Billionaire Stanley Druckenmiller Doubles Down on This Top AI Pick - Here’s Why It’s Surging

Wall Street legend makes massive AI bet as sector heats up

Stanley Druckenmiller just loaded up on his favorite artificial intelligence play—and the move's sending shockwaves through finance circles. The billionaire investor, known for crushing market returns, continues backing AI's explosive potential despite sector volatility.

Why Druckenmiller's betting big

He's chasing the same catalyst driving crypto's ascent: paradigm-shifting technology that rewrites entire industries. This isn't about quarterly earnings—it's about positioning for the next decade's tectonic shifts.

AI meets real-world value

Unlike vaporware projects that litter both tech and crypto landscapes, this pick demonstrates actual utility and adoption metrics. The numbers justify the move, not just hype.

Finance's cynical take

Because nothing moves markets like a billionaire chasing momentum—until the next shiny object distracts them. But when Druckenmiller talks, smart money listens... and then overanalyzes every share purchased.

Bottom line: When proven capital allocators place concentrated bets, it pays to understand why—even if you never touch a single share.

Image source: Getty Images.

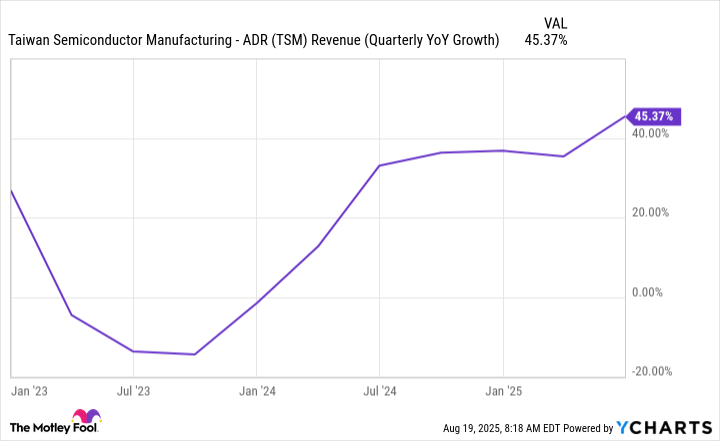

Taiwan Semiconductor's growth is rapid and accelerating

Taiwan Semiconductor -- or TSMC, as it's often called -- is a leading chip manufacturer and operates the world's premier chip foundry business. TSMC has become the chip manufacturer of choice for several leading companies, including(NASDAQ: NVDA) and(NASDAQ: AAPL). By being exposed to several key trends, including AI, it has delivered impressive growth that shows no signs of slowing down.

TSM Revenue (Quarterly YoY Growth) data by YCharts

Management is bullish about its long-term outlook and is increasing production capacity to meet the demand. Most notably, TSMC is investing $165 billion in the U.S. to get its Arizona chip factory up and running, which will help its clients avoid tariffs and have a more dependable supply chain. This makes TSMC a smart company to partner with, but it's also a proven innovator.

While other chip foundries have struggled to develop leading chip technologies that have high yields, TSMC has consistently innovated. While 3 nanometer chips are the current leading technology, 2nm chips are slated for launch later this year, and TSMC is already working on new technologies following that milestone.

This dedication to continuous improvement makes me bullish on Taiwan Semiconductor's future, and likely is a strong reason why Druckenmiller purchased shares during the quarter. But is it still a solid buy right now?

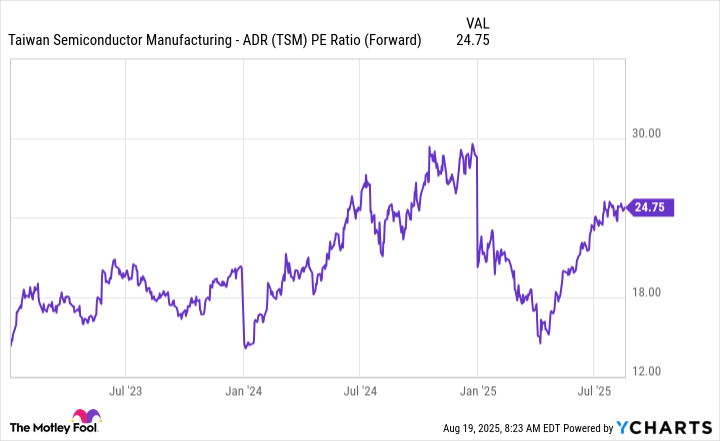

Taiwan Semiconductor's stock is fairly priced

Unlike many AI-centric companies, Taiwan Semiconductor doesn't trade at a huge premium to the broader market. With the stock trading for just shy of 25 times forward earnings, it's priced at nearly the same level as the, which trades for 24.1 times forward earnings.

While these levels aren't historically cheap, Taiwan Semiconductor is well-positioned to ride the massive wave of AI spending, mainly focused on data centers. With many of the AI hyperscalers informing investors that capital expenditures WOULD rise in 2026 due to data center buildouts, it's a bullish sign for Taiwan Semiconductor.

TSM PE Ratio (Forward) data by YCharts

All of this adds up to a stock that's still worth buying at these levels. Taiwan Semiconductor is a top investment pick in the AI realm, and recent purchases by billionaire hedge fund managers like Druckenmiller support this view. We're still in the early innings of AI buildouts, and Taiwan Semiconductor still has plenty of room to run.