If You’d Invested $1,000 in the Invesco QQQ Trust 10 Years Ago, Here’s How Much You’d Have Today - The Numbers Will Shock You!

Tech Titans Deliver Decade of Dominance—Your Portfolio Would Be Sitting Pretty

The NASDAQ Powerhouse

Forget traditional finance's sluggish returns—the QQQ trust smashed expectations while old-school investors were still rebalancing their bond allocations. This ETF packed the market's most explosive innovators into a single ticker, delivering returns that make hedge fund managers blush.

Compound Growth Machine

That initial grand didn't just grow—it multiplied like crypto on a bull run, without the sleepless nights watching charts. While bankers collected fees for underperformance, QQQ silently built wealth for anyone smart enough to ride the tech wave.

Market Outperformance Unleashed

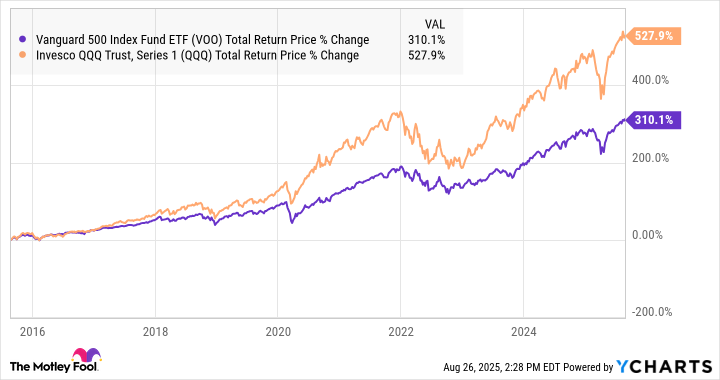

Tech stocks didn't just climb—they skyrocketed past every conventional benchmark. The numbers speak for themselves: QQQ's performance left the S&P 500 eating dust and made traditional diversification strategies look downright archaic.

Future-Proof Returns

This wasn't luck—it was foresight. Investing in innovation always beats betting on yesterday's winners. While Wall Street debated price-to-earnings ratios, QQQ investors cashed checks.

Just imagine what another decade of AI, cloud computing, and digital transformation might deliver—if you can stomach the traditional finance crowd telling you it's 'overvalued' all the way to the bank.

VOO Total Return Price data by YCharts

Why has the Invesco QQQ Trust performed so well?

In a nutshell, the Invesco QQQ Trust tracks a benchmark index, the Nasdaq-100, which has performed incredibly well over the past decade. And as a weighted index, it has a disproportionate level of exposure to the largest technology companies in the world. In fact, the "Magnificent Seven" represent just 7% of the companies in the index, but accounts for 42% of the ETF's assets.(NVDA 0.57%) and(MSFT 0.45%), the top two holdings, each account for about 9%.

Image source: Getty Images.

This also explains the outperformance versus the S&P 500, which has delivered historically excellent returns itself. While all of the large-cap tech stocks in the Nasdaq-100 are also components of the S&P 500, they make up a larger weight due to the more concentrated portfolio. For example, Nvidia makes up 9.2% of the Invesco QQQ ETF but less than 8.1% of the(VOO 0.81%).

Now, it remains to be seen whether the Invesco QQQ ETF will deliver such strong performance over the next 10 years. But with the AI boom and several other exciting trends to watch, it could certainly be an interesting index fund to watch.