Is This AI Chipmaker Stock the Ultimate Bargain Buy Right Now?

Silicon Gold Rush: AI Chip Stocks Surge as Demand Outstrips Supply

The artificial intelligence revolution runs on silicon—and one chipmaker might be sitting on the motherlode. While Wall Street analysts chase yesterday's trends, this under-the-radar player keeps quietly powering the neural networks that are reshaping entire industries.

Valuation Versus Reality

Current pricing suggests the market still hasn't caught up to the sheer computational hunger of large language models and generative AI. Training costs keep climbing while inference demands explode—someone has to build the engines making this all possible.

Manufacturing Moats and Margin Magic

Specialized AI processors aren't just fancy graphics cards—they're precision instruments requiring architectural brilliance and manufacturing prowess. The companies that cracked this code early now enjoy pricing power that would make traditional semiconductor firms blush.

The Cynical Take

Of course, if history teaches us anything, it's that chip cycles eventually turn—and yesterday's must-have hardware becomes tomorrow's commodity. But for now? The arithmetic looks compelling enough to make even the most jaded quant crack a smile. Just don't tell the hedge fund managers still trying to value AI companies with spreadsheet models from 2015.

Image source: Getty Images.

Underwhelming guidance cripples Marvell's stock

Investors don't like uncertainty. It's an old adage in the stock market, but it rings true any time a company's guidance suggests there are a lot of question marks around its future growth. Marvell is a terrific example of that. The company recently posted strong earnings numbers, but it was its guidance that underwhelmed investors, prompting a sell-off.

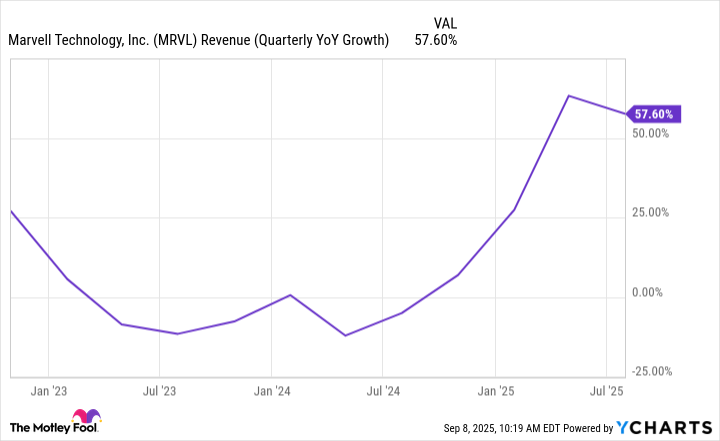

Marvell makes application-specific integrated circuits (ASICs) that can be cost-effective alternatives to more generic chips, such as those from. And while growth has been strong, the company's performance has been a bit choppy.

Data by YCharts.

Marvell's growth rate declined in its most recent quarter, for the period ending Aug. 2. Revenue of just over $2 billion rose by nearly 58% year over year (it was 63% a quarter earlier), which met analyst expectations. But for the current period, the company projects revenue of around $2.06 billion, which is lower than the $2.11 billion that Wall Street was expecting. And at $2.06 billion, its growth rate WOULD fall to 36%; in the third quarter last year, its sales totaled a little over $1.5 billion.

A discounted option for AI investors

Marvell has a market cap of $56 billion, and it trades at a fairly modest price-to-earnings multiple of 22. Not only is that cheaper than theaverage of 25, but it's also well below the average of the-- 39. By comparison, Marvell looks like an incredible bargain.

Investors have punished the stock for the poor guidance, and although it's not quite at its 52-week low of $47.09, it has still been an awful year for Marvell -- its shares are down more than 40%. CEO Matt Murphy isn't concerned, however, and says that there is strong demand for the company's chips and that while the current third-quarter sales may not look so great, he expects the fourth quarter to be much better.

Is Marvell a steal of a deal?

Marvell is a compelling option to buy on weakness right now. The markets have a tendency to overreact to bad news or earnings misses, and I think that is the case with Marvell. Growth doesn't always happen in a straight line, and so while the near-term guidance may have disappointed investors, it's the longer-term picture that should matter most. Marvell is a big player in the custom chip market, and it could play a vital role in AI's long-term growth, especially as customers look for alternatives beyond just Nvidia's chips.

While Marvell's stock performance looks horrendous this year, I don't think growth investors should give up on the stock by any means. It may not be the flashiest AI stock to own, but it could make for an underrated buy in the years ahead, given its modest valuation and continually strong growth prospects.