Got $2,500? These 3 Cryptocurrencies Could Drain Your Portfolio - Steer Clear Now!

Market turbulence exposes weak hands—and weaker tokens. While crypto's long-term trajectory points upward, some assets simply can't keep pace with genuine innovation.

Overhyped and Underdelivered

Speculative coins flashing double-digit dips aren't 'opportunities'—they're cautionary tales. When liquidity tightens, projects without real utility get exposed faster than a trader's stop-loss.

Legacy Chains Losing Ground

First-mover advantage means nothing when you're getting lapped by next-gen infrastructure. Networks struggling with throughput issues and soaring gas fees aren't just inconvenient—they're becoming obsolete.

The Regulatory Target Zone

Some tokens might as well wear 'come sue me' signs. Projects dancing in regulatory gray areas face existential risk—because nothing tanks valuation faster than a surprise FSA notice.

Smart money builds positions in assets with actual utility and clear regulatory paths. The rest? Well, let's just say some investments belong in the rearview mirror—right next to 2008 mortgage-backed securities.

1. Dogecoin and its fellow meme coins are digital lottery tickets

Created in 2013,(DOGE 12.34%) started the trend of meme coins. These cryptocurrencies are based on memes -- in Dogecoin's case, the "doge" meme that was popular back then -- or just have humorous characteristics and don't take themselves too seriously. More recent examples include,, and.

Some meme coins skyrocket in price but usually only briefly, and it's not because of any value or utility they provide. Dogecoin's biggest bull run coincided with Elon Musk tweeting about it and saying it might be his favorite cryptocurrency. It also took off after the 2024 presidential election because of Musk's ties to President Trump.

While meme coins can be an amusing diversion, buying them is more akin to gambling than investing. I wouldn't invest in a business that doesn't take itself seriously, and meme coins are the cryptocurrency version of that.

2. Tether and other stablecoins are a currency, not an investment

(USDT -0.02%) is the biggest stablecoin, with a market cap of about $167 billion (as of Aug. 19). The stablecoin market as a whole is worth $288 billion.

Stablecoins have been in the news lately. Last month, the U.S. passed the Genius Act, which provides a regulatory framework for stablecoins., a British bank, forecasts that the stablecoin market could be worth $2 trillion by 2028., issuer of thestablecoin, had its initial public offering (IPO) in June.

Even though stablecoins are a hot topic at the moment, it's important to realize that they're not an investment. The purpose of a stablecoin is to maintain a peg to the value of another asset. For example, Tether is a U.S. dollar stablecoin, and 1 Tether USD (USDT) should ideally always be worth $1. Stablecoins are useful for payments, but if you're going to put $2,500 in cryptocurrency, you probably want to buy coins designed to grow in value.

3. Bitcoin Cash is an unsuccessful spin-off of the top cryptocurrency

Nobody likes a lousy spin-off. In 2017, a dispute about a proposedupgrade led to a hard fork in its blockchain. Bitcoin continued on with its upgrade, and a new blockchain was split off for(BCH 5.49%).

At first glance, Bitcoin Cash may look like a cheaper alternative to Bitcoin. It's still a top-20 cryptocurrency, and it costs about $550, whereas Bitcoin is about $113,000 at the moment. They actually have very different purposes, with Bitcoin Cash focused on being a digital currency and Bitcoin a store of value.

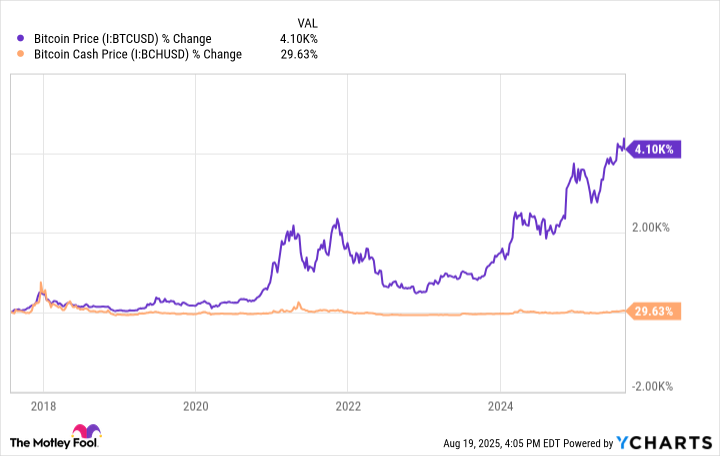

That's reflected in their returns over the years. Since bitcoin Cash started in 2017, it's up 30%. Bitcoin is up 4,100%.

Bitcoin Price data by YCharts.

Bitcoin Cash may be useful as a digital currency, although stablecoins are likely a better option because they're designed to maintain a stable value. As an investment, the original Bitcoin is a much better choice.

Which cryptocurrencies should you buy?

If you're a new crypto investor, consider starting your portfolio with Bitcoin and. They've been the top two cryptocurrencies for years and have survived multiple bear markets. They also have legitimate use cases. Bitcoin, as mentioned earlier, is a digital store of value. ethereum is a smart contract blockchain with decentralized apps and services, including decentralized finance (DeFi) protocols.

There are plenty of other interesting crypto projects to invest in. You may want to look into more types of cryptocurrency to see what they do and the problems they intend to solve, so you can pick the ones you like.

Cryptocurrencies are volatile and risky, and that includes Bitcoin and Ethereum. The safest approach to crypto investing is to make it a small portion (1% to 5%) of your portfolio and only put in money you can afford to lose.