's run out of steam, but that's not the case at all.

Palantir is performing exceptionally well, and its revenue growth is accelerating rapidly. In Q2, companywide revenue ROSE 48% compared to 39% growth in Q1. I believe Palantir will continue to grow rapidly and remain among the best-performing companies in the AI arms race.

If I think it will be a top-performing company, why am I not bullish on the stock? It all comes down to valuation.

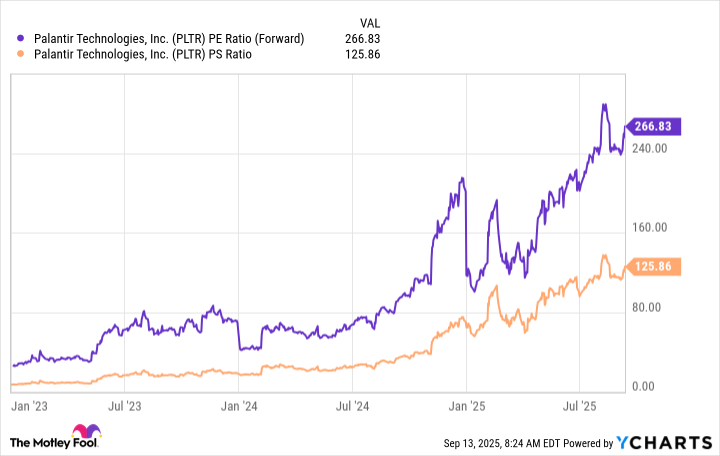

Even though Palantir's stock has increased by 2,570% since 2023, its revenue has risen by only 80%. That's a huge mismatch, indicating that the stock has achieved most of its gains through an increase in its valuation. Looking at its valuation supports this analysis, as it trades for a jaw-dropping 267 times forward earnings and 126 times sales.

PLTR PE Ratio (Forward) data by YCharts

Those are valuation levels that few companies ever achieve and no company sustains. Palantir will either need to grow into those valuations (resulting in a flat stock price) or fall dramatically to trade at a more reasonable level.

Take, for example. Despite multiple quarters in a row where it rippled its revenue year over year, it never traded for more than 50 times sales or forward earnings. Palantir is growing much slower than that, yet it has attained a valuation far higher than Nvidia ever did.

Regardless of what happens, I'd expect Palantir's stock to be flat over the next few years, even if the company maintains a strong growth rate. There are years of growth already baked into Palantir's stock, and investors WOULD be wise to take some of those gains and invest in other, more reasonably valued companies.

BigBear.ai and C3.ai

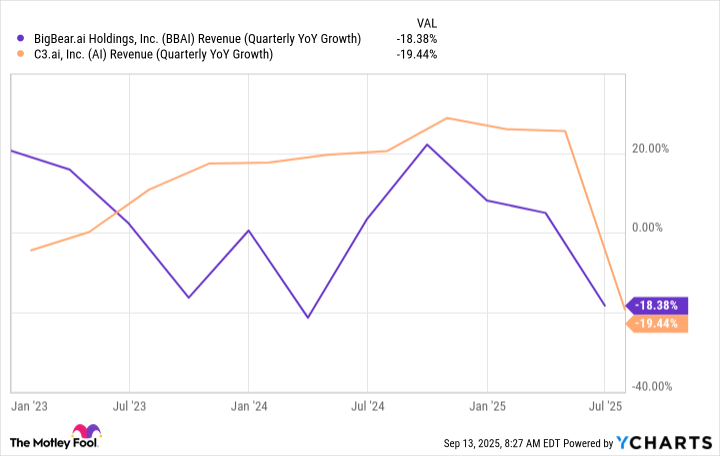

We're in the golden age of AI, and any company associated with the trend should be doing well. However, that's not the case with these two.

Both companies are struggling, and actually delivered falling revenue in the past quarter.

BBAI Revenue (Quarterly YoY Growth) data by YCharts

Given the high demand for AI by nearly every business in the U.S., it shouldn't be difficult to achieve at least positive revenue growth. Since both have negative growth, it's fairly obvious that their respective competitors offer better products and services, and are likely attracting clients away from these two.

If these two can't grow revenue right now when market conditions are optimal, what will happen five years later when the massive AI spending boom is potentially complete? These two aren't worth your time, and if you have them, I'd consider selling shares to MOVE to more attractive investments.

There are plenty of promising AI companies available to invest in, and these three are not among them. There are also several AI exchange-traded funds (ETFs) that already hold some of the top AI companies, which could be another solid investment option.