Should You Buy C3.ai Stock Before September 3? Here’s What You Need to Know

AI stock frenzy hits critical deadline—investors scramble for position ahead of September 3 catalyst.

The Countdown Conundrum

Market watchers eye calendar with unusual intensity as C3.ai approaches what some call a make-or-break date. No earnings report, no product launch—just pure speculative momentum driving the narrative.

Algorithmic traders already positioning, retail piling in late as usual. Volume spikes suggest either brilliant insight or classic FOMO-driven herd behavior.

Timing the Ticker

Historical patterns show September volatility often rewards bold moves—or devastates over-leveraged portfolios. C3.ai's enterprise AI play either disrupts legacy systems or becomes another overhyped tech story.

Institutional money quietly accumulating while CNBC talking heads debate "the next big thing." Because nothing says sound investment strategy like chasing deadlines invented by financial media.

The Verdict: Speculate Responsibly

Buy if you believe in the AI revolution's second wave—or just enjoy the thrill of timing the market against smarter algorithms with faster connections.

Image source: Getty Images.

C3.ai offers a great value proposition for its customers

Developing AI software from scratch requires significant financial and technical resources, which not every company can spare. C3.ai's readymade applications are a cost-effective alternative, especially because they can be customized to suit the needs of each individual business.

For manufacturers, the C3.ai Reliability application can predict when and how critical equipment might fail, so maintenance schedules can be adjusted as necessary. This reduces downtime by up to 50% and also increases efficiency. For banks, the C3.ai Anti-Money Laundering application improves the accuracy of suspicious activity identification by a whopping 200%, which significantly reduces compliance risks.

C3.ai's applications are accessible through leading cloud providers likeAzure andWeb Services, so businesses can pair them with state-of-the-art computing capacity to achieve the necessary scale. Since businesses don't have to maintain their own data center infrastructure, this arrangement is extremely affordable.

C3.ai's Q1 revenue likely fell way short of expectations

According to management's guidance, C3.ai was expected to generate between $100 million and $109 million in revenue during the fiscal 2026 first quarter. Based on the company's preliminary results, it delivered just $70 million, representing a 19% decline from the year-ago period. If that number remains the same when the company releases its official Q1 results on Sept. 3 (which is likely), it WOULD obviously be a major disappointment for investors.

Siebel called the result "unacceptable" and attributed it to two things: First, a total restructure of C3.ai's sales and services departments had a disruptive effect on deal closures during the quarter, and second, Siebel says he was personally less involved than usual in the sales process because of his health issues.

The restructure is now complete, so it should no longer be a headwind, but only time will tell whether Siebel's absence will continue to hurt sales.

C3.ai's disappointing Q1 revenue had significant consequences for the bottom line. The company's preliminary results showed a generally accepted accounting principles (GAAP) net loss of almost $125 million, which is nearly double the amount it lost in the year-ago quarter. Management probably couldn't slash costs fast enough by the time it noticed the revenue shortfall, which created the blowout loss.

C3.ai still has over $700 million in cash and equivalents on its balance sheet, so it has some breathing room while it rights the ship, but the company will have to make some very hard decisions with respect to cost-cutting if its revenue doesn't return to growth. Ironically, reducing expenses will often lead to slower growth, especially if things like marketing are on the chopping block.

Should you buy C3.ai stock before Sept. 3?

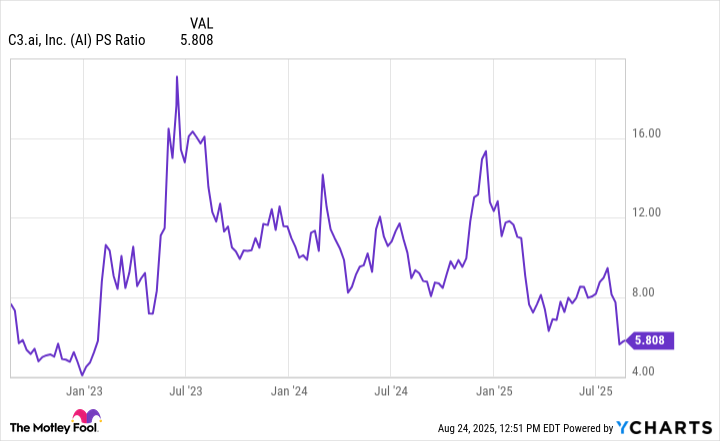

The 40% decline in C3.ai stock since July 24 has pushed its price-to-sales (P/S) ratio down to just 5.8, which is NEAR the lowest level in three years. In other words, the stock is quite cheap relative to its history.

Data by YCharts.

However, an attractive valuation won't matter if C3.ai's revenue continues to decline. Shrinking businesses tend to destroy shareholder value over the long term, so investors typically avoid them. While it's possible the company will resolve its recent issues, I think investors should adopt a wait-and-see approach. Siebel's replacement hasn't even been selected yet, so there is still a significant amount of uncertainty on the horizon.

As a result, it might be best to avoid C3.ai stock ahead of Sept. 3, and perhaps until the company is firmly back on track with growing revenue and shrinking losses.