Ford Motor Company Investors: Here’s Where the Massive Upside Lies in 2025

Ford's electric pivot charges ahead—while legacy automakers stall.

Battery breakthroughs and software subscriptions fuel the rally. Traditional dealerships? They're getting bypassed faster than a Mustang Mach-E on autobahn.

Supply chain fixes turbocharge margins. Raw material costs drop—lithium prices crater 40% since last quarter. Production delays? Ancient history.

Commercial division dominates electric vans. Amazon-backed orders hit record highs. Fleet operators ditch diesel—saving millions in operational costs.

China joint ventures finally turn profitable. Local partnerships unlock $2B tariff-free export pipeline. European subsidies pour into Cologne EV plant.

Dividend stability anchors conservative investors. 5% yield protects downside while growth narratives accelerate. Balance sheet deleveraging completes ahead of schedule.

Autonomous unit secures regulatory approval for driverless deliveries. Texas and Florida deployments scale immediately. Competitors scramble to catch up—again.

Short interest collapses amid institutional accumulation. BlackRock and Vanguard increase positions by 18% last month. Retail traders pile in post-earnings.

Cybertruck comparisons boost F-150 Lightning demand. Real-world range tests exceed specs—social media buzz goes viral. Reservation backlog stretches into 2026.

Legacy auto valuations look downright primitive next to Ford's tech stack transformation. Wall Street still prices them like metal-benders—not mobility platforms.

Bet against Detroit's comeback? That's like shorting bitcoin in 2016. Painful.

Warranty costs

Ford is currently setting a historical full-year record for recalls in the U.S. market, with an alarming record of 109 recalls -- the next closest competitor is, with 30. Ford also recently announced a global recall of 1.9 million vehicles due to a rearview camera issue that caused inverted, distorted, or blank images, according to the National Highway Traffic Safety Administration (NHTSA). It should also be noted that this recall can't be fixed over the air and will require at least some dealership involvement, which could mean higher warranty costs for the automaker.

This is a bigger deal than you might think. In fact, during last year's second-quarter results, Ford posted a big miss on earnings estimates due to a spike in warranty costs. Warranty and recall costs in the quarter totaled $2.3 billion, which was a staggering $800 million more than the previous quarter and $700 million more than the prior-year quarter.

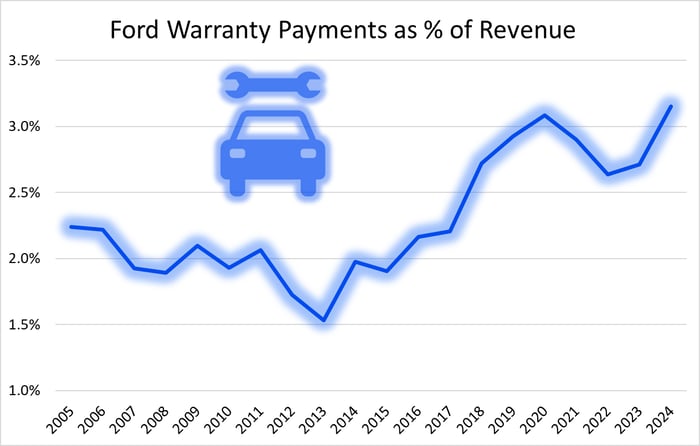

While the automaker has said for years that improving quality is a key priority, results haven't been in a straight line. You can see Ford's rising warranty costs as a percentage of revenue in the graphic below:

Data source: Ford filings with the U.S. Securities and Exchange Commission. Chart by author.

Going electric

While the future is certainly driving toward electric vehicles (EVs), the truth is that very few are profitable for global automakers at the moment; battery costs remain a significant chunk of the cost. Ford's "Model e" division, responsible for its EVs, lost a staggering $5.1 billion in 2024.

That led Ford to take a drastically different approach. It transformed its traditional assembly line into an "assembly tree." It's designed to increase efficiency by having three subassemblies running their lines simultaneously before joining parts together. The company expects to see a net 15% gain in production speed at its Louisville Assembly Plant, compared to current vehicles it manufactures.

Ford is also introducing a universal EV platform that's expected to reduce parts by 20%, with 25% fewer fasteners and 40% fewer workstations in the plant. This platform should be great news for bringing down costs and improving scale, as it will underpin as many as eight EV models, beginning with an electric pickup truck in 2027. Most importantly, Ford believes the electric pickup truck will be profitable very early on.

Image source: Ford Motor Company.

If Ford can successfully build scale while improving efficiency and lowering costs, it will be a huge win for the company in its ambitious effort to narrow its cost gap compared to rivals.

What it all means

There are a couple ways to look at this, depending on whether you're a "glass half-full" or "glass half-empty" investor. On one hand, recalls and quality issues have plagued Ford for the better part of a decade, and have occasionally dinged its bottom-line earnings. It's discouraging that Ford hasn't made more progress, and is currently setting an all-time record for annual recalls.

But on the flip side, this does suggest that there's significant upside on the company's bottom line once it finally gets a handle on quality issues and warranty costs. Along with that upside, Ford may turn its EV business unit from a zero -- considering the financials, that's being nice -- to a hero. If you believe Ford will eventually solve these issues, you have a compelling investing opportunity.