Bold Prediction: This AI Stock Could Overtake Nvidia’s Market Cap by 2030

Forget what you know about chip dominance—the AI revolution is spawning new giants.

Market Cap Showdown

While Nvidia currently rules the AI hardware space, emerging players are rewriting the rulebook. One particular stock—flying under most analysts' radar—positions itself to challenge the throne by decade's end.

Disruption in Motion

This isn't about catching up; it's about leapfrogging. The company's proprietary technology bypasses traditional computational bottlenecks, cutting processing times while slashing energy consumption. Early benchmarks show performance gains that make current solutions look downright archaic.

The 2030 Timeline

Market projections point to explosive growth trajectories that could see this contender surpassing Nvidia's valuation within six years. Because nothing says 'sound investment' like betting against the company that literally powers the AI revolution—what could possibly go wrong?

Image source: Getty Images

A massive backlog is going to supercharge this company's growth

Just like Nvidia,(MSFT 0.20%) is a pioneer in AI thanks to its early investment in OpenAI. Microsoft moved quickly to integrate OpenAI's intellectual property (IP) into its various offerings, and it is reaping the rewards of the AI-focused moves it has made over the past three years.

The company's revenue in the recently concluded fiscal 2025 (which ended on June 30) increased by 15% to $282 billion, while adjusted earnings jumped by 16% to $13.64 per share. Microsoft witnessed impressive growth across all of its business segments, with the Azure cloud business being the top performer with a 39% year-over-year jump in revenue in the previous quarter.

Even better, Microsoft's revenue pipeline increased at a much faster pace than its revenue. The company's commercial bookings jumped by 37% to more than $100 billion on the back of strong demand for its Azure cloud and Microsoft 365 production. These new contracts took the company's commercial remaining performance obligations (RPO) to a whopping $368 billion, up by 37% from the year-ago period.

RPO is the total value of a company's contracts that will be fulfilled at a future date. So, the faster growth in this metric as compared to the revenue is an indicator of a potential acceleration in Microsoft's top line in the future. Also, it won't be surprising to see Microsoft's revenue pipeline improving further going forward, thanks to the growth opportunity in the cloud AI market.

Microsoft's Azure and other cloud revenue were up by 39% last quarter. That figure could have been higher, but the demand for the company's AI cloud services is exceeding supply, which is why it has been bringing online more data center capacity. The company's Azure cloud business generated $75 billion in revenue in fiscal 2025. So, the company's contracted backlog indicates that this business has a lot of room for growth in the future.

Also, the demand for cloud-based AI services is expected to increase at an annual rate of almost 40% through the end of the decade. This could pave the way for further growth in Microsoft's backlog and revenue in the future, especially considering the massive amount of money it is spending to build AI-first data centers.

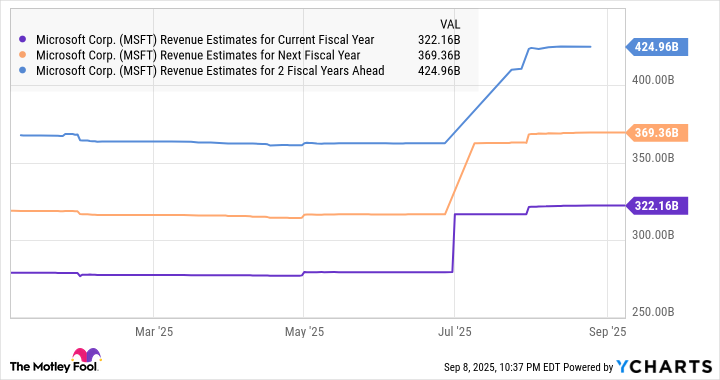

Higher data center capacity should ideally allow Microsoft to accelerate its revenue growth over the next five years. Analysts expect this "Magnificent Seven" company's top-line growth to pick up going forward and have hiked their estimates.

Data by YCharts.

Can Microsoft really exceed Nvidia's market cap?

The chart above says analysts expect Microsoft's revenue to grow in the mid-teens over the next three fiscal years, reaching almost $425 billion in fiscal 2028 (which will end in June that year). However, the secular growth opportunities in the cloud AI market, as well as the improving adoption of its Microsoft 365 suite of AI-powered productivity tools, could help it exceed Wall Street's expectations.

But even if Microsoft sustains a 15% annual growth rate in the two years beyond fiscal 2028, its top line could hit $562 billion by the end of the decade. Microsoft is currently the world's second-largest company with a market cap of $3.72 trillion, which is 16% lower than Nvidia's market cap. Importantly, Microsoft is trading at a much lower 13 times sales as of this writing. That's half of Nvidia's price-to-sales ratio.

It won't be surprising to see Microsoft sustain its sales multiple (which is a premium to the U.S. technology sector's average sales multiple of 8.5) after five years, as its growth rate improves. But even if it trades at a discounted 10 times sales in 2030 and hits $562 billion in revenue, its market cap could jump to $5.6 trillion.

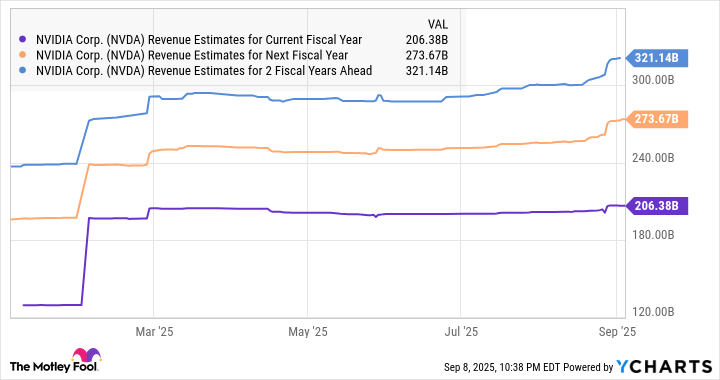

Nvidia may not be able to match that market cap as its top-line growth is expected to slow down going forward, which could prompt a reduction in the big valuation premium it is trading at.

Data by YCharts.

So, the possibility of Microsoft overtaking Nvidia as the world's largest company by 2030 cannot be ruled out.