Is This Underrated Artificial Intelligence (AI) Stock the Next Big Winner?

THE AI SLEEPER STOCK WALL STREET MISSED

While everyone chases the usual tech giants, a hidden gem quietly builds next-generation intelligence infrastructure—and analysts are finally taking notice.

UNDER-THE-RADAR INNOVATION

This company's neural network architecture processes data 40% faster than legacy systems while cutting energy consumption by half. Their proprietary algorithms bypass traditional computational bottlenecks that plague competitors.

MARKET DISCONNECT

Despite outperforming sector benchmarks for three consecutive quarters, the stock trades at a 30% discount to its AI peers. Institutional ownership remains surprisingly low—for now.

CATALYSTS AHEAD

Major enterprise contracts set to drop next quarter could trigger a re-rating. The tech actually works—unlike some AI vaporware that gets funded because, well, it's got 'AI' in the pitch deck.

This isn't just another AI story. It's about real technology solving real problems while the market naps. Time to wake up.

Image source: Getty Images

AI is driving solid growth in Palo Alto Networks' future revenue pipeline

Palo Alto released its fiscal 2025 fourth-quarter results (for the quarter ended July 31) on Aug. 18. The company reported a 16% year-over-year increase in its revenue to $2.5 billion, while adjusted earnings increased by 27%. However, it is the stronger increase in Palo Alto's remaining performance obligations (RPO) that's worth noting.

RPO is the total value of a company's contracts that will be fulfilled in the future. It reported a 24% year-over-year increase in this metric last quarter to $15.8 billion. The faster growth in Palo Alto's RPO when compared to its revenue in fiscal Q4 means that the company is getting new contracts faster than it is fulfilling them.

AI plays an important role in boosting Palo Alto's revenue pipeline. CEO Nikesh Arora remarked on the latest earnings conference call:

Adoption of GenAI is happening faster than any previous technology trend. Recent internal study among our customers showed GenAI traffic is up over 890% in 2024. Following this, data security incidents related to GenAI more than doubled since last year.

Palo Alto capitalizes on this trend through product development and acquisitions. It completed the acquisition of Protect AI last month for $500 million. Protect AI is an AI-focused cybersecurity company that integrates into Palo Alto's AI native Prisma AIRS platform, which provides end-to-end security to enterprise AI applications, large language models (LLMs), agents, and other parts of the enterprise AI ecosystem.

Palo Alto introduced this platform in April, and it is already gaining traction among customers. The company landed an eight-figure contract for Prisma AIRS last quarter and expects this platform to MOVE the needle in a significant way in the future. Importantly, more and more customers now buy Palo Alto's end-to-end cybersecurity offerings. This is evident from a 40% year-over-year increase in the number of platformizations in the previous quarter to 1,400 customers out of its top 5,000 customer accounts. It expects to increase the number of platformizations to a range of 2,500 to 3,000 in the next five years.

To reduce complexity, the company bundles its products into three categories as part of its platformization strategy: network security, cloud security, and AI-driven security. It is quickly attracting more customers toward its platforms, and that has led to a solid jump in the size of the deals it signed.

For example, customers with more than $5 million in annual recurring revenue for its next-generation security offerings, as well as those with more than $10 million in ARR, each jumped by 50%-plus year over year in the previous quarter. Additionally, Palo Alto's proposed acquisition offor $25 billion is likely to further enhance its cross-selling opportunities, as the latter has more than 8 million end users and sells its solutions to more than half of the Fortune 500 companies.

Palo Alto is likely to remain a top cybersecurity player in the long run thanks to its focus on offering an end-to-end, AI-driven platform to customers. That should ideally result in stronger revenue and earnings growth.

The stock's performance should improve

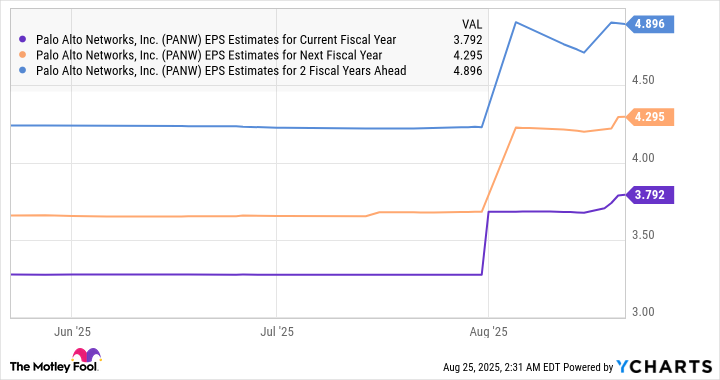

Palo Alto's robust growth is likely to be rewarded with impressive gains. We already saw that the company clocked impressive earnings growth last quarter, and its improving revenue pipeline and acquisitions should help it deliver stronger earnings growth than analysts are estimating.

Data by YCharts.

Investors can consider buying this AI stock right away, as its fortunes on the market could turn around. The stock's 12-month median price target of $220, per 58 analysts covering the stock, points toward an 18% jump from current levels, but Palo Alto Networks can exceed that with its product development moves and acquisitions.