Prediction: Investors Who Buy the Dip in Chewy’s Stock Will Be Rewarded

Chewy's recent dip presents a golden opportunity for savvy investors—here's why loading up now could pay off massively.

The Pet Economy Boom

Pet ownership surged during the pandemic and shows no signs of slowing. Chewy dominates the online pet retail space with sticky subscription revenue and loyal customers who treat Fido better than their 401(k).

Undervalued Growth Story

Wall Street's short-term panic ignores Chewy's long-term potential. The company continues gaining market share while expanding into high-margin services like telehealth and insurance.

Technical Bounce Brewing

Historical patterns suggest oversold conditions rarely last. Previous dips saw 30-50% rebounds within months—because apparently even algorithms understand pets need treats.

Smart money's already accumulating while retail investors panic-sell. Because nothing says 'financial wisdom' like selling at the bottom and buying back at the top.

Image source: Getty Images.

Revenue growth picks up, but so do expenses

Although revenue growth stagnated in the first half of last year, Chewy's sales growth has been strong in recent quarters. This continued into its fiscal second quarter (which ended Aug. 3), with revenue jumping nearly 9% year over year to $3.1 billion. That was just ahead of the company's earlier forecast for sales of between $3.06 billion and $3.09 billion.

Chewy has a very steady business, with the bulk of its sales coming from consumables, such as dog food and pet medication. On top of that, more than 80% of its sales come from autoship customers who have their orders scheduled to be delivered regularly. Autoship sales climbed nearly 15% year over year to $2.6 billion, and provided 83% of total revenue. Net sales per active customer (NSPAC) continued to increase, rising 5% on the year to $591. Chewy also added 150,000 active customers in the quarter compared to fiscal Q1.

Operating leverage, which is affected by gross margin and operating expenses, has been a big focus for investors. Chewy has had solid improvement in gross margin, and that continued in Q2, as it ticked up 90 basis points year over year and 80 basis points sequentially. Chewy credited this strength to its sponsored ads business, and more sales coming from higher-margin categories.

However, while gross margin was strong, operating expenses ROSE more than 7% year over year, with selling, general, and administration (SG&A) costs climbing 8%. Although it had 30 basis points of SG&A deleveraging, investors wanted to see more (changes in SG&A magnify revenue's impact on operating profit. High SG&A leverage can see large profit increases with a small sales increase, but also faces significant losses during downturns). Management said it still expects to deliver modest SG&A leverage this year, and that SG&A expense growth will moderate in the back half of the year.

Adjusted earnings per share (EPS), meanwhile, climbed nearly 38% year over year from $0.24 to $0.33, falling in line with guidance for $0.30 to $0.35. Adjusted EBITDA climbed 27% year over year to $183.2 million.

Chewy continues to generate solid free cash flow, coming in at $106 million for the quarter. It used that to help buy back $125 million in stock in the period. It ended the quarter with $591.8 million in cash and marketable securities, and no debt.

Looking ahead, Chewy forecasts fiscal Q3 revenue to grow by 7% to 8%, to $3.07 billion to $3.1 billion, with adjusted EPS of $0.28 to $0.33. It posted adjusted EPS of $0.20 a year ago. For the full year, the company upped its revenue guidance from between $12.3 billion and $12.45 billion to a new range of $12.5 billion to $12.6 billion. It kept its adjusted EBITDA margin guidance of 5.4% to 5.7%.

Should investors buy the dip?

Despite the stock's reaction, Chewy is actually enjoying some really positive developments. Sales are growing nicely, and the autoship business continues to be a larger and larger part of its overall revenue pie. At the same time, it continues to grow its gross margin. Like and, it's experiencing nice growth in its high-margin sponsored ads business. It's also pushing a paid membership program that offers perks like free shipping and discounts, which both Amazon and Walmart have successfully used.

Like-- one retailer that has done really well with private brands -- Chewy is also moving further into private brands, which carry higher margins; it recently launched a new "healthy fresh dog food" brand called Get Real.

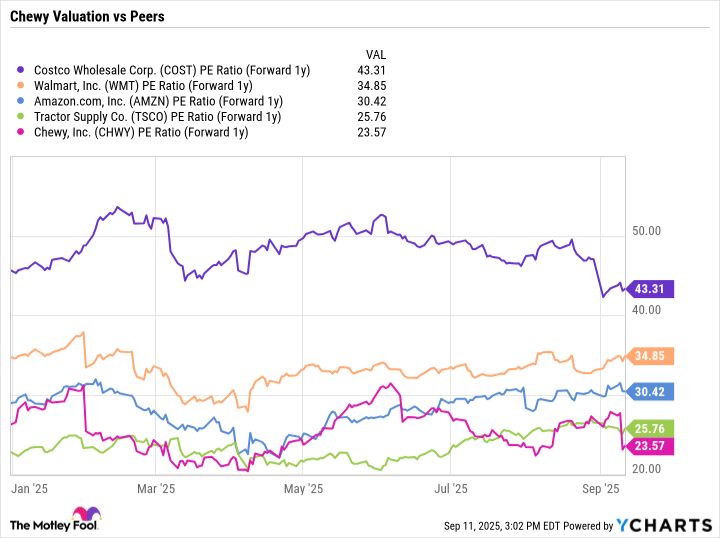

From a valuation perspective, Chewy stock currently trades at a forward price-to-earnings (P/E) ratio of around 23.5 based on next-year analyst estimates. That's a discount to other recession-resistant retailers such as Costco, Walmart, and, as well as e-commerce giant Amazon:

Data by YCharts.

Overall, I don't think slightly elevated SG&A expenses should have caused the huge sell-off in Chewy's stock, given all the company's positives. In fact, cutting costs tends to be the easy part when running a business. The stock's valuation is attractive, as is the opportunity ahead. I think the recent price drop is a good buying opportunity, and that investors buying the dip will be rewarded.