Prediction: After Soaring 68% This Year, This Cathie Wood Stock Is Primed for Monster Gains Ahead

Cathie Wood's latest rocket ship just hit escape velocity—and the trajectory points straight to alpha territory.

Fueling the Fire

That 68% surge since January isn't just momentum—it's a statement. While traditional finance still debates blockchain legitimacy, this play bypasses the noise and captures pure tech disruption.

Institutions are finally waking up. They see the institutional-grade infrastructure being built while Wall Street analysts still worry about quarterly earnings. The smart money isn't waiting for permission.

Gains don't ask for consensus—they break it. This stock embodies crypto's core thesis: outdated systems get replaced, not reformed. Another 68%? That's just the next resistance level before the real breakout.

Because let's be honest—if your portfolio isn't outperforming Cathie's picks, you're basically just collecting vintage brokerage statements.

Keep your eyes on the Federal Reserve

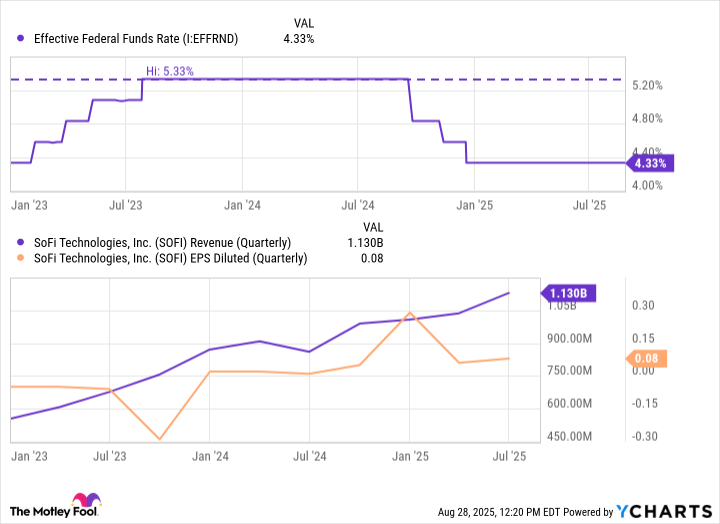

Last year, the Federal Reserve reduced interest rates three times. Since then, rates have held steady -- though Chairman Jerome Powell recently hinted another interest rate reduction could come as soon as next month.

At first glance, lower interest rates might seem like a headwind for SoFi since compressed net-interest margins can pressure its lending operation. But that's only half the narrative.

Effective Federal Funds Rate data by YCharts

As the charts above show, SoFi's revenue growth and profitability have remained resilient even during prior reductions to the federal funds rate.

Lower borrowing costs can unlock pent-up demand for refinancing student loans and mortgages -- areas where SoFi enjoys activity. The company's ability to merge consumer engagement, technology-driven infrastructure, and a full suite of financial services under one roof positions SoFi to capitalize on these tailwinds.

A contrarian view might suggest that falling interest rates could reinvigorate SoFi's lending segment and, more importantly, expand cross-selling opportunities across its ecosystem.

SoFi is returning to crypto

According to a recent survey from Motley Fool Money, younger investors are significantly more likely to invest in cryptocurrency compared to Gen X and baby boomers. SoFi's core user base skews younger, with strong adoption among millennials and Gen Z -- the very demographics driving interest in crypto investing and fintech innovation.

With crypto investing now returning to SoFi, the company has a clearer path to compete with other tech-driven financial apps like. This move could also attract new users who prefer trading crypto directly though an integrated platform rather than relying on stand-alone exchanges such as.

Image source: Getty Images.

Is SoFi stock a buy right now?

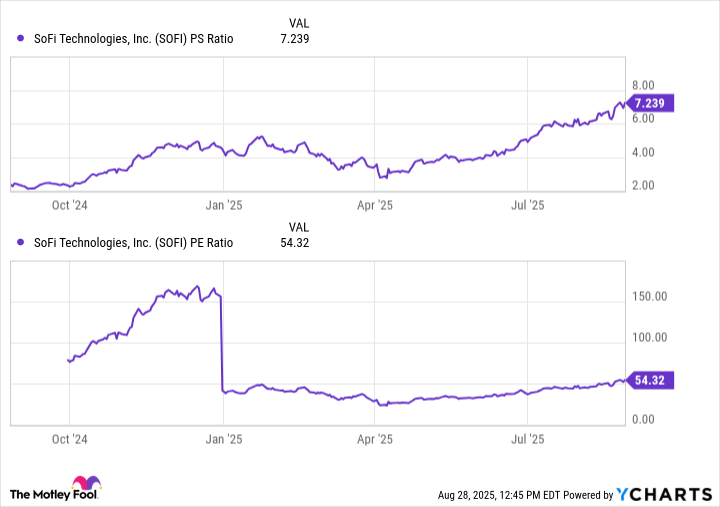

Perhaps the strongest bear case against SoFi centers on valuation. By traditional banking benchmarks, the stock is undeniably expensive. As the charts illustrate, SoFi trades at multiples that suggest a technology premium rather than a standard financial sector profile.

SOFI PS Ratio data by YCharts

I think SoFi's valuation should be considered through the lens of growth and optionality. SoFi is more than just a digital bank -- it's an integrated financial ecosystem that spans lending, investing, insurance, and more. Each new product not only broadens the company's total addressable market (TAM), but also deepens customer engagement -- driving higher lifetime value. This flywheel effect is something that legacy incumbent banks struggle to replicate.

Investors tend to pay a premium for companies that are profitable, growing, and actively expanding into new markets -- three qualities that position a business for long-term success. SoFi checks each of these boxes. Its premium valuation isn't a reflection of HYPE -- it's a reflection of the company's position as a multi-product platform still in the early innings of growth.

For long-term investors, SoFi represents a compelling opportunity to buy and hold as the company doesn't just survive in a crowded financial landscape, but steadily continues to build a differentiated platform designed to scale for years to come.