Is Lucid Stock a Buy Now? Here’s What You Need to Know Before Investing

Lucid Motors faces a make-or-break moment as EV competition intensifies.

Market positioning struggles against Tesla's dominance while cash burn rates spark investor concern. The luxury EV space isn't getting any less crowded—every automaker wants a piece of the premium electric pie.

Production delays and supply chain headaches haven't helped. Lucid's ambitious growth targets now face the harsh reality of execution risks. The company's future hinges on delivering vehicles at scale while maintaining that premium appeal.

Financial analysts remain divided—some see untapped potential while others spot another overhyped EV play. Remember: stock picks often tell you more about the analyst's portfolio than the actual company's prospects.

Bottom line? Lucid could either revolutionize luxury electric transportation or become another cautionary tale in the auto industry's electric transition. Your investment thesis better be bulletproof.

The immediate risk is solved

When a company is told by the exchange on which it trades that it may be de-listed, it creates a major problem. Essentially, that company's access to capital markets is being put at risk. For a start-up like Lucid, which is attempting to build an electric car company from the ground up, that could be a disaster. Access to capital is the company's lifeblood, since it is still losing money on every car it makes.

Image source: Getty Images.

Maintaining access to capital markets is the main reason why companies like Lucid do reverse stock splits. But given the above discussion, you can easily see that it is not a positive sign (like a normal stock split); it is an indication that a business is probably struggling.

The ongoing red ink on Lucid's income statement is a testament to the company's financial hardships. But that isn't the only issue that investors need to keep an eye on. In fact, as a start-up, losing money is pretty much par for the course. Another issue, that may be even more important, is the company's operational success as it looks to build its business.

For example, it produced over 3,800 vehicles in the second quarter of 2025, allowing it to deliver 38% more of its cars to customers than it did a year ago. That's great progress, but still little more than a rounding error when compared to legacy automakers.

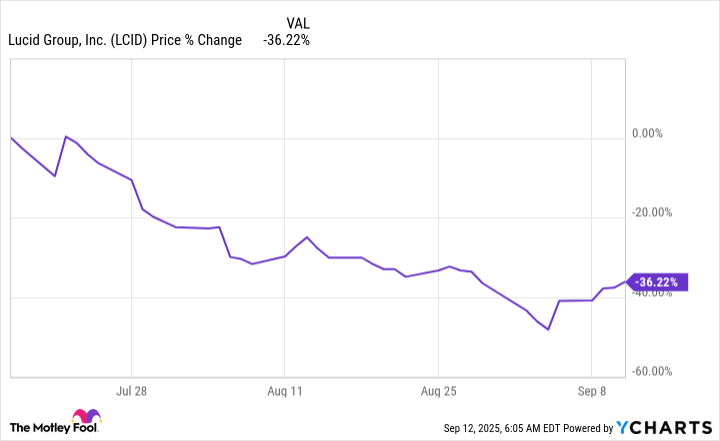

LCID data by YCharts

The market reacts as expected to Lucid's split

Lucid announced that it had filed the paperwork for a reverse stock split with the Securities and Exchange Commission on July 17, 2025. Since that point, the stock has lost 40% of its value, as the chart above shows (taking the reverse stock split into account). That's pretty normal market behavior, as investors worry that the business effecting the reverse split isn't performing well enough to survive over the long term. An ongoing price decline, meanwhile, makes it even more costly to raise capital from stock sales, further complicating the business' future.

All in all, only aggressive investors should be looking at Lucid today. And even there, caution is probably warranted. But not all of the news is bad. Lucid has award-winning technology, notably on the battery front. Running out of power is one of the biggest fears among potential electric vehicle (EV) customers. So there is likely some value in the business, even if that value ends up in the hands of another company someday (think an acquisition or take-private transaction).

And there are clearly companies that see the value in Lucid's tech right now. For example, the big announcement from the second quarter was Lucid's deal with(NYSE: UBER), which plans to use Lucid's cars for autotaxis. Over a six-year period starting in 2026, Uber intends to deploy a total of 20,000 Lucid vehicles. The deal includes a $300,000 investment in Lucid, which provides additional growth capital for the carmaker without the need to tap capital markets.

A risk/reward balance

Lucid is a high-risk/high-return type of investment. If the company manages to become consistently profitable, the stock price today will look like a steal. If it flames out, investors will likely end up losing their entire investment. This is why it is only appropriate for risk-tolerant investors.

That said, it is only worth buying if you believe strongly in its long-term story. Otherwise, most investors will be better off waiting for Lucid to hit a few more milestones before buying. Increasing production is the target that will be most salient for now, followed by achieving a gross profit. But both of these goals are still a good distance away.