Where Will Broadcom Stock Be in 1 Year? Expert Predictions and Market Outlook

Broadcom's trajectory sparks heated debate among analysts—will chip dominance or market volatility dictate its fate?

Semiconductor Supremacy vs. Macro Pressures

Riding the AI infrastructure wave while navigating geopolitical supply chain tangles. The company's vertical integration gives it an edge, but trade tensions could clip its wings.

Financial Engineering Masterclass

Aggressive acquisition strategy continues paying dividends—literally. Their recent software stack additions create sticky revenue streams that even skeptics admit are impressive.

The Regulatory Wildcard

Antitrust scrutiny looms over every tech giant. Broadcom's expanding empire might attract unwanted attention from regulators who suddenly remember they have jobs to do.

One thing's certain: while analysts debate price targets, the company keeps printing money—proving once again that in tech, actual execution beats Wall Street crystal balls every time.

Image source: Getty Images.

AI is moving the needle in a big way for Broadcom

Broadcom reported a 22% year-over-year increase in its revenue last quarter to $16 billion, while adjusted earnings shot up by 36% to $1.69 per share. The numbers exceeded consensus expectations. The robust demand for AI chips played a central role in boosting Broadcom's revenue and earnings last quarter.

Its revenue from sales of its custom AI processors increased 63% year over year to $5.2 billion, which means that it is getting a third of its top line from this niche now. Even better, Broadcom is anticipating its AI revenue to grow to $6.2 billion in the current quarter. That WOULD bring its fiscal 2025 AI revenue to almost $20 billion, a potential improvement of 64% from last year.

The good part is that Broadcom's AI revenue could grow at a breathtaking pace in the coming year. The company ended the quarter with a record $110 billion worth of bookings, driven by "robust demand from AI," according to CEO Hock Tan.

To put things in perspective, Broadcom expects to end the current fiscal year with $63.3 billion in revenue. So, the size of its bookings seems solid enough to allow Broadcom to keep up its healthy growth levels in the next year.

Another important development that investors should note is that Broadcom has secured production orders for custom AI processors from a fourth customer. The company was already designing custom chips for three hyperscale customers and was engaged in discussions with another four potential customers. One of those potential customers -- said to be OpenAI -- placed orders worth more than $10 billion for Broadcom's custom AI chips last quarter.

With the new customer on board, the company now expects its "fiscal 2026 AI revenue to improve significantly from what we had indicated last quarter." The company was earlier expecting a 60% spike in AI revenue in the next fiscal year, but analysts are now forecasting that figure to double. It won't be surprising to see Broadcom actually living up to that forecast, since it has the potential to bring more customers on board.

Moreover, OpenAI could move the needle in a big way for Broadcom in the coming year. The ChatGPT Maker is expected to burn a whopping $115 billion in cash through 2029 as it scales up its AI infrastructure. Its cash burn is expected to double in 2026, and don't be surprised to see Broadcom gaining from this higher spending.

So, it is easy to see why Broadcom's growth estimate for fiscal 2026 has been hiked substantially.

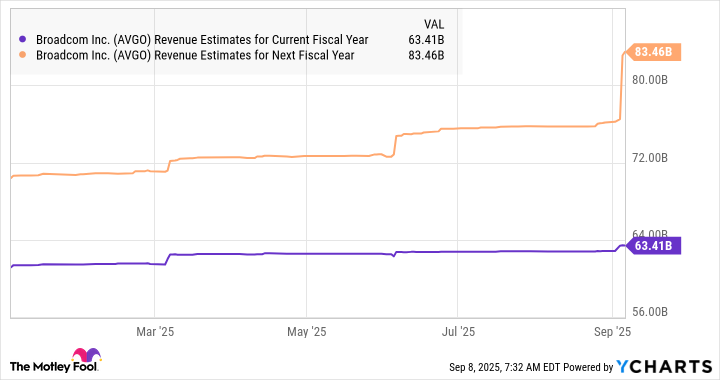

AVGO Revenue Estimates for Current Fiscal Year data by YCharts.

Here's how much upside investors can expect

Broadcom's revenue is expected to jump by 31% in the next fiscal year (which will end in November 2026), as per the chart above, to $83.5 billion. There is a chance that it may be able to exceed that mark if it can win more business from the three customers that it currently has in its pipeline, as well as an increase in spending by its existing customers.

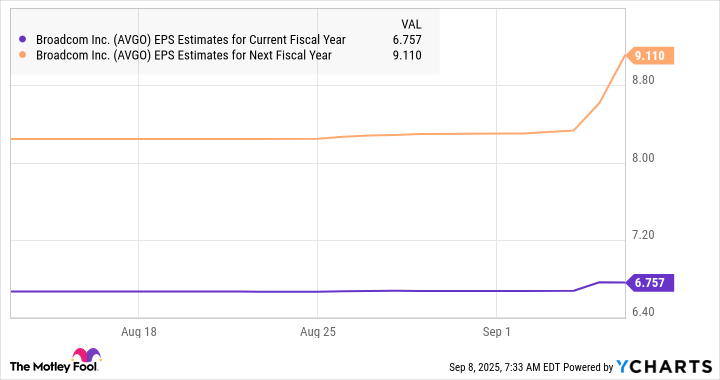

Importantly, Broadcom's earnings are also expected to jump by 35% in the next fiscal year to $9.11 per share. Even that estimate has moved up significantly following its latest quarterly report.

AVGO EPS Estimates for Current Fiscal Year data by YCharts.

If Broadcom can hit that mark in the coming year and trades at 48 times earnings (in line with the average price-to-earnings ratio of the U.S. technology sector), its stock price could jump to $437. That would be a 30% jump from current levels.

So, this AI stock has the potential to jump higher even if it trades at a significant discount to its trailing earnings multiple of 86. The possibility of more upside is also there, as the market could reward Broadcom's accelerating growth with a premium valuation.