3.5 Reasons to Buy High-Yield Realty Income Stock Like There’s No Tomorrow

Realty Income's dividend machine prints cash while traditional finance sleeps at the wheel.

High-Yield Haven in a Volatile Market

Forget chasing meme stocks—Realty Income delivers consistent returns through triple-net leases with investment-grade tenants. The 4.5% yield crushes most savings accounts while providing actual asset backing.

Monthly Dividend Compound Effect

Twelve payouts annually accelerate wealth building compared to quarterly distributions. Reinvestment compounds faster—mathematics doesn't care about Fed policy meetings.

Recession-Resistant Portfolio

Supermarket chains, drugstores, and convenience stores anchor the portfolio. People buy groceries and medicine regardless of economic conditions—unlike speculative tech plays.

Inflation Hedge With Teeth

Lease escalators built into contracts automatically boost revenue as consumer prices rise. Unlike fixed-rate bonds, this REIT actually benefits from inflationary environments.

Because let's be honest—if your financial advisor hadn't missed Bitcoin's rise, they wouldn't be pushing REITs so hard now.

1. Realty Income's yield is attractive

Since Realty Income is a dividend stock, the first logical thing to look at is its dividend yield. That yield is currently around 5.5%. That's attractive on an absolute level, but it starts to get even more attractive when you consider it relative to other yields.

Image source: Getty Images.

For example, the dividend yield for the(^GSPC -0.32%) right now is roughly 1.2%. That's pretty miserly. The yield for the average real estate investment trust (REIT) is 3.9%. Realty Income's yield is a step above both of those.

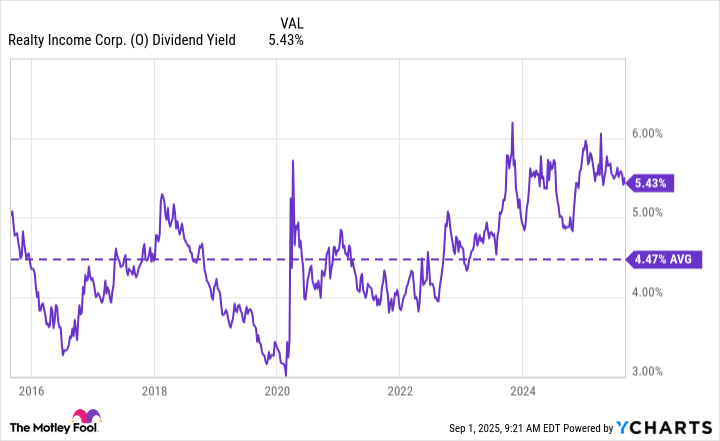

But Realty Income's yield is also attractive relative to its own recent history. The stock's average yield over the past decade was roughly 4.5%. That means that the current yield is also high compared to Realty Income's own historical dividend range. If you are looking for a high-yield stock right now, Realty Income stands out on both an absolute basis and on a relative basis for long-term dividend investors.

O Dividend Yield data by YCharts

2. Realty Income has been a reliable dividend payer

A high yield isn't really worth buying if it isn't backed by a business that can support the dividend over the long term. But Realty Income has proven it is capable of paying through good times and bad. To put a number on that, the REIT has hiked its annual dividend for three decades and counting.

But that's not the only streak it has going. Within that annual streak is a streak of 111 quarterly dividend hikes. If you believe that the safest dividend is the one that's just been increased, well, Realty Income's dividend gives you a quarterly safety check. To be fair, dividend growth is on the slow side, with the annualized average over the past 30 years coming in at 4.2%. But that's above the historical rate of inflation growth, so the buying power of the dividend has increased over time.

3. Realty Income is looking for ways to grow

One of the reasons why Realty Income's dividend growth is slow is its size. It is over three times larger than its next closest peer in the net lease REIT niche. With over 15,600 properties in its portfolio, Realty Income has to make a lot of deals to move the needle on the top and bottom lines. Given its size and investment-grade credit rating, Realty Income has the wherewithal to make huge investment moves. But slow and steady is still the best that investors should realistically expect.

That said, Realty Income isn't simply resting on its laurels and hoping for the best. It is actively looking for ways to increase its investment opportunity set. For example, a few years ago, it started investing in Europe, where the net lease approach is relatively new. But that's not all it has done. It has expanded into new property markets like casinos and data centers. It has started to offer debt investments to companies. And it is setting up an asset management service meant for institutional investors. Basically, Realty Income is preparing for the future, so it has more irons in the fire to support its dividend growth.

3.5? Don't overlook how often Realty Income pays its dividend

So, the final half point -- perhaps it's best looked at as a bonus point -- is one that some investors will overlook. But it could be very important, particularly if you are retired. As the company's nickname highlights, it pays dividends with a monthly frequency. Most companies pay dividends quarterly, which, in retirement, can be a budgeting complication. Getting a monthly dividend check is as close to a paycheck replacement as you can get.

There are big reasons to like Realty Income

If you are in the market for a dividend stock today, you should put Realty Income on your list. It has a large yield, a proven record of being a reliable dividend payer, and it is working hard to ensure it can continue to reward investors for sticking around. And, as a bonus, it pays dividends 12 times a year, making your financial life in retirement just a little less complicated.