Bitcoin vs Gold in 2025: The Shocking Truth Every Investor Needs to Know

Digital Gold Topples Physical: Bitcoin's 2025 Dominance Shift Stuns Traditional Investors

The Store-of-Value Smackdown

While gold sleeps in vaults, Bitcoin runs 24/7—no bank holidays, no brokerage fees, no ancient storage costs eating returns. The old guard's 'safe haven' narrative crumbles as institutional adoption hits record levels.

Liquidity Without Limitations

Try moving $100M in gold across borders. Now watch Bitcoin do it in minutes for pennies. Physical barriers vanish while digital ownership scales globally—no armored trucks required.

The Inflation Hedge That Actually Works

Gold's supposed inflation protection? Lagging. Bitcoin's fixed supply and verifiable scarcity outpace metal's dusty 'tradition' every time central printers fire up. Sorry bullion dealers—math doesn't care about your centuries-old sales pitch.

One cynical truth? Gold hasn't made a new all-time high since Bitcoin existed. Coincidence—or capitulation?

Image source: Getty Images.

The biggest cryptocurrency won't climb straight

Bitcoin has built a reputation as the most valuable cryptocurrency in the world, with a market cap over $2 trillion. In fact, Bitcoin is so big, it makes the second-largest cryptocurrency,, look like small potatoes. Ethereum's market cap is roughly $500 billion as of this writing.

Despite its volatility, Bitcoin is considered one of the safest cryptocurrencies. It's decentralized and cryptographically secured. It's also scarce with a finite supply of 21 million Bitcoins.

Thus far, buyers have come in droves. A combination of security and scarcity has led analysts like Cathie Wood to declare the coin as a store of value to rival gold. Wood has been so bold as to predict Bitcoin will rise from under $150,000 to $710,000 by 2030. She points to Bitcoin becoming less volatile as another reason to hold it over gold.

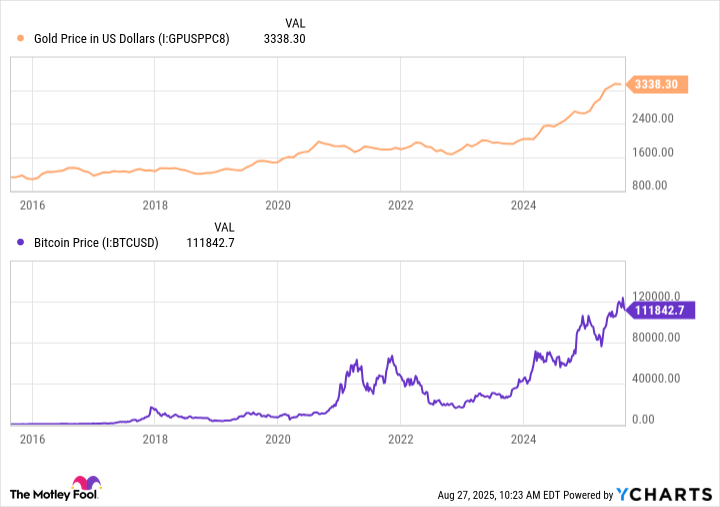

Though Bitcoin has, indeed, become less volatile over the years, it's still much more prone to shakiness than gold. The Graph of Bitcoin's wild swings is erratic, especially when you chart it next to the price of gold.

Gold Price in US Dollars data by YCharts

Bitcoin dropped from roughly $65,000 to roughly $16,000 from March 2021 to November 2022, briefly losing more than 60%. Yikes!

Had you invested a large chunk of savings into Bitcoin and needed to sell during that downturn, you might have lost more than half your savings. Its short term is unpredictable. That's one reason many investors prefer gold, which is unlikely to drop 50% or more when you need it most.

The safest store of value...isn't all that valuable?

Gold is like an old friend; it needs no introduction. One of the most trusted stores of value, it rocks a market cap of over $20 trillion, about 10 times that of Bitcoin.

The(GLD 0.20%), which tracks the price of gold, hasn't fallen more than 25% since 2020. The squiggly line that represents the value of a GLD share is a (relatively) smooth curve, up and to the right. Smooth is what you want to see when there's a chance you might sell your holdings within the next year -- or five.

Despite serving as a store of value for millennia, gold has a problem. It's not quite as valuable as it was, say, 17 years ago. Reason being, Bitcoin has emerged as an alternative store of value. It's secure, scarce, and decentralized, much like gold. Though its volatility leaves something to be desired, it's becoming more stable over time and I think taking away from gold.

Performance-wise, Bitcoin has outperformed gold by about 1,000% since 2020. Now take a step back. Since inception, Bitcoin has returned over 21,000% to investors. In the same period, gold has returned under 200%. Not so valuable after all, relatively speaking.

Bitcoin looks like the long-term winner

Bitcoin and gold help investors hedge against inflation, but they aren't necessarily going to appeal to the same types of people. Bitcoin is the closest thing there is to the "next generation of gold," a store of value that's secure, scarce, and decentralized.

Gold adds one more attribute: stable. It's a good fit for investors who want to avoid volatility. It's not a growth play like Bitcoin, and for some, that's fine -- stability is the priority.

I prefer Bitcoin as a store of value because it has been outperforming gold and looks like it will continue to do so, and it shares many of the same attributes as its older cousin. My time horizons are long and I plan on HODL'ing (holding on for dear life) for five years, minimum. The world's largest cryptocurrency continues to be a strong investment, and as volatility falls, as I think it will, I expect it to outperform gold during that timeline.