The Ultimate Growth ETF to Park Your $1,000 in Today

Forget picking stocks—smart money's flooding into this ETF powerhouse.

Why chase individual winners when you can own the entire growth engine?

This fund bundles tomorrow's titans—tech disruptors, biotech innovators, and clean energy pioneers—all in one trade.

Diversification without dilution: get concentrated exposure to sectors poised to explode, not just meander.

Zero stock-picking stress, zero emotional trading—just set it and watch compound interest do the heavy lifting.

Wall Street's still charging 2% for actively managed mediocrity? This ETF delivers alpha for a fraction of the cost.

Bottom line: if you're not using ETFs to capture growth, you're basically investing with blindfolds on.

A leading technology ETF

The Vanguard Information Technology ETF is a growth fund focused on the technology sector. It has 317 stocks in its portfolio, which isn't super-large as far as ETFs go, but it still provides exposure to a lot of companies in the sector under the umbrella of a single investment. That minimizes some of the risk that you'll face that any particular company will perform poorly while giving you access to some of the stocks with the highest potential, including some you might find too risky to invest in individually.

Since it's a weighted index, the largest companies make up the biggest fractions of the portfolio. As you might have already guessed, the largest component is the world's largest company,-- it accounts for 18% of the total portfolio. If you've been hesitant about investing in the chipmaker today, this is a great way to add it to your portfolio.andcombine to make up another 28%.

Image source: Getty Images.

Most of the remaining stocks account for relatively minuscule fractions of the total, but you still get access to hot stocks likeand the recently IPO'd. These are stocks trading at astronomical valuations -- artificial intelligence specialist Palantir trades at 185 times forward, 1-year earnings, while digital design tech company Figma trades at a ratio of 339.

Premiums that high might deter many investors. Here, you can get a small piece of such businesses wrapped up in a bigger and more secure investment. However, this ETF gets Vanguard's highest risk rating. It has an average P/E ratio of 40, well over the S&P 500 average of 26, which is already expensive relative to its historic levels. This ETF is suitable only for the risk-tolerant investor.

However, some of the risk is mitigated in an ETF like this because many of its components are well-established industry leaders. Companies likeandare more mature, and they both trade at a P/E ratio of 22.8.

Also, because it's an index fund, stocks that aren't performing well enough will be automatically traded out as soon as they don't meet the index's criteria. Another benefit of index funds is that they are passively managed and don't come with high management fees. The Vanguard Information Technology ETF's expense ratio is just 0.09%, in contrast with what Vanguard says is an average of 0.93% for similar ETFs.

One way to beat the market

Growth investors aim to beat the market. The risks they take in pursuit of that goal are usually in line with their potential for reward, and it works both ways. When the market is thriving, growth stocks are usually leading the way. When the market is sinking, growth stocks are typically tumbling the hardest.

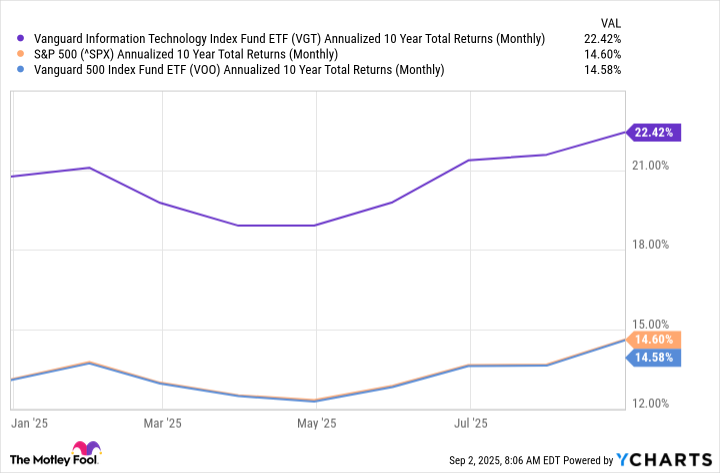

Over time, though, that dynamic often ends up working in the growth investor's favor, because historically, the market has spent more time in growth mode than not. Over the past 10 years, for example, the ETF's annualized gains have more than doubled the S&P 500's.

VGT Annualized 10 Year Total Returns (Monthly) data by YCharts

In fact, the Vanguard Information Technology ETF's average annualized 10-year gain of 22.4% is the highest of any Vanguard ETF. It's also outperforming the market this year -- unsurprisingly, since the market is up.

If you have some appetite for risk and a long time horizon for your investments, the Vanguard Information Technology ETF could be a great addition to your portfolio.