Remitly Global Just Dropped a Bombshell for Investors - Here’s Why It Matters

Remitly Global just shifted the entire cross-border payments landscape—and investors are scrambling to reposition.

The Digital Migration Accelerates

Traditional remittance channels are getting bulldozed. High fees? Slow processing? Not anymore. Remitly's latest move leverages blockchain infrastructure to bypass legacy banking bottlenecks entirely.

Market Impact and Financial Implications

This isn't just another product update—it's a direct assault on the $800 billion global remittance industry. While Wall Street analysts debate P/E ratios, disruptive tech keeps eating their lunch. Remitly's pivot toward crypto-integrated solutions positions them ahead of the regulatory curve and ahead of competitors still stuck in the SWIFT era.

Why This Isn't Just Hype

Real-time settlements. Lower transaction costs. Enhanced transparency. The trifecta that actually matters to users—not just buzzwords for investor presentations. While traditional finance plays catch-up, Remitly's betting that digital natives would rather use tech that works than trust institutions that barely do.

Final Take: Adapt or Get Left Behind

Remitly isn't just building a better product—they're building the inevitable. The only question now is who follows fast enough. Because in today's market, if you're not leveraging blockchain for real utility, you're basically just digitizing paperwork—and that's a business model with an expiration date.

Disrupting the stablecoin narrative

Along with its Q2 earnings report (which will be covered below), Remitly announced new products that its 8.5 million active customers can use earlier this month. First is the Remitly Wallet, a digital wallet through Remitly where customers can hold currencies instead of just sending them from a bank account. Importantly, stablecoins are included in the currencies customers can hold.

Second, Remitly is using payment provider Stripe to help fund remittance transactions on the platform with stablecoins. This expansion in the number of ways people can send and receive money through Remitly will make the platform more valuable for users, which should drive more customer adoption. Lastly, Remitly is utilizing stablecoins on its balance sheet to help MOVE money across border in real time when funding transactions for users, which should reduce its operating costs while again improving the customer value proposition of the platform.

More growth and reduced costs should mean more profits for Remitly going forward.

Image source: Getty Images.

Strong growth and market share gains

The last quarter was stellar for Remitly. Revenue grew 34% year-over-year to $412 million on the back of 40% send volume growth, with positive net income of $6.5 million. If people are utilizing stablecoins to bypass Remitly's remittance platform, it is not showing up in the numbers yet. The company is barely generating a profit, but that is because of all the new products its team is building, along with heavy marketing spend to acquire new users. Both are worthwhile buckets to pour money into as long as new customers keep joining Remitly and revenue is growing at this blistering rate.

As a disruptor in remittance payments, Remitly is gaining a TON of market share by stealing customer spending from the likes of. Legacy players are seeing declining send volumes as more customers adopt mobile native solutions like Remitly. The story is not over yet, though, with Remitly having an estimated market share of below 5% in total remittance payments around the world. Its revenue from outside North America has grown at close to 100% year-over-year and hit $350 million over the last 12 months.

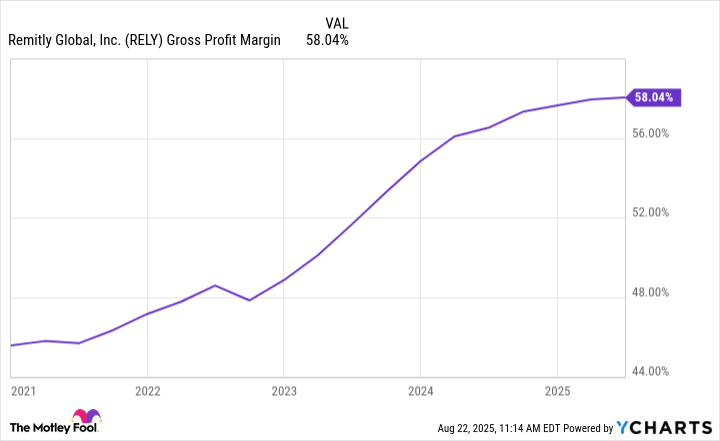

RELY Gross Profit Margin data by YCharts

Why Remitly stock is a buy today

Despite this massive growth tailwind, investors are still discounting Remitly stock, likely due to the stablecoin disruption narrative and recent immigration changes in the United States. Immigration has been a headwind to the overall remittance market in recent quarters but has not impacted Remitly's growth whatsoever, which is a good sign for the market share gainer.

At today's price of $19 a share, the stock has a market cap of $3.9 billion. It is generating revenue of $1.46 billion and growing quickly, with room to double overall sales within a few years time to $3 billion. With gross profit margins of 58%, Remitly has plenty of room to expand its bottom-line net income margin. A figure of 20% is entirely reasonable over the long haul. $3 billion in revenue and a 20% net income margin is $600 million in net income, which WOULD be a forward price-to-earnings ratio (P/E) of just 6.5 based on the current share price.

A future P/E below 10 in just a few years makes Remitly significantly undervalued at today's share price, which is why the stock is a buy after its recent drawdown.