Bitcoin’s Bull Run Just Went Staircase Mode - MVRV Data Confirms the New Paradigm

Forget the boom-bust cycles of old. Bitcoin's latest bull market isn't just charging ahead—it's building a staircase to the stars.

The MVRV metric—Market Value to Realized Value—paints a clear picture: steady, sustainable growth replacing volatile spikes. No more reckless speculation, just methodical value accumulation.

This isn't your 2017-style frenzy. Institutional adoption, clearer regulations, and maturing infrastructure are creating a foundation that supports each step up. The data doesn't lie—this is how mature bull markets behave.

While traditional finance still scratches its head about 'digital gold,' Bitcoin keeps climbing one solid step at a time. Guess Wall Street's still waiting for the elevator.

Image source: Getty Images.

1. Vanguard High Dividend Yield ETF

When it comes to making money from stocks, most people focus on stock price appreciation, but that's only one means. The other way to benefit from owning stocks is via dividends. Not only are dividends guaranteed (in most cases), but they also provide a cushion during market downturns -- which isn't far-fetched given how overvalued the market seems right now.

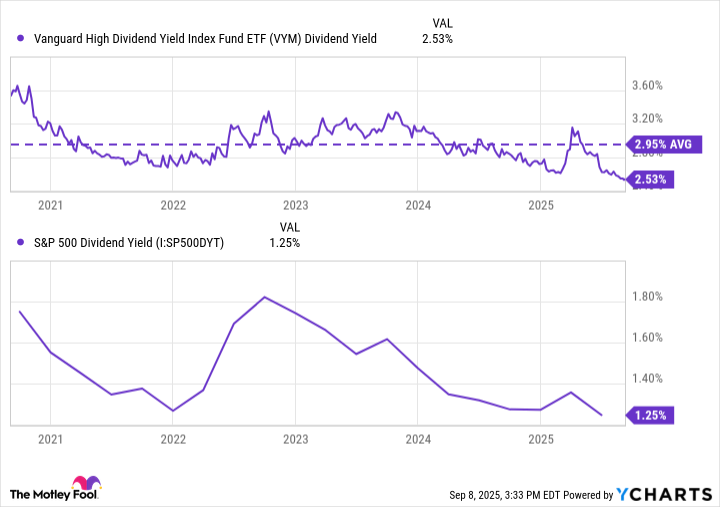

One dividend-focused ETF I recommend is the(VYM 0.89%). With a current yield of just over 2.5%, it's more than double the S&P 500 average, but slightly below its average over the past five years.

VYM Dividend Yield data by YCharts

VYM holds 580 large-cap stocks spanning all major sectors. The top five represented sectors are financials (21.6% of the ETF), industrials (13.6%), technology (12.3%), healthcare (11.6%), and consumer discretionary (10.1%).

With maybe the exception of the technology sector, many of the top companies in these sectors are known for their stable cash FLOW and shareholder-friendly dividends. When you invest in VYM, you're getting exposure to blue chip companies like,,,, and.

Although cash payouts from dividend stocks can be good, the real power comes from reinvesting those dividends (via a dividend reinvestment plan) to acquire more shares. At its current yield, a $500 investment WOULD only pay out $12.50 annually, which is far from life-changing. However, if you were to reinvest your payout over time, you could set yourself up nicely down the road.

2. Vanguard Total International Stock ETF

Part of having a diversified portfolio is investing in companies outside of America. American companies, particularly in the, have been some of the best-performing stocks over the past few decades, but you don't want to put all your eggs in one basket, no matter how strong the past or bright the future looks.

An international ETF I recommend is the(VXUS 1.13%) because it covers a lot of ground. It holds over 8,600 stocks in both developed and emerging markets, providing you with the best of both worlds.

Developed markets typically have more mature financial markets and established economies, so stocks from there tend to be more stable. Examples of non-American countries that fit this description are the U.K., Japan, Australia, Germany, and Canada.

Emerging markets are still growing, maturing, and industrializing, so stocks from there are often more volatile, but that comes with more upside in many cases. Examples of countries that fit this description are Brazil, India, Mexico, China, and South Africa. Here's how the ETF is divided by region:

- Europe: 39%

- Emerging markets: 27.2%

- Pacific: 25.4%

- North America: 7.7%

- Middle East: 0.7%

I don't recommend having a large part of your portfolio in international stocks, but a small portion is a good way to hedge against any potential downturns in the U.S. economy. A $500 investment would be a good way to start building an international stake.