Warren Buffett’s Secret 63% Yield From This Dividend King Will Blow Your Mind (Yes, You Read That Right!)

Warren Buffett just cracked the code on traditional yields—and it's not even close.

The Oracle of Omaha's portfolio is pulling a staggering 63% return from one dividend aristocrat. That number isn't a misprint—it's a masterclass in value investing that makes most hedge funds look like amateurs.

How He Did It

Buffett bought this dividend king years ago at basement-level prices. Now, his cost basis is so low that the current dividend payout represents a yield nearly ten times the market average.

Timing beats timing the market—again.

Why It Matters

While crypto traders chase memecoins and leverage, Buffett's quietly collecting checks that would make any DeFi yield farmer blush. Traditional finance isn't dead—it's just selective.

One cynical take? Wall Street would rather sell you a complex ETF than admit that simplicity prints.

Bottom line: Sometimes the best moonshot is a dividend check that compounds like blockchain—but without the gas fees.

Image source: The Motley Fool.

The secret behind Buffett's monster dividend yield

That Dividend King I'm referring to is(KO -0.83%). You might wonder how Buffett is enjoying a yield of nearly 63% when Coca-Cola's forward dividend yield currently stands at only 3%. That's a good question with a simple answer.

Buffett first initiated a position in Coca-Cola in 1988. He added to Berkshire's stake over the next few years, eventually spending around $1.3 billion to acquire a significant stake in the giant beverage and food company.

Although Buffett hasn't always adhered to his favorite holding period of forever, he's on the right track to do so with Coke. The stock is his longest-held position. Berkshire still owns 400 million shares, making Coca-Cola the conglomerate's fourth-largest holding.

Those 400 million shares generate annual dividends of $816 million for Berkshire. Dividing that total by the $1.3 billion Buffett initially spent to buy the stock gives an effective dividend yield of roughly 62.7%.

The secret behind Buffett's monster dividend yield, therefore, boils down to a buy-and-hold strategy. It's also helped that Coca-Cola has increased its dividend every year since the legendary investor first bought the stock.

Coca-Cola has given Buffett more than dividends

Coca-Cola hasn't only generated nice dividends for Buffett through the years, though. It has also provided jaw-dropping returns.

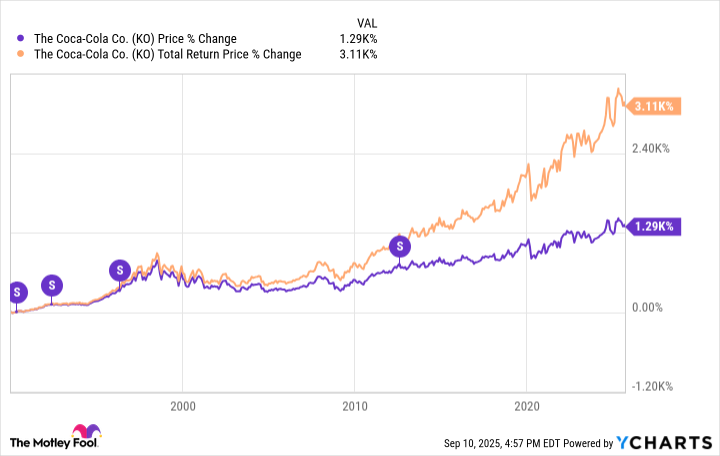

Since early 1988, Coca-Cola's share price has skyrocketed almost 1,300%. This includes four stock splits along the way. Importantly, though, that gain doesn't include dividends. With dividends reinvested, Coca-Cola's total return during the period is over 3,100%.

KO data by YCharts

Coca-Cola has also given Buffett something else: refreshment. The multibillionaire said at Berkshire's annual shareholder meeting in May as he picked up a can of Coke, "At 94 years of age, I've been able to drink whatever I like to drink." (Buffett turned 95 on Aug. 30, 2025, by the way.)

Buffett has mentioned in the past that he typically drinks five cans of Coca-Cola each day. He said in a 2023 interview, "I think happiness makes an enormous amount of difference in terms of longevity. And I'm happier when I'm drinking Coke or eating hot fudge sundaes or hot dogs."

Is Coca-Cola stock a buy now?

While Coca-Cola is unquestionably one of Buffett's favorite stocks, he hasn't bought additional shares in a long time. Is Coca-Cola stock a buy now? I think the answer depends on your investing style.

If you're a growth-oriented investor, Coca-Cola probably won't appeal to you very much. The stock has lagged well behind the(^GSPC -0.05%) in recent years. Wall Street analysts also project that Coke's earnings will grow more slowly than the S&P 500's earnings in 2025 and 2026.

What if you're a value investor as Buffett has been throughout his career? Coca-Cola might not be at the top of your list, either. The stock's forward price-to-earnings ratio is 21. While that's not a terribly lofty valuation, it likely isn't cheap enough to attract much interest from value investors.

On the other hand, if you're an income investor, Coca-Cola looks like a great stock to buy right now. We've already mentioned the company's status as a Dividend King and its solid dividend yield. I think income investors can count on this stock to keep the dividends flowing and growing for years to come -- just as it has for Buffett over the last four decades.