History Says September is the Worst Month for Stocks—But Should You Really Invest Now?

September's stock market curse strikes again—or does it? Historical patterns scream caution, but savvy investors know timing beats timing the market every time.

The Seasonal Slump Myth

Wall Street's favorite horror story resurfaces each fall. September's reputation as a portfolio killer gets more attention than a crypto pump-and-dump scheme. Yet blindly following calendar superstitions? That's how you end up holding bags instead of gains.

Beyond the Calendar

Market cycles don't read calendars. Fundamentals, macro trends, and sheer investor psychology drive prices—not some arbitrary month-based voodoo. Remember: the only thing predictable about markets is their unpredictability.

Opportunity Knocks

While traditional investors panic-sell every September, crypto markets operate on a different rhythm. Digital assets dance to their own beat—often ignoring seasonal stock market dramas altogether.

Final Verdict

Waiting for the 'perfect' month to invest is like waiting for Bitcoin to drop back to $100—it's not happening. The real risk isn't September's historical stats; it's missing the next bull run because you're too busy reading calendars instead of charts.

Image source: Getty Images.

S&P 500 performance over five years

First, let's take a look at the performance of the major benchmark over the past five years. The S&P 500 advanced last year during the month of September -- but in the previous four years, it slid between 3% and 9%.

| 2020 | down 3.9% |

| 2021 | down 4.7% |

| 2022 | down 9.3% |

| 2023 | down 4.8% |

| 2024 | up 2% |

Data source: YCharts.

So history shows us there's a greater likelihood that the benchmark will decline this month than rise. That said, it's important to note that many factors may get in the way of a historical trend. And two big ones are corporate news and economic news or happenings. We've already seen the former take action this month, helping to lift the benchmark.

For example, tech giantsandboth reported strong gains in their artificial intelligence (AI) businesses in the latest quarter, propelling their share prices -- and the prices of other tech stocks -- higher. Tech stocks are heavily weighted in the S&P 500, so any movement can determine the direction of the index.

Broadcom, in a report on Sept. 4, said AI revenue soared 63% to $5.2 billion and predicted it will reach $6.2 billion in the next quarter. Then, this past week, Oracle wowed investors with its forecasts for cloud infrastructure revenue -- driven by AI customers -- in the years to come. The company said revenue from this business increased 55% in the quarter to $3.3 billion and forecast it will advance 77% to $18 billion in the fiscal year -- then progress to $144 billion in four years.

Nvidia's prediction

This follows's prediction last month that AI infrastructure spending may reach $4 trillion by the end of the decade. All of these forecasts have helped supercharge interest in technology stocks, and as a result, drive the S&P 500 higher.

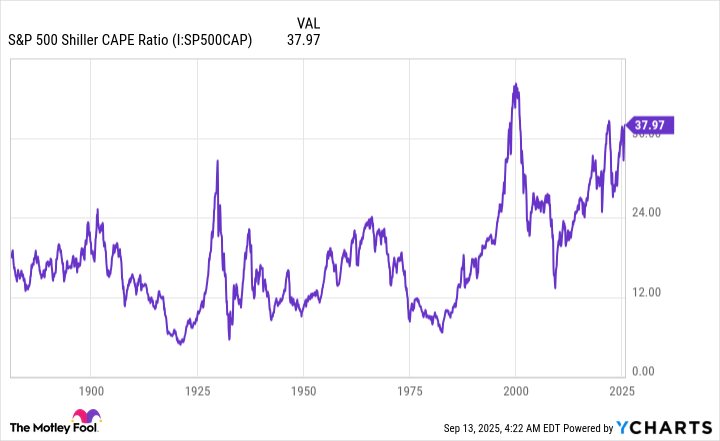

Due to this positive momentum, stocks, as a whole may be seen as expensive. A look at the S&P 500 Shiller CAPE ratio, an inflation-adjusted view of stock price in relation to earnings, confirms this. This metric has reached 37, a level it's only surpassed two other times in the past. This suggests that it may be hard to find bargains in the current environment.

S&P 500 Shiller CAPE Ratio data by YCharts

Finally, as we head into a new week, another catalyst sits on the horizon, and that's the Federal Reserve's decision on interest rates. The Fed's decision is set for Wednesday, and economists are expecting a rate cut -- such a MOVE could boost stocks as investors focus on the idea of lower costs for the consumer and for companies that take on debt.

Now let's return to our question: Should you really buy stocks in September, considering this full picture? After all, valuations are high, and there's still time for the index to follow historical trends and decline this month. Still, the positive corporate news we've seen may continue to buoy stocks, and an interest rate decision could possibly offer positive momentum too.

Take a long-term view

What's an investor to do? The answer is simple. Think long term. Don't be distracted by the general valuation picture and the direction the index takes this month -- instead, this month and every month, consider stocks individually. Look at a particular stock's valuation, the company's financial health, and its long-term prospects. If the stock is reasonably priced and these other elements are positive, you may have found yourself a great stock to buy.

It's important to remember that the S&P 500 always has recovered from down times and gone on to deliver gains. In fact, it's registered a 10% average annual gain since its early days.

So, when you focus on the long term, you can invest during any month or market environment -- and you'll be able to sleep at night without worrying about what happens next.