Will Opendoor Stock Get Another Win From the Fed on Wednesday? It’s Not That Simple

Fed Day Looms—Will Opendoor Catch Another Break?

The iBuyer's fate hangs on Powell's next move. Markets hold their breath as Wednesday approaches.

Interest Rate Roulette

Opendoor's entire model thrives on cheap capital. Lower rates mean more aggressive home acquisitions, higher margins, and happier shareholders. Another dovish tilt from the Fed could send this stock soaring.

But here's the catch—the housing market isn't just about rates anymore. Inventory shortages, shifting migration patterns, and that pesky inflation thing complicate the picture. Even if the Fed delivers, Opendoor still has to execute.

Wall Street's Selective Amnesia

Remember when everyone thought ZIRP would last forever? Good times. Now we're all Fed-watching junkies, hanging on every FOMC comma. Opendoor bulls pray for accommodative policy while ignoring the structural headwinds brewing in the housing sector.

Because nothing says 'healthy market' like a company whose entire business model depends on the kindness of central bankers.

Image source: Getty Images.

The good news

Lower mortgage rates are likely to give the housing market a much-needed jolt in activity. Rates are still hovering above 6%, more than double what they were during much of the pandemic.

The spike in mortgage rates has created a "lock-in effect," meaning Americans who bought or refinanced homes during the pandemic are reluctant to give up those mortgages when rates are so much higher, even if they'd like to move.

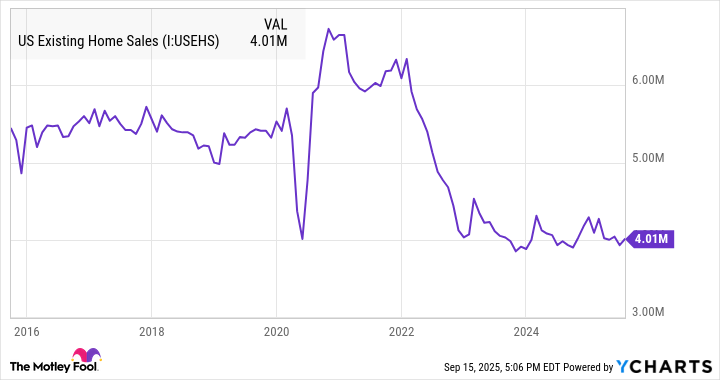

As a result, existing home sales have been in the dumps for years now. As you can see from the chart below, existing home sales have been trending at around 4 million annually for the last three years, down about 30% from pre-pandemic levels.

US Existing Home Sales data by YCharts

If mortgage rates fall substantially, more prospective homebuyers and sellers should enter the market, benefiting Opendoor, and housing inventory is likely to climb. More inventory gives the company more opportunities to buy homes and more potential transactions to drive its business. A more active housing market could also decrease the amount of time that Opendoor keeps homes on its books, which would save the company money.

Additionally, Opendoor benefits from lower interest rates because it uses the debt market to fund its home purchases. It finished the second quarter with $1.2 billion in asset-backed debt and $1.5 billion in real estate inventory.

Why it might not matter

Arguably, the most important housing market factor affecting Opendoor isn't the number of existing home transactions, but home prices, as the company clearly benefits from prices rising.

However, while housing market activity has been stalled, prices have remained at all-time highs. After a brief pullback in 2022, the S&P CoreLogic Case-Shiller U.S. National Home Price Index is now at 331.5 as of June, which is up about 50% from when the pandemic started. The median sales price for a home in July 2025 was $422,400, according to the National Association of Realtors.

Home prices could keep moving higher, but there may not be much room to go up as there's a significant housing shortage in the U.S., estimated to be in the millions, and several metrics point to a housing affordability crisis. According to some measurements, home prices have never been higher compared to income.

Of course, lower mortgage rates will lower monthly payments, encouraging buyers to come into the market, but an unwinding of the "lock-in effect" could also raise supply, pressuring prices.

Additionally, the weakening labor market could tamp down demand for home purchases.

What it means for Opendoor

Whatever happens in the housing market, it will take time to play out, especially as Jerome Powell has signaled a cautious approach, wary that inflation is still above the Fed's target of 2%.

Still, any sign of an improving macro climate is likely to be a boon to Opendoor stock. Whether the business can take advantage of a more active housing market and turn a profit remains to be seen. As investors adjust their expectations for Opendoor, they should keep in mind that housing prices already look stretched, meaning the upside for Opendoor could be limited.