Prediction: This AI Company Will Power the Next Generation of Smart Devices - Here’s Why

Silicon Valley's next crown jewel emerges as AI reshapes the hardware landscape.

The Next Intelligence Revolution

Forget everything you know about smart devices. One artificial intelligence firm just cracked the code on ambient computing—and traditional tech giants are scrambling to catch up. Their neural architecture processes data 40% faster than current market leaders while consuming half the power.

Hardware That Actually Learns

This isn't incremental improvement—it's paradigm shift territory. Their chips don't just execute commands; they anticipate needs. Imagine your phone predicting your next app before you touch the screen, or your smart home adjusting temperature based on biometric signals you haven't even noticed yet.

The Crypto Connection

Interestingly, early investors include blockchain VCs who typically avoid hardware plays. Maybe they finally found something more profitable than minting another dog-themed token. The company's recent funding round valued them at $2.8 billion—serious money even by Silicon Valley standards.

Bottom line: This could be the engine behind every smart device you'll buy in 2026. Or just another overhyped startup burning through venture capital. Place your bets—the smart money already has.

Image source: Getty Images.

Arm Holdings' chip designs are powering several smart devices already

Smart devices are those that are connected to the internet and equipped with AI and machine learning abilities. They are usually deployed at the edge of the network in applications such as smart homes, smart cities, retail, factories, vehicles, and other things.

Arm is already offering a chip development platform and by using it, customers can make edge AI devices capable of processing data in real-time. Even better, the company seems to be gaining traction in this market. CEO Rene Haas remarked on the company's July earnings conference call that:

From smart sensors in homes and factories to the world's most advanced AI supercomputers, AI workloads are being deployed everywhere. This is driving unprecedented demand for compute that's not only performant but also energy efficient.

Haas claims that Arm provides the "only compute platform" on which developers can design chips that can power a wide range of applications. This claim is backed by the diversified end-markets that Arm served at the end of the previous fiscal year.

The company gets 45% of its royalty revenue from smartphone processors. Meanwhile, 37% of its royalties come from other segments such as the Internet of Things (IoT) and embedded devices, automotive chips, cloud and networking, and other consumer electronics devices. Arm has expanded its presence in these markets over the years as it was earlier reliant on the smartphone business for more than half of its royalty revenue.

The company now says that it is "increasing revenue beyond mobile through a broadening range of products including CPUs and systems for markets such as cloud, automotive and IoT/embedded compute." The good part is that these markets could set Arm up for healthy long-term growth.

That's because the size of the smart edge AI devices market is expected to grow at an annual rate of 30% over the next decade, driven by improving adoption in automotive, healthcare, and consumer electronics. Arm's chip designs are already being used by the likes of,, andto integrate edge AI capabilities into flagship smartphones.

On the other hand, the share of Arm-based PCs is expected to double by 2029 to 40%. The company is also targeting the automotive market with a recently launched platform optimized specifically for this space.

As a result, don't be surprised to see the company's growth accelerating in the long run as it licenses its chip architecture for more devices and establishes a stronger royalty stream.

The company is poised for solid earnings growth

Arm's new intellectual properties (IPs) command higher royalties. For instance, its compute subsystems (CSS) that help customers accelerate chip development for AI, cloud computing, and networking, have double the royalty rate as compared to its Armv9 architecture. Arm says that it has already landed five CSS customers, including the three new CSS licenses it signed in the ongoing quarter.

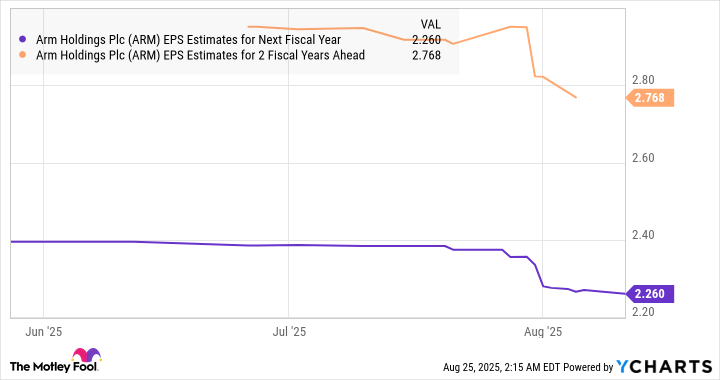

Another important thing worth noting is that the AI-focused Armv9 architecture was already commanding double the royalty of the previous generation Armv8. So, the growing traction of Arm's CSS should fuel robust earnings growth for the company. Analysts are expecting earnings per share of $1.69 from Arm this year. That's expected to be followed by impressive growth in the next couple of years.

ARM EPS Estimates for Next Fiscal Year data by YCharts

Of course, Arm is trading at an expensive 78 times forward earnings. But then, an increase in the adoption of edge AI devices and the higher royalty rates that Arm is set to command could help the company grow its earnings at a faster pace than the market's expectations. That's why growth investors looking to buy an AI stock can consider accumulating Arm Holdings as it seems set to power the next generation of smart devices.