2 Sinking Stocks That Could Keep Heading Lower

Market tremors expose two ticking time bombs in traditional equities—just as crypto continues its relentless ascent.

Legacy Finance's House of Cards

These stocks aren't just dipping—they're caught in a structural decline that makes last year's banking crisis look like a minor correction. While Bitcoin flirts with new ATHs, these dinosaurs keep digging their own graves with outdated business models and regulatory baggage.

Portfolio Anchors Dragging Investors Down

First on the block: a retail giant hemorrhaging cash while DeFi protocols print millions daily. Their 'innovation'? Closing stores faster than traders exit leveraged positions. Second contender: an energy play betting on fossil fuels while blockchain mining operations pivot to renewable energy solutions.

Meanwhile, crypto's quietly eating their lunch—and coming back for seconds. Maybe traditional investors should try reading the whitepapers instead of quarterly reports.

Image source: Getty Images.

Sweetgreen

Consumers have a lot of choices when it comes to fast-casual lunch options. Sweetgreen, a purveyor of pricey salads, seems to be losing out to the competition.

Sweetgreen grew revenue during the second quarter, but just barely, and only because it continues to open new restaurants. Same-store sales plunged 7.6% year over year, driven by a 10.1% decline in traffic. Menu price increases could be partly to blame in addition to the macroeconomic environment.

For the full year, Sweetgreen now expects same-store sales to drop by 4% to 6%. Previously, the company had guided for flat same-store sales in 2025. Sweetgreen will still open at least 40 new restaurants, which will help offset the same-store sales decline to a degree. Full-year revenue is now expected in a range of $700 million to $715 million, down from previous guidance of $740 million to $760 million.

Sweetgreen stock has plummeted nearly 80% from its 52-week high. Even after that decline, the valuation isn't all that attractive. Sweetgreen is still valued at around $1.05 billion, which works out to be roughly 1.5 times the company's revenue guidance. Sweetgreen isn't profitable, reporting net loss of $23 million in Q2, and restaurant-level profitability is crashing amid slumping sales.

Sweetgreen is unlikely to be the kind of restaurant chain that does well in a deteriorating economy marked by inflation worries, sinking consumer sentiment, and a rough jobs market. There are too many similar options, and many of them offer better value than the salad chain. While Sweetgreen stock has already been put through the wringer, the rout may not be over as the restaurant chain struggles with tumbling sales.

Figma

Recent software IPO Figma initially surged after going public, but the stock has since cooled off considerably. From its peak, shares of Figma have dropped more than 50%.

Figma's results have been solid. The company, which specializes in design software, reported 41% year-over-year revenue growth in Q2. The net dollar retention rate, which measures how quickly existing customers are expanding spending, was an impressive 129% for customers spending at least $10,000 annually. Figma is also already profitable on a generally accepted accounting principles (GAAP) basis, with a positive operating income in Q2.

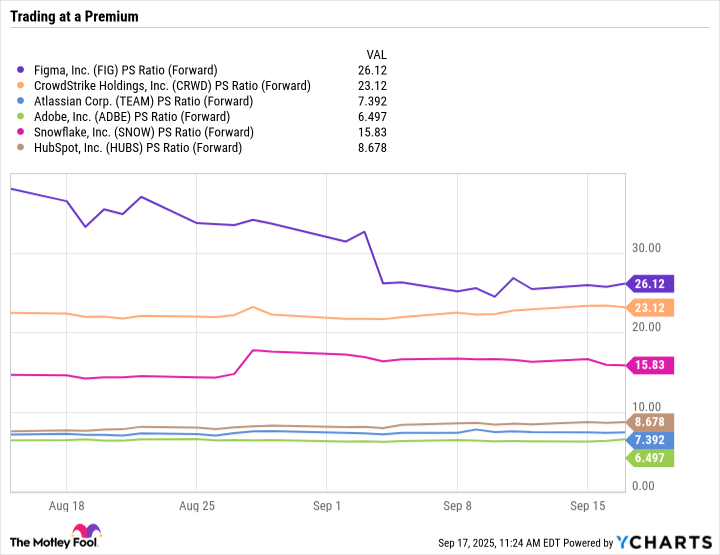

What makes Figma stock risky even after its steep decline is the valuation. Figma expects to generate as much as $1.025 billion in revenue for the full year, which puts the price-to-sales ratio above 25. That's down from the astronomical levels touched soon after the initial public offering (IPO), but it's still in nosebleed territory, and it's pricier than many other software-as-a-service stocks.

FIG PS Ratio (Forward) data by YCharts.

Figma expects strong revenue growth to continue for the rest of the year, but given the uncertain economic environment, growth could deteriorate if businesses pull back on non-essential spending. Any slowdown could send shares of Figma tumbling and bring the valuation back to earth.