Prediction: Nvidia Will Skyrocket Over the Next 3 Years—Here’s the One Catalyst Driving It

Nvidia's next-gen AI chips are rewriting the rules of computational power—and Wall Street hasn't fully priced in the seismic shift.

Demand isn't just growing—it's exploding. Data centers, autonomous vehicles, and metaverse infrastructure all crave more processing muscle, and Nvidia keeps delivering.

While traditional analysts scratch their heads over 'valuation concerns,' the real story is simpler: if computation is the new oil, Nvidia owns the refinery.

Three years from now? Look back and wish you'd bought more—or just shrug and admit that sometimes, the obvious trade is the hardest one to make.

Image source: Getty Images.

Nvidia has a massive opportunity ahead -- even without China

Nvidia CEO Jensen Huang may be largely responsible for investor fears. In a May interview in which Huang discussed chip export restrictions, he said that being cut out of the $50 billion Chinese market over the next several years WOULD be a "tremendous loss" for U.S. companies.

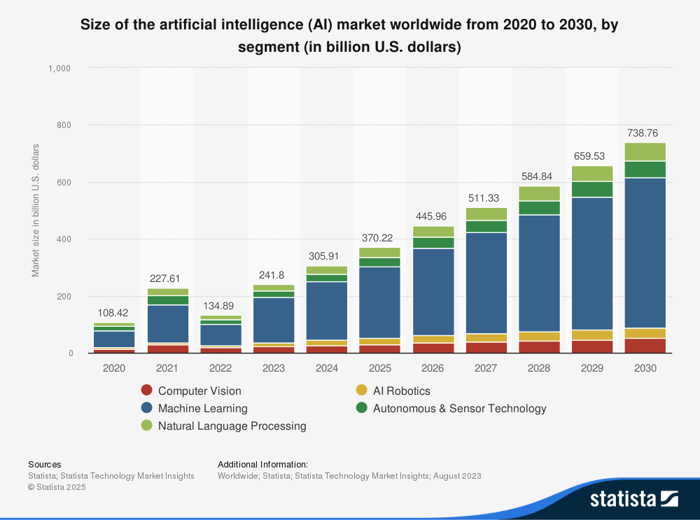

Nvidia's data center sales only grew 5% sequentially in the most recent quarter. That was largely due to the lack of China sales and was a big drop from the sequential quarterly sales increases it had been reporting in the last two years. But investors focusing on China are overlooking the bigger picture. The overall AI market is expected to continue to grow strongly for the remainder of this decade.

Image source: Statista.

The data in the chart represents a 16.5% compound annual growth rate over the next three years and about 15% through 2030. Nvidia will play a leading role in supplying those needs. Nvidia's business is broad enough for the company to still be expecting a 15.6% sequential overall revenue increase in Q3, even without any China sales.

Demand remains strong, and that should continue for several years. The global picture should give investors confidence to buy the recent dip in Nvidia stock.