Berkshire Hathaway’s Top Steel Stock Pick: Where to Invest $10,000 for Maximum Returns

Warren Buffett's $10,000 steel bet just signaled the entire sector's comeback—and one company stands above the rest.

The Oracle's Metal Move

Forget speculative tech plays. Berkshire's latest filing reveals a massive position in a foundational industry most investors overlook. This isn't about chasing trends—it's about betting on the backbone of global infrastructure.

Why Steel Now?

Supply chain reshoring, infrastructure bills, and inflationary pressures create a perfect storm for domestic producers. This pick leverages all three catalysts while trading at a fraction of tech multiples—because sometimes the smart money prefers bulldozers over algorithms.

The $10,000 Blueprint

Concentrated position. Long-term horizon. Zero regard for quarterly earnings theatrics. This is classic Buffett—applied to an industry he hasn't touched this aggressively in decades. The play? A company with pricing power, modernized facilities, and contracts stretching into the next decade.

Wall Street's still obsessed with AI stocks while the real value gets forged in Pennsylvania mills. Sometimes the best trade is the one everyone else considers boring.

What does Berkshire Hathaway do?

Berkshire Hathaway owns insurance businesses, which is why it falls into the finance sector. But it is really a massive conglomerate, with fully owned businesses across a wide range of industries. On top of that, it also owns a collection of stocks, with investments like and as longtime holdings. There are also holdings that are more opportunistic in the mix, includingand, both of which have seen their positions in the portfolio reduced recently.

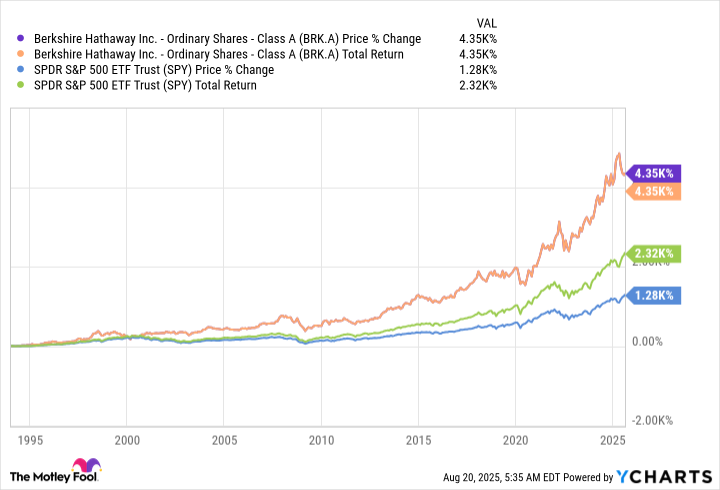

BRK.A data by YCharts

The big picture here is that Berkshire Hathaway is really the investment vehicle of Warren Buffett and his team. The performance they have achieved has been nothing short of incredible, with Berkshire Hathaway stock easily outdistancing theindex over the long term on both stock-only performance and total return. It all goes back to Warren Buffett's investment approach.

While the Oracle of Omaha has never specifically listed what he does on a granular level, he's given a big-picture overview. Buffett likes to buy good companies when they are attractively priced and then hold them for the long term to benefit from their business growth over time. Sounds simple, but in practice it is harder than it looks.

But if you think that approach sounds interesting, then you might want to look at recent portfolio addition(NUE 3.17%).

Image source: The Motley Fool.

Why is Nucor attractive?

Nucor is one of the largest and most diversified North American steelmakers. It uses electric arc mini-mills, which are more flexible than older blast furnaces. Nucor can, basically, ramp up and down with steel demand, allowing it to have stronger margins through the entire steel cycle. The steel cycle is important here.

Steel is cyclical, noting its importance to economic activity such as construction, manufacturing, and home building. Right now, the steel sector is kind of soft, leading investors to sell steelmakers. Even after a recent price bounce, at least partly thanks to Berkshire's buy, the stock is still 25% or so below its 2024 highs. The thing is, the best time to buy a cyclical business is usually not when it is flying high. It is when the company is in an industry trough, like Nucor is right now.

There are good reasons to think Nucor can survive this industry soft spot and thrive over the long term. For starters, it is a Dividend King. So it has not only survived prior industry pullbacks, but it did so while continuing to support a growing dividend. That's a sign that management has a strong business plan that it executes well in both good times and bad ones.

One of the most important parts of Nucor's business plan is that it invests for growth. While that is always a focus, it is during steel downturns where it tends to have the most benefit. In fact, Nucor often leans into downturns when it comes to its capital investment plans. It is currently in the middle of a $3 billion investment plan for 2025. And it has a number of important projects that are coming online right now and into 2026. That should help support both near-term and long-term growth, which is likely why Berkshire Hathaway added Nucor to the portfolio now.

Nucor has an attractive goal

Being a cyclical business, Nucor is not a stock for the faint of heart. You need to understand that you are buying for the long term and that the shares will rise and fall, often in dramatic fashion. However, the long-term goal of the business is to produce higher highs and higher lows. That has translated over time to a growing business and a growing stock price.

If you have never heard of Nucor, Buffett's Berkshire Hathaway has now brought it to your attention. And while the company's business (and stock price) is a bit weak right now, a cyclical steel upturn will eventually come along with capital investments supercharging the business' recovery. It could be a great stock to invest in right now, with $10,000 netting you around 68 shares of the stock.

But don't buy it just because Buffett and his team did. Buy Nucor because you like the business and its long-term prospects.