Can $10,000 in Caterpillar Stock Turn Into $50,000 by 2030?

Heavy machinery giant faces the ultimate growth test—can yellow iron deliver green returns?

The $10K to $50K Question

Caterpillar's massive industrial footprint meets investor ambition head-on. Turning ten grand into fifty requires nearly 400% returns in just five years—a tall order for even the most bullish construction cycle.

Infrastructure Bets and Economic Cycles

Global infrastructure spending creates tailwinds, but cyclical industries love breaking hearts when recessions hit. CAT stock dances to the tune of commodity prices and government budgets—both notoriously fickle partners.

The 2030 Reality Check

Five-fold returns demand perfect execution and macroeconomic cooperation. Meanwhile, Wall Street analysts keep collecting fees whether the prediction hits or misses—some things never change.

Image source: Getty Images.

What needs to happen for Caterpillar's share price to quintuple in five years?

For Caterpillar to 5x by August 2030, share prices (minus dividends) WOULD need to compound at about 38% per year. That's a moonshot, especially for a cyclical company with a market cap of about $200 billion.

For perspective: Over the last five years, Caterpillar's compound annual growth rate (CAGR) was about 24%, and share prices ROSE almost 180%.

But what would need to happen for the company to achieve a 38% CAGR?

First, profits would need to explode. Think: a commodity supercycle that accelerates orders for mining trucks coinciding with a massive global construction boom, with significant price inflation driving top- and bottom-line growth. Think: a sustained AI boom that drives demand for power generation equipment in data centers. Finally: new tech, like autonomous construction robots, and investors willing to value an industrial company as if it belongs to tech.

In short, the perfect storm of tailwinds.

Now, the reality check: Total sales and revenue for Caterpillar have been falling, and the company now expects to lose $1.5 billion to $1.8 billion to tariff-related expenses this year.

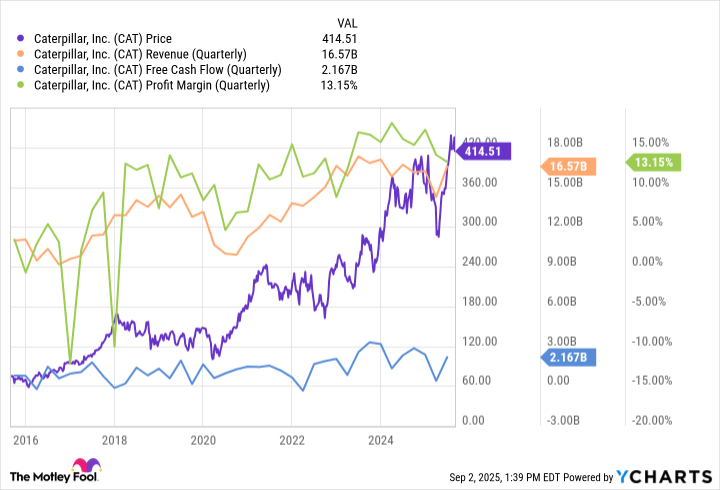

Caterpillar's business is also cyclical, meaning its earnings are tied to economic growth, as the chart illustrates.

CAT data by YCharts

So, can Caterpillar's share price quintuple in five years? It's possible with the right set of tailwinds, but I wouldn't hold your breath. The company is already trading at a forward price-to-earnings ratio of 22.5, which is a premium for an industrial stock that typically cycles between 15 and 18.

Caterpillar might be a buy for modest growth, but don't expect it to explode.