1 Compelling Reason to Buy Altria Stock Before September 15

Altria's Dividend Deadline Looms—Smart Money Positions Before Payout Cutoff

The Clock's Ticking

September 15 marks the ex-dividend date for Altria's next distribution—miss it and you're watching from the sidelines for this quarter's payout. The tobacco giant's yield remains one of the market's fattest, consistently ranking among top income plays despite regulatory headwinds.

Cash Flow Machine

Altria's nicotine empire keeps generating monstrous free cash flow—enough to cover dividends with room to spare. While ESG funds clutch their pearls, the company's financial engine hums along, funding those quarterly checks investors actually care about.

Defensive Play

When markets get jumpy, sin stocks often become safe harbors. Altria's consumer staples profile provides stability while tech stocks do their rollercoaster impression—because sometimes boring is beautiful when everything else is crashing.

One cynical finance jab: Because nothing says 'secure investment' like betting on humanity's addiction to nicotine while pretending you're in it for the dividend aristocrat status.

Image source: Getty Images.

One of the stock market's top dividend stocks

When Altria recently announced that it was increasing its quarterly dividend to $1.06 per share (up from $1.02), it marked the company's 56th consecutive year increasing its dividend, and the 60th total increase in that span. That track record of growth helped Altria earn the designation as a Dividend King.

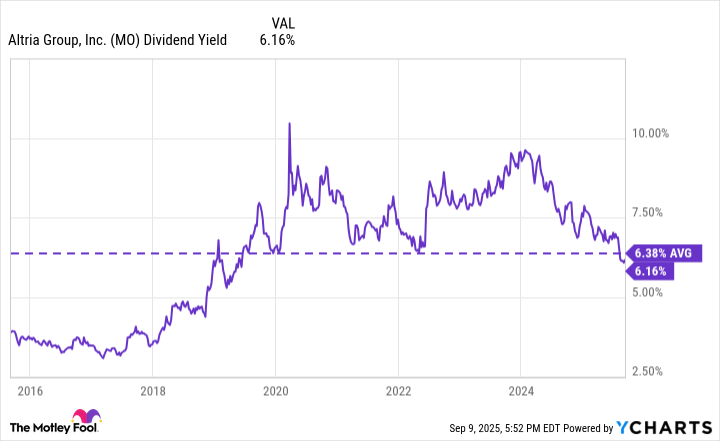

At the time of writing, Altria's dividend yield is around 6.16%, which is slightly below its average over the past decade, but more than five times the S&P 500's current average of 1.2%.

Data by YCharts.

While Altria's appeal has long been its dividend, the stock has had an impressive 2025 so far, up 26%. I wouldn't invest in the stock expecting these returns year in and year out, but if you're looking for a company that can provide reliable dividend income, Altria is a good choice.