The 1 No-Brainer Crypto Index Fund to Buy Right Now for Less Than $1,000

Forget Wall Street's Overpriced Offerings—This Digital Asset Fund Delivers Real Alpha

Market-Beating Potential Without The Guesswork

While traditional finance peddles bloated expense ratios and mediocre returns, crypto index funds slice through the noise. This pick tracks top-tier digital assets—think Bitcoin, Ethereum, and emerging DeFi giants—without requiring you to become a full-time chart analyst.

Diversification That Actually Works

Instead of betting your entire portfolio on one volatile coin, this fund spreads risk across multiple blockchain winners. It's the smart money's play—institutional-grade exposure without the six-figure minimums hedge funds demand.

Timing The Digital Revolution

With traditional markets looking shaky, digital assets are poised for their next leg up. This fund captures that momentum—no complex trading strategies or sleepless nights watching leverage ratios.

Bottom line: While your broker pushes 'safe' bonds yielding less than inflation, this sub-$1,000 move actually positions you for growth. Sometimes the no-brainer move is the smartest one.

Image source: Getty Images.

Not even Warren Buffett can predict market swings

At the heart of my VOO recommendation, you'll find this simple truth: Time in the market almost always beats timing the market.

You have to be some sort of genius to consistently predict broad market swings before they happen. The closer you want to get to the absolute peaks and bottoms of each cycle, the harder it gets. And even the greatest masters of investing are wrong very often.

Remember our Motley Fool CAPS playground for serious investors? The five highest-rated CAPS players have an average stock-picking accuracy of 68.9%. That's far from perfection, but good enough to dominate an investing game with more than 88,000 players. Oh, and investing legend Warren Buffett often reminds people that he can't predict the stock market's general trend in the short or medium term. He's all about betting on sensible business growth over the long haul.

Most of us ordinary humans might as well flip a coin. Maybe there's a Wall Street storm brewing, or the bull market might continue for years. I don't know for sure, neither do you, and unexpected developments could knock even the best predictions wildly off target. The coronavirus pandemic was as predictable as the Spanish Inquisition, and so was the artificial intelligence boom.

I tested the "safer" alternatives -- and I wasn't impressed

I still tried to find a few lower-risk ideas for a rainy day. To backtest my ideas, I compared the candidate index funds against the Vanguard S&P 500 ETF. For testing periods before Vanguard launched that exchange-traded fund (ETF) almost exactly 15 years ago, the underlying(^GSPC 0.85%) index served the same comparative purposes.

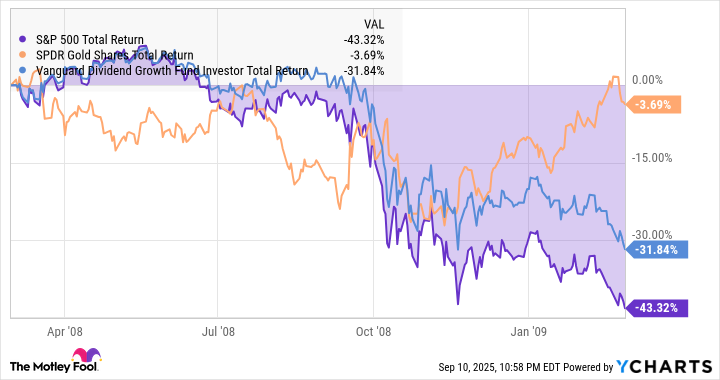

At first glance, some of the low-risk investments looked promising. The classic gold-tracker(GLD -0.15%) held up better than the S&P 500 in the first year of the subprime mortgage meltdown in 2008. So did the(VDIGX -0.30%):

^SPX data by YCharts

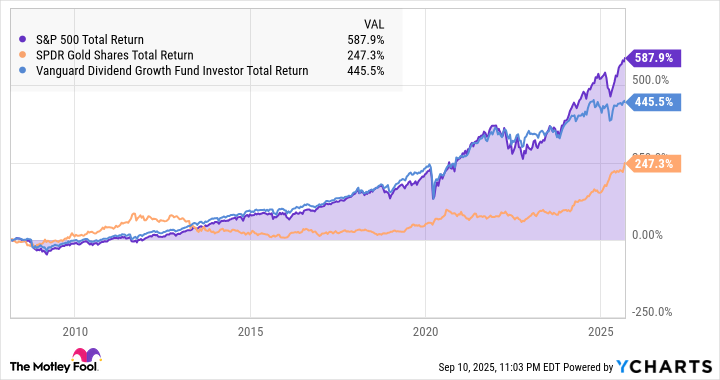

But the low-risk magic melts away in the long run. The Gold fund lagged behind the S&P 500 index after six years, and the dividend growth fund delivers very S&P 500-like returns over time. I know which asset I'd rather hold on to today, 17 years after the crisis (hint: it rhymes with "less than three, fly under"):

^SPX data by YCharts

Cash under the mattress is another losing strategy

Similar trends developed with other lower-risk ETFs and different financial crisis periods. In some cases, the supposed low volatility funds either followed the S&P 500 trend line down or actually underperformed the market index when times were tough.

And what about simply sitting on that cash for a while -- perhaps a few years? That's another underperforming idea. Even if you start from an all-time high just before a steep drop, the S&P 500 and its index funds will certainly gain value in a five- or 10-year period. Meanwhile, the cash under your pillow keeps losing value to inflation effects.

So yeah, I'm talking myself into buying some more Vanguard S&P 500 ETF shares very soon. It's a proven long-term strategy, endorsed by geniuses like Warren Buffett and Jack Bogle, and arguably a great investment idea in any economy -- including this one. And you don't have to be rich to get started. One share of this fund costs roughly $600 today.