Nvidia’s Biggest Risk Is Far and Away More Daunting Than You Think

Nvidia faces a monumental threat that could dwarf all other concerns—and it's not what Wall Street expects.

The AI Chip Supremacy Challenge

Competition heats up as rivals aggressively target Nvidia's core market. Custom silicon from tech giants and specialized startups erodes their dominance quarter by quarter.

Regulatory Overhang Intensifies

Global regulators circle like hawks. Export controls and antitrust scrutiny create unpredictable headwinds that could slam growth trajectories overnight.

Supply Chain Vulnerability

TSMC's manufacturing bottlenecks and geopolitical tensions expose critical dependencies. One disruption could throttle their entire production engine.

Market Saturation Looms

AI infrastructure spending can't accelerate forever—eventually even hedge funds run out of other people's money to pour into server farms. The valuation assumes perpetual hypergrowth that even crypto bulls would blush at.

Nvidia's trajectory looks spectacular until suddenly it doesn't—ask any investor who chased the last 'can't-miss' tech story.

Image source: Getty Images.

The vast majority of Nvidia's revenue comes from just six customers

Nvidia has multiple segments that it generates revenue from, including automotive, gaming, professional visualization, and data centers. But its main income source right now is its data center business, which accounted for 88% of the $46.7 billion in revenue it posted in its most recent period, which ended on July 27.

What's most concerning, however, is the customer concentration risk in that segment. Nvidia's AI chips aren't cheap, and it's primarily the big tech companies that can afford to spend significantly on them. Companies disclose when customers account for a big slice of revenue, and Nvidia says that its two largest customers, which it refers to as just Customer A and Customer B, represented 23% and 16% of revenue for the past quarter, respectively.

But that's not all. It also noted that there were four direct customers that each made up 10% or more of its quarterly sales. In total, approximately 85% of its revenue was attributable to just six customers. While specific names weren't mentioned, my guess is that its key customers are big hyperscalers, with the majority of them potentially among the "Magnificent Seven."

The problem is clear: if there's a slowdown in AI-related spending, Nvidia's growth rate could quickly unravel given its exposure to just six customers.

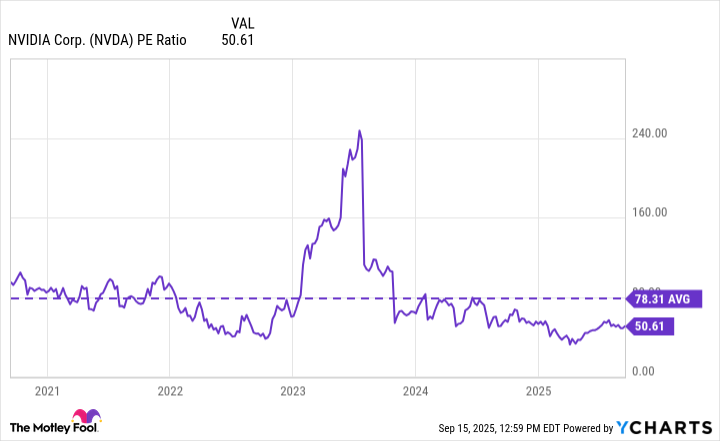

Nvidia's valuation has come down, but it remains high

Currently, Nvidia's stock trades at a price-to-earnings multiple of more than 50. Although that premium has come down over the past year and it's below its five-year average, that's still a high price to be paying for the AI stock.

Data by YCharts.

Both Nvidia's sales and profits were up over 50% last quarter, but that hasn't been enough to give the stock much of a boost. Over the past month, the stock has declined in value by nearly 6% (as of Sept. 17). There could be some resistance from investors to price the stock much higher than where it is right now, given the risks related to the overall economy, its fragility, and the potential for a slowdown in AI spending in the future.

Is Nvidia stock still a good buy?

In just five years, Nvidia has generated life-changing returns of nearly 1,300% for investors. But now with its market cap up around $4.3 trillion, the inevitable questions come up of how much higher it can possibly go. It's no longer chasing any other stock -- it has already become the most valuable company in the world.

I think Nvidia has a fantastic business, and it commands impressive margins, and there's potentially much more growth out there in the long run due to AI. If you're looking at holding onto the stock for at least the next five years, then Nvidia can still be a good investment, but I WOULD suggest bracing for the possibility of at least a modest pullback in the near future.