Is Vanguard Value ETF Primed for Massive Gains in 2025?

Wall Street's sleeping giant just woke up—and it's hungry for value.

Vanguard's Value ETF quietly positioning for what analysts call a 'perfect storm' of market conditions. Traditional finance finally catching up to what crypto traders knew years ago: undervalued assets create the biggest opportunities.

The 2025 Outlook: Why Value Investing Might Crush Growth

Market cycles favor value plays when inflation stabilizes and interest rates plateau. Vanguard's massive institutional backing provides liquidity that would make any DeFi protocol jealous. Their fee structure remains the industry's gold standard—almost makes you wonder why traditional funds charge so much for underperformance.

Rising institutional adoption mirrors crypto's 2021 trajectory but with one key difference: regulatory clarity. While the SEC keeps playing whack-a-mole with crypto projects, value ETFs operate in clearly defined territory—boring, but profitable.

Technical indicators suggest consolidation phase ending with potential breakout patterns emerging. Volume spikes in recent weeks hint at smart money positioning before retail catches on.

The bottom line? Sometimes the best innovation is recognizing when old-school strategies work better than flashy new alternatives—especially when those alternatives keep getting sued by regulators.

Image source: Getty Images.

Poised for gains and ready for a swing

Without getting too DEEP into the woods, Vanguard Value ETF does pretty much what its name implies. It buys value stocks.

When screening stocks, it uses metrics such as book-to-price ratio, future earnings-to-price ratio, historical earnings-to-price ratio, dividend-to-price ratio, and sales-to-price ratio. These all sound like the opposite math of metrics you're used to seeing, like price-to-sales and price-to-book value, because that's basically what they are. It is just a different way of looking at the same basic valuation tools.

That said, Vanguard Value ETF is specifically focused on large companies. On that front, it uses market cap. It also uses market cap when weighting the portfolio, so the largest companies have the biggest impact on performance.

(VUG -0.47%) uses all of the same metrics to create its portfolio, it just selects from the other side of the growth/value spectrum. The Growth ETF is an important comparison point because Wall Street tends to swing like a pendulum between extremes. When growth is in favor, value tends to be out of favor, and vice versa.

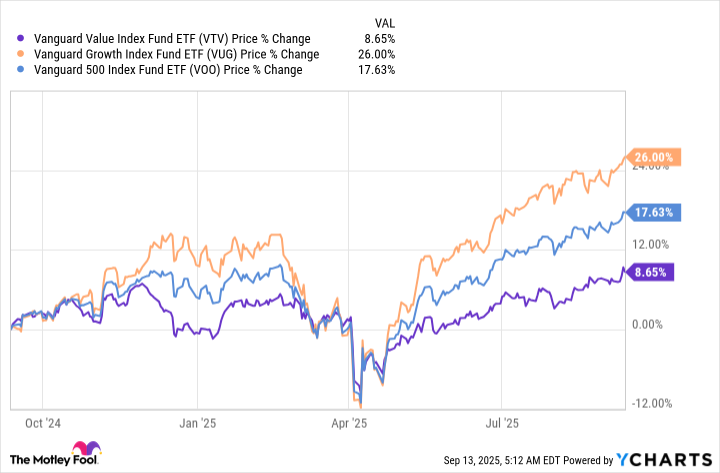

Right now, Vanguard Value ETF is up around 8% year to date in 2025. Vanguard Growth ETF is up roughly 26%. For reference,(VOO -0.17%) is in the middle, up about 17%. So even though it looks like Vanguard Value ETF is heading for an up year, its value focus is still clearly out of favor.

VTV data by YCharts

Is it time to buy Vanguard Value ETF?

Recent performance is nice to look at, but you always have to keep in mind the emotional swings that the market goes through. That pendulum is squarely on the growth side right now. To put some numbers on that, the average price-to-earnings ratio of Vanguard Growth ETF is 39. That's well above the multiple of 27 or so for the S&P 500 index and the just-under-20 multiple of the Vanguard Value ETF. The same trend exists when you look at the P/B ratio.

If you are looking for a place to put some cash today, buying growth stocks will feel like a good idea. After all, growth is leading the market higher. But for investors that are more conservative or that believe a reversion to the mean MOVE is likely to occur sooner rather than later, it might make a lot more sense to add a little value to your portfolio. And a strong option for that is Vanguard Value ETF. You could look at that as a diversification move or simply a prudent choice, given the valuations in the market today.

Trees don't grow to the sky

There's a saying on Wall Street that trees don't grow to the sky. It's a somewhat nonsensical statement, but that's why it is so important to remember in times when the market is at an extreme. It can be hard to do the opposite of what the crowd is doing, like buying Vanguard Value ETF when growth stocks are clearly performing much better. But growth has been so strong lately that it seems like caution is in order. That's why going contrarian and buying Vanguard Value ETF is likely to be a great way to hedge your bets today.