Why UPS Under $85 Could Be Your Next Smart Move

Logistics Giant Dips Below Key Threshold—Time to Pounce?

Market watchers eye delivery behemoth as stock slides under psychological barrier. That $85 mark isn't just a number—it's a signal flashing bright green for value hunters.

The Numbers Don't Lie

UPS hasn't traded this low since the last time FedEx missed earnings. While traditional investors sweat over delivery volumes, sharp money's already positioning for the bounce.

Logistics Meets Legacy

Old-school value meets e-commerce backbone. While crypto bros chase the next meme coin, UPS moves actual goods—and generates actual cash flow. How delightfully retro.

Bottom Line: Buy Signal or Value Trap?

Either you believe in global trade continuing, or you're stacking canned goods in your basement. At sub-$85, UPS offers a contrarian play on physical commerce in a digital-obsessed world—because sometimes the smartest trade is buying what everyone else is ignoring.

Image source: Getty Images.

What went wrong

To understand what went wrong, we have to remember what went right. And what went right for UPS was, of course, its position during the COVID-19 pandemic. During the pandemic, while households were on lockdown and e-commerce spending was growing, UPS's daily package volume surged. In 2020, revenue spiked 14.2% to $84.6 billion, a then record high that it beat in 2021 when full-year revenue climbed to $97.3 billion.

Although these years weren't perfectly executed (delivery delays due to overwhelming volumes), they have become, in retrospect, the "golden" years for UPS investors as the stock was up over 60% from today's prices.

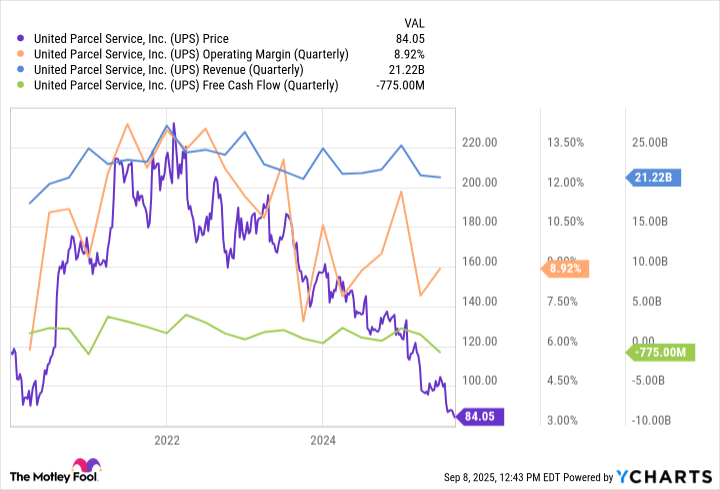

UPS data by YCharts

Fast-forward to 2025, and UPS is in a very different situation. Pandemic-fueled demand for e-commerce has cooled significantly, and new rivals in the parcel industry, like frenemy, have commandeered business that was once UPS's. Average daily volume in the U.S. fell over 7%, while operating margin was 7% -- a big whomp whomp for those who remember its double-digit margin during the pandemic.

The company is also adjusting to a structural hit from labor costs. Two years ago, it agreed to a five-year Teamsters contract that gave about 330,000 workers a significant raise. Full-time employees WOULD see a total raise of $7.50 by 2028 (dished out progressively each year), while starting pay for part-time workers was also increased.

The agreement also had some technology stipulations, like preventing the introduction of driverless vehicles and drones without a UPS-union meeting, that could hurt UPS's cost-cutting abilities in the short term.

Softer economic conditions, plus new structural costs, have also coincided with UPS's own "better not bigger" initiative, which is aimed at cutting low-margin business in favor of packages with better margins. In effect, that has meant saying goodbye to Amazon, along with potentially other customers whose e-commerce business was high-volume but low pay. Indeed, by June 2026, UPS plans to cut Amazon package volume, once a high revenue driver, by 50%.

How UPS can still win

Aside from operating one of the densest and most efficient delivery networks in the world, I see a few bright spots in UPS's near-term.

The first is its small and medium-sized business segment (SMB), which has been growing. This customer base often offers higher prices per package than e-commerce giants. It's notable that SMB made up about 32% of U.S. volumes in the second quarter, a slight increase from last year.

Another bright spot is UPS's expansion into healthcare logistics. Indeed, the company already operates some temperature-controlled facilities, which offer customers special handling of medical devices, lab specimens, pharmaceuticals, and other sensitive materials. Like its SMB segment, packages in healthcare logistics are delivered with a high level of urgency that makes their handling more expensive than your average package of sneakers. According to CFO Brian Dykes, healthcare logistics grew revenue by 5.7% last quarter.

As far as valuation goes, UPS looks cheap by traditional standards. The stock trades around 12 times forward earnings, well below the(around 22) and slightly below its rival.

So, is UPS a buy today? For long-term investors with a three to five-year horizon, UPS looks pretty attractive at today's depressed price. That's even more the case if you're seeking income, as UPS has one of the highest annual yields (7.85% at today's price) that you'll find.

That said, this isn't a risk-free investment, and even long-term investors should keep their eyes on UPS's margins and volume trends. If UPS can deliver on today's initiatives -- and the economy avoids a DEEP recession -- today's buyers could see upside over the next few years, all while collecting a rich dividend.