Could Buying AGNC Investment Stock Today Actually Set You Up for Life?

AGNC Investment Stock: Lifetime Golden Ticket or Reckless Gamble?

The Yield Chase

Mortgage REITs promise mouthwatering dividends—AGNC's double-digit yield screams attention in a low-rate world. But that payout comes with strings attached tighter than a Wall Street banker's bonus structure.

Interest Rate Roulette

The entire mREIT model hinges on borrowing short and lending long. When the Fed pivots, these stocks either soar or get crushed—no middle ground. Predicting rate moves? Good luck outsmarting the market's collective genius.

Leverage Landmines

AGNC runs on borrowed money—lots of it. Leverage amplifies gains during smooth sailing but magnifies losses when storms hit. One wrong interest rate bet could wipe out years of dividend income in weeks.

The Sustainability Question

High yields often signal distress, not opportunity. That juicy payout means nothing if book value keeps declining—and mREITs have a nasty habit of cutting dividends when spreads compress.

Portfolio Poison or Hidden Gem?

Maybe AGNC delivers lifelong income—or maybe it becomes another 'shoulda bought Bitcoin instead' story. In finance, anything promising lifetime security usually comes with lifetime risk attached.

Image source: Getty Images.

A potentially lucrative investment strategy

AGNC Investment is a real estate investment trust (REIT) focused on investing in residential mortgage-backed securities (MBS) protected against credit risk by government agencies such asand. These mortgage pools are lower-risk investments with fixed-income yields in the low-to-mid-single digits.

The mortgage REIT invests in MBS on a Leveraged basis, using repurchase agreements to buy additional MBS. This strategy enables AGNC Investment to earn even higher returns. For example, the company noted on its second-quarter conference call that in the current environment, it can earn a return on equity of around 19% on new investments. That's above its current cost of capital, which enables the REIT to generate enough income to cover its operating costs and lucrative monthly dividend payment.

AGNC has managed to earn a high-enough return to maintain its present dividend level for more than five years. That's impressive, considering all the volatility in interest rates during that period. As long as the REIT can continue generating returns above its cost of capital, it can keep paying its monster dividend.

Risks that can impact returns

AGNC employs dynamic risk management strategies to safeguard the value of its portfolio against risks such as interest rate fluctuations. However, even with these efforts, those risks can still impact its income.

Changes in interest rates are the biggest risk factor that can impact the REIT's business. For example, falling interest rates enable homeowners to refinance their mortgages at lower rates. As a result, the REIT earns less interest income on its existing MBS and needs to accept lower yields when reinvesting the repaid capital into new MBS investments.

Meanwhile, an unexpected uptick in interest rates can impact AGNC's borrowing costs. That can cause it to earn less of a spread between the interest it earns on its MBS investments and its borrowing costs.

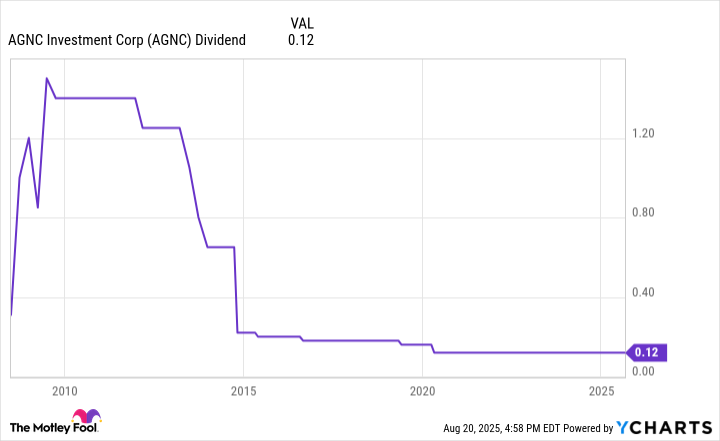

If interest rates or market conditions change dramatically, it can impact AGNC's cost of capital and returns. When returns fall below certain levels, the REIT might need to cut its dividend, which it has done several times in the past:

AGNC Dividend data by YCharts

If AGNC cuts its dividend in the future, investors would earn less income, which would lower their overall returns.

The stock price

Another factor that can affect AGNC Investment's total return is the stock price. The company would need to maintain its current stock price to deliver the mid-teens total return currently produced by its monster monthly dividend.

The problem is that the REIT's stock price hasn't stayed steady throughout its history. It has lost nearly 50% of its value since AGNC's IPO in 2008.

One factor weighing on the stock price is that the company frequently issues new shares to fund additional MBS purchases, substantially increasing its outstanding share count over time. For example, it issued 92.6 million new shares in the second quarter, raising $799 million in proceeds. This steady dilution has weighed on AGNC's total returns.

Because of this, AGNC's average annual return since its IPO has been 10.7%, not 15%. At that rate, a $10,000 investment would grow to about $200,000 in 30 years. That's solid, but likely not enough to change your life. And there's no guarantee future returns will match the past.

Probably not a game changer

AGNC Investment does offer appealing monthly dividends, but it also comes with real risks. If the dividend payment or the stock price drops, your long-term returns could take a big hit. Given this possibility, AGNC probably won't be a life-changing investment.