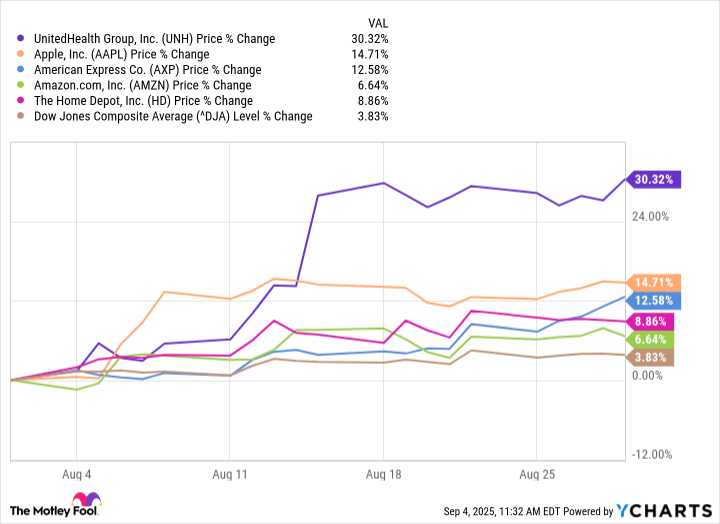

These Were the 5 Top-Performing Stocks in the Dow Jones Industrial Average in August 2025

Dow's August champions defy market gravity—while crypto quietly eats their lunch.

THE HEAVYWEIGHT HITTERS

Five blue-chip titans ripped through August like a bull market on rocket fuel—delivering returns that left traditional benchmarks choking on their dust. These weren't subtle gains; these were portfolio-altering moves that had Wall Street scrambling to reposition.

BEATING THE STREET—BUT NOT BITCOIN

While these legacy giants posted impressive numbers—we're talking double-digit percentage surges—they still trailed Bitcoin's August performance by a country mile. But hey, at least they didn't require understanding private keys or self-custody—comforting news for finance bros who still think 'blockchain' is a new Equinox class.

THE OLD GUARD'S LAST STAND?

These five stocks proved traditional equities still pack punch—even as decentralized networks quietly absorb their market share. They delivered exactly what investors craved: predictable growth, regulatory comfort, and the soothing familiarity of ticker symbols their grandfathers would recognize.

August's lesson? Legacy finance can still run hot—just don't look at what's happening off-exchange.

UNH data by YCharts.

UnitedHealth Group: Up 30.3%

(UNH 1.61%) stock has been a disappointment in 2025, down 50% heading into August. But it made a massive turnaround on a couple of key investments.

First,, led by famed CEO Warren Buffett, disclosed a $1.5 billion position in UnitedHealth, pocketing 5.04 million shares. It was a big MOVE for Berkshire, which also operates an insurance company in GEICO, and signaled to investors that the beaten-down insurer was ripe for the picking.

Second, investor Michael Burry disclosed his own investment through his Scion Asset Management hedge fund. Burry, who's best known for his bet against the housing market that was dramatized in The Big Short, disclosed that Scion bought 20,000 shares of UnitedHealth stock and another 350,000 call options.

The company's second-quarter earnings were also solid, with revenue of $111.6 billion up $12.8 billion from a year ago. UnitedHealth issued full-year guidance for revenue between $344 billion and $345.5 billion, which WOULD be up 15% from 2024.

Apple: Up 14.7%

Buffett's cash to fund his UnitedHealth purchase came from his sale of(AAPL -0.16%) stock. The Oracle of Omaha trimmed Berkshire's stake by 20 million shares. But Apple had some other positive things going for it, so it still had a very good August.

First, Apple had a better-than-expected earnings report. Financials for its fiscal 2025's third quarter (ended June 28) showed revenue of $94 billion, up 10% from a year ago. Earnings per share totaled $1.57, which was a 12% increase from last year.

Apple badly needed a quarter like that because the company's revenue has been flat since 2023. While some investors were expecting more of the same, Apple was able to report double-digit growth in its iPhone, Mac, and Services segments.

American Express: Up 12.6%

(AXP -1.30%) is a credit card company that has distinct advantages over competitorsand. While it has a smaller market share, American Express caters to corporate accounts and affluent customers who crave the American Express Gold or platinum card perks.

In addition, the company operates its own payment network and extends loans, giving it another income stream from the interest charged.

Although there remains some concern about the strength of the economy, American Express reported revenue that was up 9% in the second quarter to $17.8 billion. Adjusted earnings per share came in at $4.08, up 17% from the second quarter of 2024.

American Express isn't sitting on its laurels, though. CEO Steve Squeri indicated that the company is looking to upgrade its Platinum card in an effort to draw Generation Z and millennial customers.

Amazon: Up 6.6%

(AMZN -1.46%) has multiple growth engines with its lucrative Amazon Web Services (AWS) cloud computing segment and its powerful e-commerce division. Both had good news to report in August, pushing Amazon shares higher.

First, the company's second-quarter results showed strong performance from AWS, with revenue in the segment coming in at $30.87 billion and operating income of $10.16 billion. AWS is by far most profitable segment for Amazon, and its cloud computing division is essential for companies that are looking to operate artificial intelligence-infused programs without spending massive amounts of money to create their own data centers.

![]()

Image source: Getty Images.

Amazon also is seeing greater success with advertising. Its advertising-services segment brought in $15.69 billion in the second quarter, up 23% from the previous year.

Finally, the company's Amazon Prime Day shopping event in July brought in billions. The company said it was the biggest Prime Day event in its history. While Amazon didn't release sales figures yet, Adobe Analytics projected $23.8 billion in overall sales from the three-day event.

Home Depot: Up 8.8%

(HD 1.69%) had a good August after reporting solid earnings of its own. As home sales are struggling in 2025, more people seem to be putting work into their existing properties, according to CEO Ted Decker, who cited "smaller home improvement projects" as driving the company's successful quarter.

Home Depot said it saw sales of $45.3 billion in the second quarter, up 4.9% from a year ago. Adjusted earnings per share of $4.68 were $0.01 per share higher than a year ago. The home-improvement retailer reaffirmed its 2025 guidance for sales growth of 2.8%.